Few would deny that central bankers have become the superheroes of global markets, injecting trillions of capital to help fill the gaps left by a pandemic-induced global economic shutdown. Now with the economy on a more solid footing, the trend among central banks has them taking their foot slowly off the monetary gas pedal.

Over the past three months, 10 of the bigger central banks hiked their overnight rates. These have been mainly among developing nations but central banks in developed economies edged closer as well.

Quantitative easing is on the decline in Canada (they announced the end of its program in October), while all eyes remain on the U.S. Federal Reserve as they begin to taper their purchase programs. Each incremental taper gets the market closer to interest rate hikes.

The market has currently priced more than two interest rate hikes by the Federal Reserve in 2022, starting around mid year. The UK and Canada are forecast to move sooner, eurozone later. Unless the economy or markets derail, the tightening cycle is upon us.

If history is our guide, this isn’t necessarily a bad scenario. Intuitively this makes sense. The Federal Reserve starts hiking when the market and economy are strong enough to remove accommodation, cooling parts of the economy that may be overheating and giving the central bank more flexibility should weakness arise down the road.

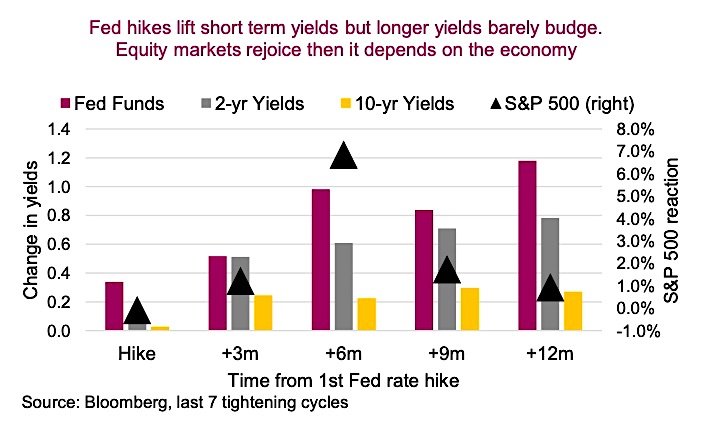

Looking at the market’s reaction to the last 7 Federal Reserve tightening cycles, there is more good news than bad. Starting with bond yields, raising the overnight rate understandably puts upward pressure on shorter-term yields. However, for longer-term yields such as the 10-year, the reaction is muted. In 3 of the last 7 cycles, the 10-year yield was lower six months following the first hike. The bond markets are foretelling, as yields usually move higher well in advance of the start of a rate-hiking tightening cycle.

Turning to equities, in the last 7 tightening cycles, the S&P 500 Index was higher six months after the first hike. Sure, volatility rose as the markets adjusted to the change in monetary policy, but with the Federal Reserve hiking due to strength in the economy, equity markets have been amenable. A year later, things are much less clear.

There are risks to this gradual pivot in global monetary policy. On one hand, it is likely overdue given inflationary price pressures and how far the economy has recovered. However, asset prices have been inflated over the past year-and-a-half thanks to these monetary policies. This includes stock prices, bond prices and house prices. The sensitivity of those prices to tightening monetary policies may be higher than historical patterns.

2022 will be a monetary adjustment year as policy moves back towards normal. Given the health of the economy, we don’t believe a recession is imminent, which has us believing this will add to market swings butnot trigger a bear.

Sources: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.