SailPoint Tech (SAIL) continued…

SAIL customer numbers the last three years have risen to 933 in 2017 from 520 in 2015 and subscription revenues are currently just 38% of total revenues. SAIL believes to have penetrated just 2% of approximately 65,000 companies needing its solutions.

Its customers span a wide range of industries, including manufacturing, energy and industrials (17%); banking (15%); government, education and non-profit (13%); technology, media and telecommunications (12%); finance (11%); healthcare (10%); insurance (10%); and retail and consumer (8%) (percentages are based on our customer counts as of March 31, 2018). According to IDC, worldwide spending on public cloud services and infrastructure will reach $160 billion in 2018, an increase of 23.2% over 2017. While organizations are shifting a portion of their IT budgets to invest in technologies such as cloud computing, the majority of IT investment remains on-premises. Consequently, organizations continue to operate highly complex hybrid IT environments, and will do so for many years to come. Forrester estimates the worldwide market for identity and access management software is $9.8 billion in 2018 and will grow to $13.3 billion in 2021.

According to Gartner, by 2020, data-centric audit and protection (“DCAP”) products will replace disparate siloed data security tools in 40% of large enterprises, up from less than 5% today. SAIL is set to benefit from industry tailwinds like identity pervasiveness, automation, and stricter compliance obligations. My take on SAIL is shares are very attractive at this level and a must-own name in cyber security. The company is growing strong, moving to more of a subscription model, adding customers and in the early stages of benefitting from multiple industry tailwinds.

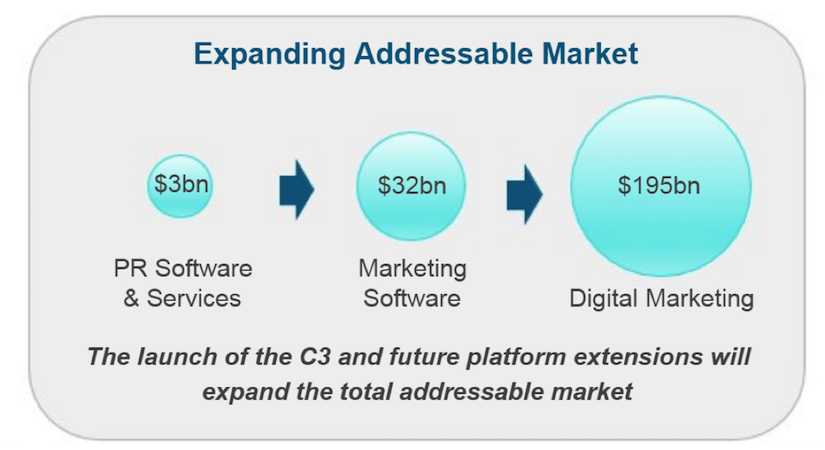

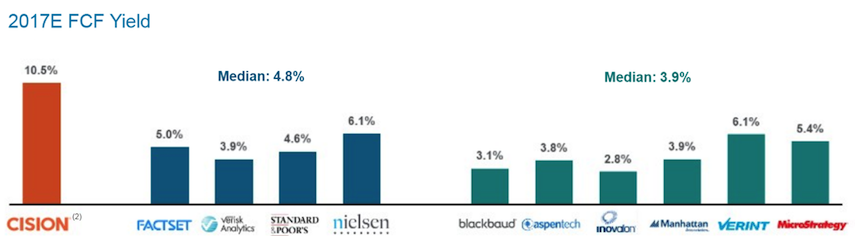

Cision (CISN) is a $2B software company focused on software solutions for public and government relations such as distribution, media monitoring and media analysis. CISN trades 4.4X FY19 EV/Sales and generated 35% topline growth last year with 15% growth expected in 2018, so not quite as hot of a growth name which leads to the depressed multiple. CISN is operating in a massive market, the marketing software market is $32B and digital marketing and data market is $195B. CISN is operating a subscription model with 82% of revenues from subscriptions and has an 82% renewal rate.

CISN’s comprehensive product set gives it an advantage to peers and it is much larger. CISN is expecting its Cision Communications Cloud launch to transform the communications industry and driver higher ASP and total spend. It is expanding its addressable markets with adjacent media categories like ratings, reviews, content marketing and user-generated content. CISN is targeting an 8.2% CAGR for revenue growth through 2021 and 13.7% EBITDA growth with EBITDA margins expected to reach 44% by 2021 from 36.2% in 2017. CISN’s acquisition of PR Newswire added 16,000 customers and also leads to cost synergies. My overall take on CISN is that while it is not an explosive revenue growth name like many of these Tech IPO’s, it is an attractive financial story trading at discounted valuation. It is positioned to capture more share of a large and growing market, benefit from acquisition synergies, expand margins, and generate strong FCF.

Carbon Black (CBLK) is a $1.75B provider of cloud security solutions at the endpoint trading at a forecasted 6.5X FY19 EV/Sales. CBLK states it is transforming security through big data & analytics in the cloud as a next generation endpoint leader. CBLK estimates its market opportunity at $19B and has 3,700 customers (45% 3 year CAGR) with 33 of the Fortune 100. CBLK is looking to expand its market opportunity to $19.1B from $6.5B by leveraging unfiltered endpoint data, streaming analytics, and predictive cloud technologies for additional product functionalities.

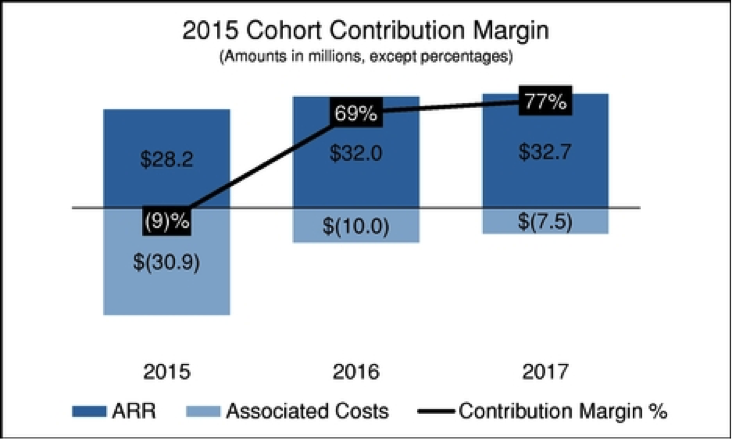

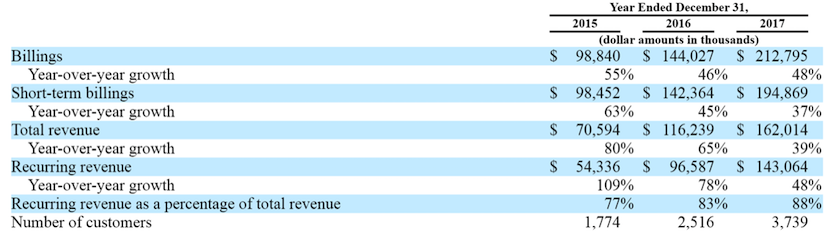

CBLK’s subscription model provides strong visibility with recurring revenue moving to 88% in 2017 from 77% in 2015 and revenues growing to $162M from $70.6M in the same period. Annual recurring revenue, or ARR, was $76.8 million, $124.2 million and $174.2 million as of December 31, 2015, 2016 and 2017, respectively. IDC expects the enterprise endpoint security software market to grow to $8.3B in 2021 from $6.5B in 2016, the vulnerability management market to reach $9B from $5.4B, public cloud security software market to reach $10B from $5.3B, and IT asset management market to reach $2.8B in 2021 from $1.9B in 2016. CBLK retention rates for customers the last three years are 93%, 92% and 93%. CBLK has a close relationship with Optiv Security as a reseller, accounting for 27% of revenues in 2017. CBLK is addressing the need for companies to replace legacy antivirus products, and the ability to expand into adjacent markets could expand its opportunity to a $30B+ market. CBLK should be able to capture market share the next few years and will benefit from the continuing adoption to cloud. CBLK will report on 6-7 and look quite attractive at this valuation as one of the few Tech IPO’s yet to make a move.

ForeScout Tech (FSCT) is a $1.27B provider of automated security solutions and network management trading 3.2X FY19 EV/Sales. FSCT grew revenues at 32.5% each of the last two years and for FY18 expects 25.6% growth followed by 20% each of the following two years. FSCT recently reported Q1 results with 42% Y/Y revenue growth and improvement in both operating margins and cash flows. The company noted the increasing demand for visibility solutions with so many new devices coming online and the cloud transition.

Gartner forecasts an estimated $96B to be spent on enterprise security software in 2018 and FSCT internally sees its total addressable market at $10.8B. FSCT is clearly innovating as shown by its sharply rising R&D expenses as well as marketing. Net-recurring revenue retention rate on support and maintenance contracts as of December 31, 2015, 2016, and 2017 were 116%, 127%, and 126%, respectively. The number of annual end-customer deals over $1 million is increasing. For the years ended December 31, 2015, 2016, and 2017, FSCT had 26, 28, and 48 deals, respectively, representing year-over-year growth of the collective value of those deals of 61% and 55%, respectively. For the year ended December 31, 2017, its average deal size was approximately $217,000, an increase of 24% from the average annual deal size for the year ended December 31, 2015. FSCT is targeting emerging threats to IoT devices with over 29 billion devices expected to be connected by the end of 2020.

There is a visibility gap across networks, ranging from campuses to data centers and public cloud, and across both virtual and physical devices. ForeScout fills this gap with an agentless solution – an important distinction given the variety and diversity of IoT devices. My overall take is shares are far too cheap at this level, though its weaker FCF margin and gross margins deserve a discount to some higher quality peers, a multiple closer to 5X feels appropriate, and looking ahead of around $400M sales in 2020 one can argue a $2B valuation, or 57% higher from the current level. FSCT would make a lot of sense as an acquisition target for Cisco (CSCO) who is building out its cyber-security segment, or even F-5 (FFIV).

continue reading on the next page…