Zscaler (ZS) continued…

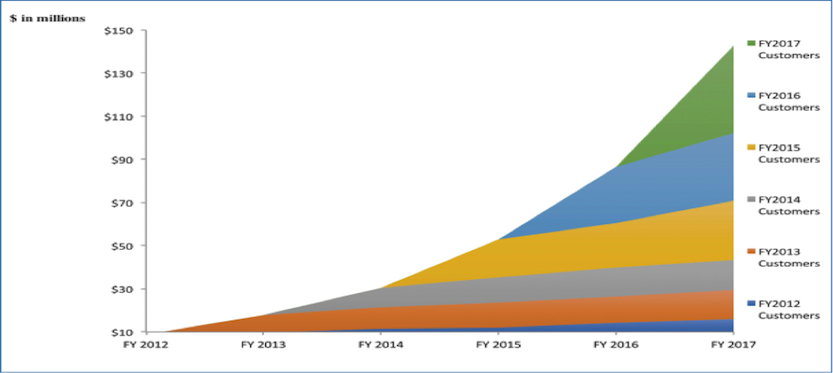

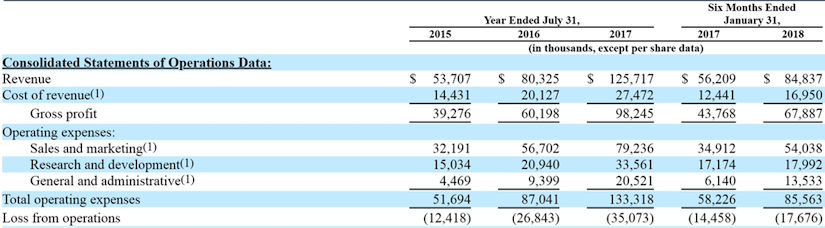

Dollar based retention rate is a key metric and has been right near 115% each of the last three fiscal years. Calculated billings increased 62% for fiscal 2017 over fiscal 2016, 44% for fiscal 2016 over fiscal 2015 and 55% for the six months ended January 31, 2018 over the six months ended January 31, 2017. Customer numbers the last three years have been 2,050; 2,450; and 2,800. The ARR is growing nicely and shown below. I can also see ZS is investing in its business with rising headcount and R&D.

Gross margin increased from 78% during the six months ended January 31, 2017 to 80% during the six months ended January 31, 2018. My overall take in ZS is that shares are quite expensive to peers at this level, but it is a disruptive player with major secular tailwinds that will enable well above-average growth for many years to come, so a name to consider adding on the price corrections that are almost certain to come over the next year. The long term model calls for 20-22% operating margins and $1B revenues and its best of breed margins call for a premium valuation to a peer like ProofPoint (PFPT), so the opportunity for ZS to become an $8-$10B company is there.

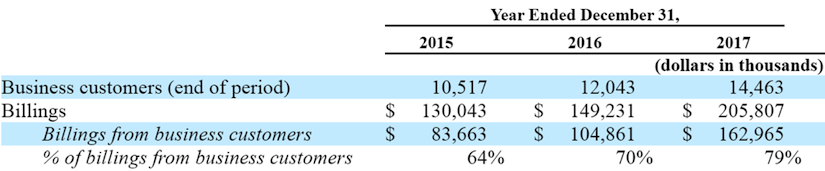

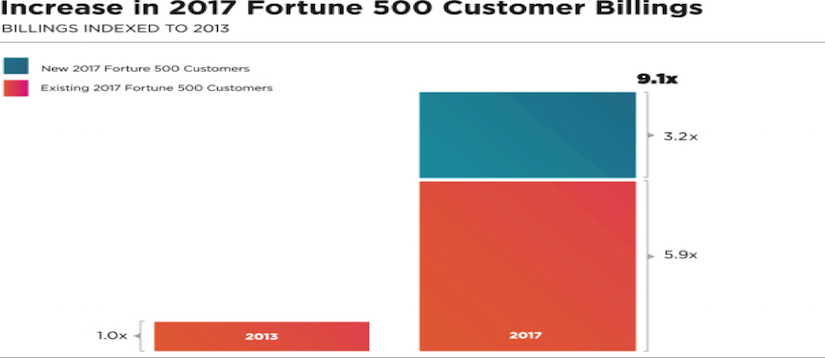

Pluralsight (PS) is a $3.05B provider of cloud-based skill development technologies such as learning tools, adaptive skill tests, courses, interactive labs and live mentoring. PS trades around 11X EV/Sales for my forecasted 2019 numbers. According to the company over 60% of Fortune 500 companies are using Pluralsight which helps companies close the technology skills gap to reach full potential. From 2013 to 2017 its billings from its Fortune 500 customers increased 9.1 times in aggregate.

Training Industry Inc. estimates global spend on corporate training to be $359B in 2016, and PS estimates its total addressable market exceeds $24B based on data from Evans Data Corp. PS currently has over 6,700 on-demand and online courses on its platform and is adding on average 80 new ones per month. PS posted 38% Y/Y billings growth in 2017 with 55% growth from business customers. PS has seen a surge in business customers as well as sales to existing customers with a 120% dollar-based retention rate. My overall take is shares are trading pricey but also a name with a significant opportunity for growth over a long period of time meeting a critical need for companies looking to invest in their people. I think it can be a long term winner but prefer to own it closer to $18 with a $30 target in mind.

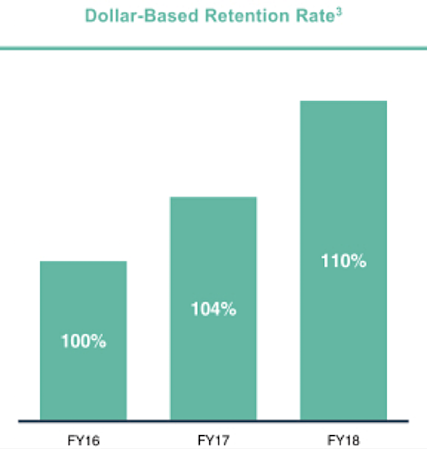

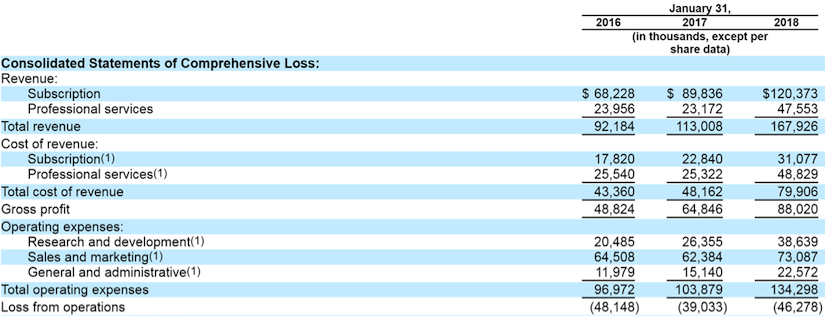

Zuora (ZUO) is a $2.79B provider of subscription billing and management software for accounting and payment services trading 12.5X FY19 EV/Revenues. ZUO posted 48.6% revenue growth in 2018 and this year expects 32% growth. ZUO’s products allow companies to transform into a subscription business, which has become a major market theme the past few years. Shares recently jumped sharply after reporting 60% Y/Y revenue growth and 39% subscription growth with ACV (annual contract value) of $100K+ rising to 441 customers versus 415 the prior quarter, while dollar based retention rate came in at 112%.

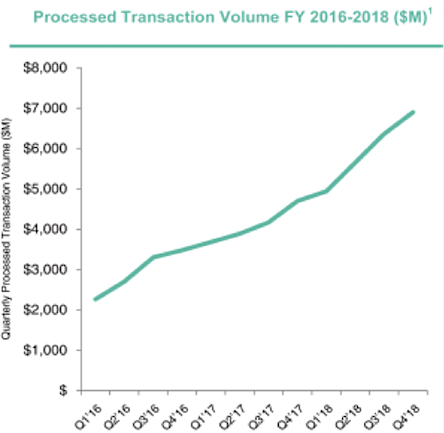

Transaction volume through its platform rose 46% Y/Y to $7.2B. Jefferies sees ZUO as the logical play for the transition to a “Subscription Economy” and expects sustainable hyper growth for many years to come. ZUO believes we are in the early stages of the Subscription Economy with inevitable multi-industry and multi-decade global shift to towards that business model. In terms of market potential the Company indicates “The market size for our current core cloud-based billing and revenue recognition products was nearly $2.0 billion in 2017 and is expected to be $9.1 billion by 2022, growing at a 35% CAGR, according to MGI Research. Additionally, Gartner estimates that spending on ERP software is expected to reach $40.6 billion by 2021. As ERP systems cannot fully address the needs of companies in the Subscription Economy, we believe we are well-positioned to take a share of this spend as the Subscription Economy continues to grow.” ZUO shares recently rose 50% after establishing a nice post-IPO base and breaking out at the $20 level. Shares are undoubtedly trading rich on valuation, but at this stage in its growth and the long term opportunity, a name to accumulate on dips as the story has many years to play out.

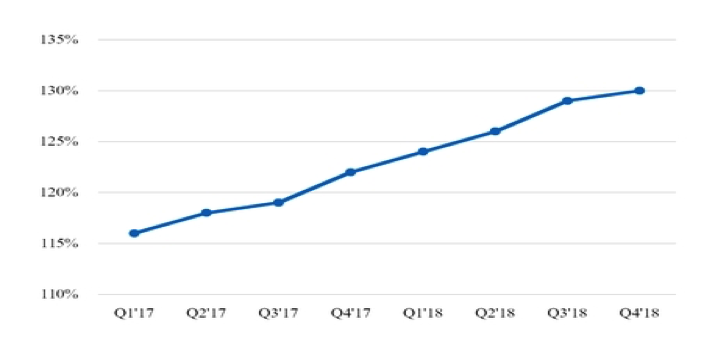

Smartsheet (SMAR) is a $2.72B platform for managing and automating collaborative work flows trading 18.3X FY18 EV/Sales. SMAR grew revenues 66% in 2018 and expects 44% growth this year and 35-40% each of the two years thereafter. SMAR now has over 3.6M users with 90% of the Fortune 100 using its product and a 130% net dollar retention rate. Its 81% gross margins are also the best of this entire group.

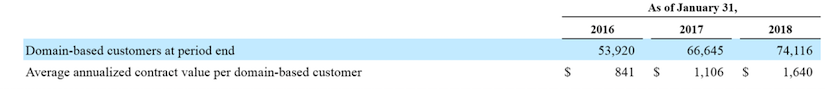

As of January 31, 2018, over 92,000 customers, including more than 74,000 domain-based customers, 90 companies in the Fortune 100, and two-thirds of the companies in the Fortune 500, with annualized contract values, or ACVs, ranging from $99 to $2.3 million per customer, relied on Smartsheet to implement, manage, and automate processes across a broad array of departments and use cases. A commissioned report by Forrester Research, Inc., or Forrester, demonstrated that organizations using Smartsheet could achieve a return on investment of over 480% over a three-year period. SMAR is a play on a number of key themes like digital disruption, the changing nature of work, and a need for greater productivity/efficiency. IDC estimates the market for collaborative applications and project management applications to be a combined $21.4B in 2017 and growing to $31.6B in 2021. SMAR is experiencing rapid growth while key metrics like customer adds, ACV and retention rates (shown below) keep improving. SMAR has also risen more than 50% over the past two weeks and now trades extremely rich on EV/Sales, but once again, a name with a massive market opportunity that is showing extremely strong growth and execution, a future leader in Tech, and a name to build a stake.

SailPoint Tech (SAIL) is a $2.4B provider of enterprise identity governance solutions allowing companies to manage access rights. SAIL is trading 8.2X FY19 EV/Sales and has strong 75%+ gross margins while growing revenues 40.5% in 2017 and expects around 22.5% growth in 2018 & 2019. SAIL recently reported Q1 results with 40% Y/Y revenue growth with subscription revenue most importantly growing 54%, and unlike many of the other names is operating profitably. The recent media discussion of data sharing and the European General Data Protection act play right into SAIL’s identity control solutions. Security breaches often come from misuse of identity credentials and SAIL provides solutions for enterprises to manage and secure its identities.

continue reading on the next page…