Bonds continue to show leadership, but European equities are also perking up and outperforming U.S. equities in early 2015. Can European equities lead global markets higher? Or will a slowing US economy prove to be a bigger threat? Here’s what I’m watching.

Below are excerpts from this week’s Market Navigator newsletter. Please note that the Newsletter is free – sign up here.

As a reminder, the weekly Market Navigator focuses on three areas: 1. Macro Themes 2. News & Economics Calendar 3. The Week Ahead.

Macro Themes

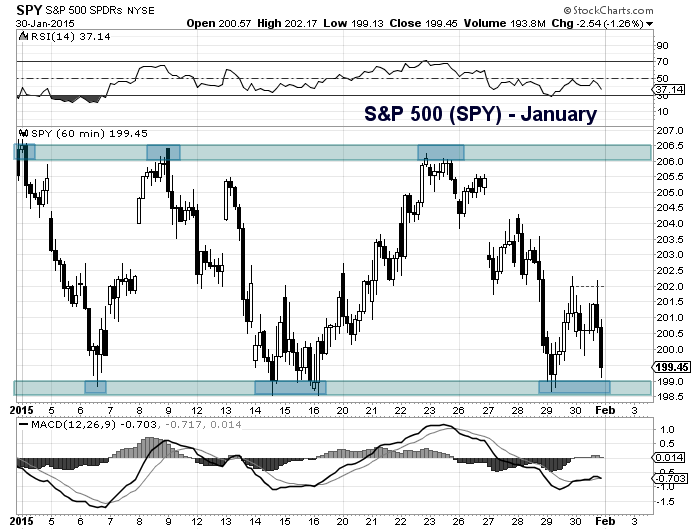

The markets continue to see more of the same theme: uncertainty. And this shows up in the market price behavior. Check out my weekend post on the well-defined January trading range on the S&P 500. This is what happens when uncertainty is prevalent and volatility comes back into the markets.

S&P 500 ETF (SPY) – January

Although there are plenty of global concerns to work through, the US Equity markets have taken the focus back home. US 4th quarter GDP was okay, but a bit softer than expected. Retail sales have been a bit light, and earnings below par.

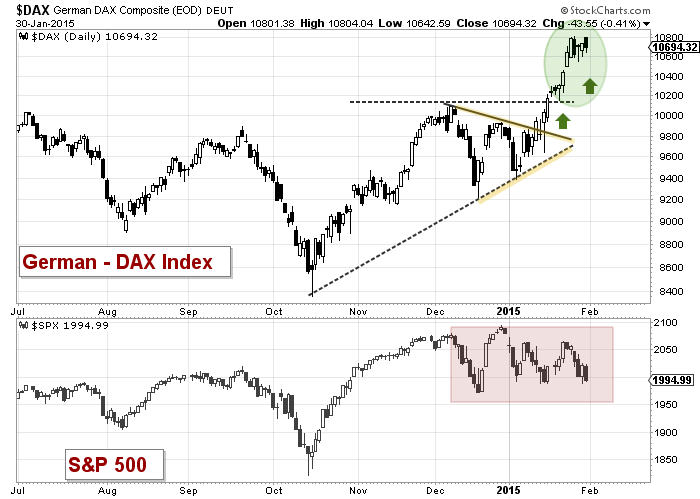

And on the global front, mainland European equities are outpacing US Equities in 2015. Fellow contributor Andrew Thrasher wrote an excellent piece on Germany’s ETF (EWG) in January.

Note as well that France’s CAC40 Index (not shown below) is also outperforming the S&P 500 in 2015.

German DAX Index vs S&P 500 Index

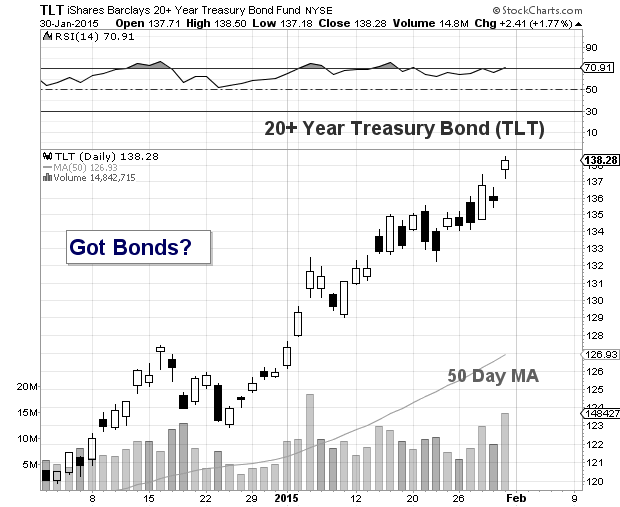

Bonds: The long bond continues to outperform in the US Markets. Investors continue to find peace holding bonds while they wait for clarity. Check out the chart of the long bonds ETF below… It’s a bird, it’s a plane, it’s the TLT!

20+ Year Treasury Bond (TLT)

Look at the gap between the current price and the 50 Day Moving Average. And every pullback in December and January has been bought up. Now that’s heavy demand.

The takeaway: As long as bonds are this strong, we may continue to see some indecision in equities.

News & Economics

- More fun in Washington: President Obama proposes $3.99 Trillion Budget, sets up political battle.

- Keep an eye on Greece. Bank troubles, government posturing, and political uprising are consistent themes in Greece’s battle with the EU.

- This week’s US economic data calendar watch list:

- MONDAY: Core Price Index, Manufacturing PMI, and ISM Manufacturing

- TUESDAY: Factory Orders, FOMC members Bullard & Kocherlakota speak

- WEDNESDAY: ADP Non-Farm Employment, ISM Non-Manufacturing PMI, FOMC member Mester speaks

- THURSDAY: Initial Jobless Claims, FOMC member Rosengren speaks, Non-Farm Productivity, Trade Balance

- FRIDAY: Non-Farm Payrolls Report for January, FOMC member Lockhart speaks

The big report here is Friday’s non-farm payrolls for january. And the markets will be lying in wait. The non-farm payrolls report is always a market mover and is issued along with other highly followed data points: participation rate and unemployment rate.

The Week Ahead

The S&P 500 had a rough week, falling from the high end of its January range to the low end. For the week, it was down 2.8%. So we’ll be looking for follow through to the downside. A break through point 2 on the chart below would be caution. And, as mentioned in last week’s Market Navigator, we’ll be watching the December lows (1972.56) closely (point 3). If the lows give way, we could see a move to 1940 or potentially 1898 (Fibonacci extension levels).

Last week, fellow contributor Chris Ciovacco also pointed out a key fibonacci retracement level in this area.

Overhead resistance (point 1) lies around 2064. This area marks the highs from January 22/23 and 8/9.

S&P 500 Daily Chart

Invest with discipline and have a great week.

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.