General Electric’s stock (GE) has been in free fall for the last year. Could that be coming to an end?

Perhaps not… but perhaps we’ll see the stock bounce from here.

Why On Earth Would GE’s Stock Bounce Here?

Clearly, this is not your typical relative strength play… but price comes first.

On Monday and Tuesday, GE rallied with strength. Though it gave back much of those gains today, it does make one think about the price area where GE bounced off of.

Here are a few reasons why General Electric’s stock may be poised to bounce:

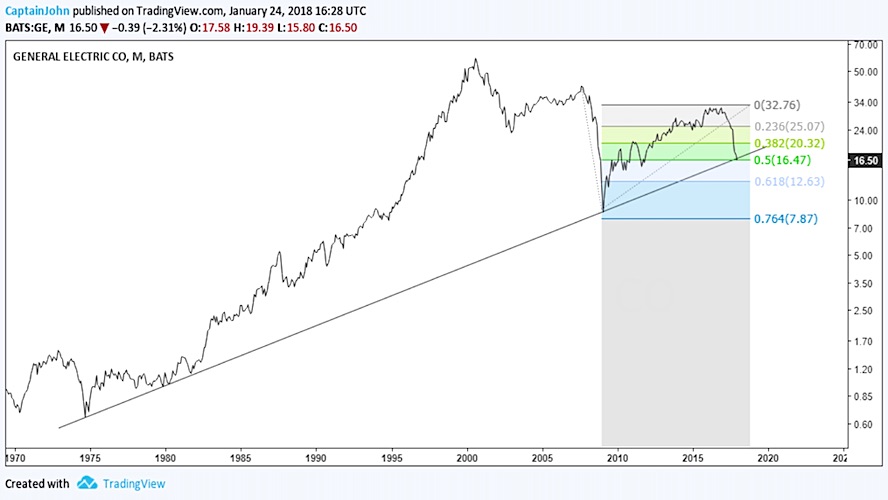

- GE’s 43-year trend line is still intact.

- Price is testing the 50% Fibonacci Retracement off the 2007 highs.

- RSI is approaching 2009 oversold lows

General Electric “Long-Term” Stock Chart

If you are interested in learning more about our investing approach and financial services, visit us at CaptainJohnCharts.

Twitter: @CptJohnCharts & @FortunaEquitis

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.