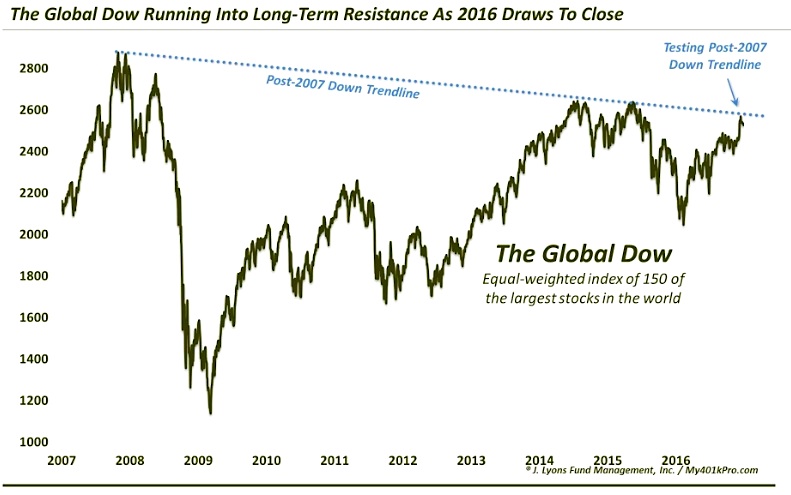

The Global Dow Index is running into its long-term Down trendline stemming from the 2007 all-time peak.

Here in the U.S., equity investors have been a bit spoiled as they’ve watched index after index break into all-time high ground this year. Around the globe, investors have not been so lucky. Yes, most international indices have rallied solidly this year. However, with few exceptions, the rallies have still left these international markets shy of their all-time highs.

One illustration of this situation can be seen in a chart of the Global Dow Index (INDEXDJX:DWG).

We’ve posted many times on the Global Dow Index (GDOW) due to its reliable conformity to technical charting tools, despite the fact that very little money is traded off of it. Additionally, we have found it to be an accurate barometer of the state of the global equity market. Specifically, the GDOW is an equally-weighted index of 150 of the world’s largest stocks. While this includes U.S.-based companies, its heavy dose of international exposure has led to its aforementioned position below its all-time high.

Furthermore, it is currently running into potential resistance in the form of its post-2007 Down trendline connecting the 2007, 2014 and 2015 tops.

Will this hold? We don’t have a crystal ball, but it has briefly repelled the GDOW thus far. And while most U.S.-based indices have succeeded in reaching all-time high ground, it is important to note that such circumstances are not unanimous. Along with the Value Line Geometric Composite, there are still some key hurdles facing global stocks as we head into 2017.

Thanks for reading.

Twitter: @JLyonsFundMgmt

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.