After the successful attack on GameStop (GME) we saw the Reddit Army expand their attack to stocks such as Nokia (NOK), AMC (AMC), Blackberry (BB) and others. What was happening was a swath of new traders all coming in at the same time, mostly on one side of the trade, in a tactical pursuit to destroy short sellers and inevitably pushing the stock prices higher.

People do not often think of stocks in the context of the market in which they trade.

The fact is there is a buyer and seller on either side of every trade agreeing on a price to trade the stock. In these cases there is clearly a current imbalance of buyers over sellers.

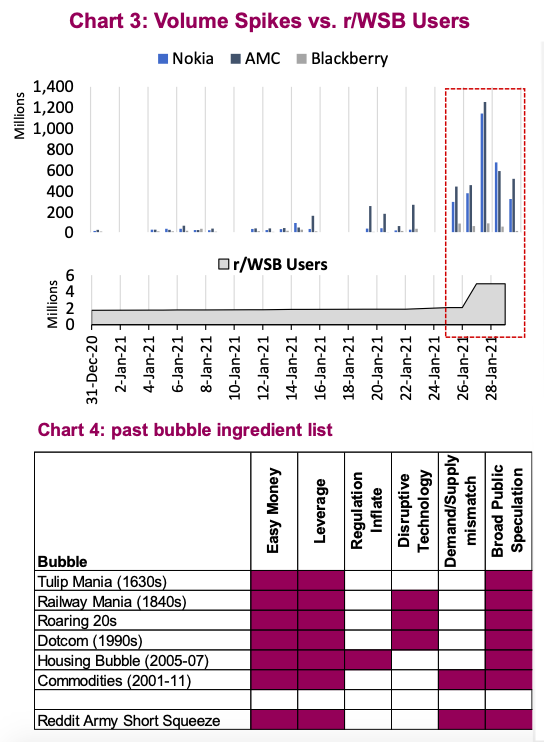

Chart 3 below shows the spike in volume in these heavily shorted stocks as the Reddit army grew; annotated by Wall Street Bets subscribers, a popular Reddit forum.

The fear of missing out (FOMO) is real and has captivated the attention of many investors around the globe – take it from one of the newest Reddit subscribers. My subscription was partly to better understand the sequence of events driving this mania.

Behavioral mistakes and feedback loops are evident in almost every bubble and clear as ever in last week’s episodic melt up. The reposts, net new Reddit subscribers and volume on thinly traded stocks are evidence that feedback loops are fueling investor FOMO.

Is this a bubble? We have written about and warned about bubbles in the past, such as crypto in 2017 and cannabis in 2018. And we’ve highlighted the often similar characteristics of bubbles, such as easy money, access to leverage, regulation change, new technology, extended mismatch between supply and demand and increasingly broad adoption or speculation.

Money can’t come easier than the government sending you a cheque like we saw in pandemic relief funds. The options market has provided the access to leverage. This bubble is missing the regulation inflate but trading halts on specific names and regulators stepping in could deflate the trade. The new technology provided by discount brokerages and social media are certainly providing the necessary platform ingredients. In terms of the supply/demand mismatch, there is certainly mass speculation on which name the army will attack next.

The one commonality of every bubble is that they all end, usually very abruptly. There is money made along the way but there is also money lost by those who get involved late. This is similar to a pyramid scheme, albeit not an illegal one.

We all suffer from behavioral mistakes and missteps when investing. To avoid them or even profit from them involves making a strategic plan in advance of making an investment decision. Sticking to that plan is the hard part as we battle the internal feelings these biases instill. But working with a trusted advisor can be key to helping avoid those mistakes.

Having a tactical or momentum strategy can be part of a holistic portfolio but certainly not a material part. So, if you are going to chase this phenomenon, approach it systematically, size your position small and stick to the plan, getting out before it’s too late because like previous bubbles this hype won’t last forever.

This research article was written by Chris Kerlow, CFA.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.