Key Takeaway: With the economy continuing to make slow progress and stock market volatility already rising, a surprise Federal Reserve rate hike today could help rebuild its credibility. Note that the Federal Reserve concludes its 2 day monetary policy meeting today with an announcement on rates at 2:00 pm ET. Janet Yellen will hold a press conference at 2:30 pm ET. The markets are eagerly awaiting the Fed’s announcement.

Compared to when Federal Reserve raised rates in December, inflation has continued to move higher, labor market conditions have continued to tighten, and the overall tone of the economic data has improved.

Also, consider this: The Federal Reserve has talked its reputation almost into a corner with a series of conflicting messages. While data dependency is stressed, this is often interpreted as reacting to the latest data point, not movement in line with persistent trends. As such, expectations over the timing of the next Federal Reserve rate hike ebb and flow as individual economic releases are printed. Odds of a rate hike this week are quite low. A surprise increase could help re-establish the Fed’s credibility.

The looming Presidential election (and the risk of stock market volatility in advance of it) is cited by some as a reason to defer a Federal Reserve rate hike until later this year. If stocks are going to be volatile anyway (at a time when the economy continues to make slow but positive progress), stepping up and increasing rates now may actually be the less risky option for the Fed (and its reputation).

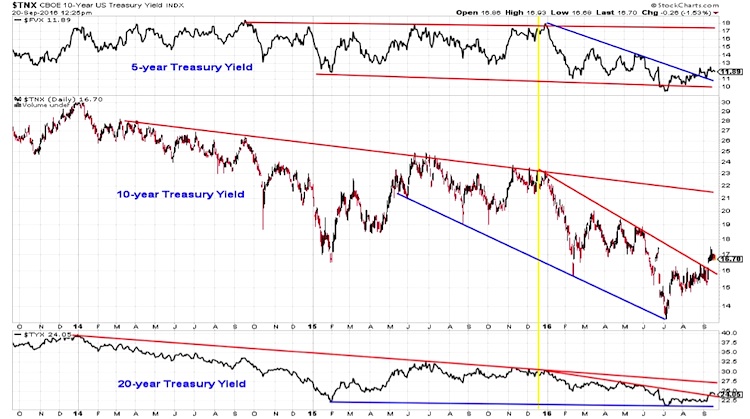

Bond yields remain below the levels seen when the Fed raised rates in December, but importantly they have risen off of their post-Brexit lows, suggesting global macro stress are easing. The recent rebound in bond yields has been a global event, with the yield on the 10-year German Bund actually spending some time on positive territory of late.

While global macro uncertainty has emerged as a factor in the Federal Reserve’s decision making process, historically its mandate has focused on employment and inflation. Employment trends show that labor market conditions continue to tighten. Job openings are near record levels and workers are increasingly voluntarily leaving their jobs in search of better opportunities. Since December, wage growth has continued to move higher, and job switchers have seen an even more significant bump in income. This could weigh into the prospects of a Federal Reserve rate hike.

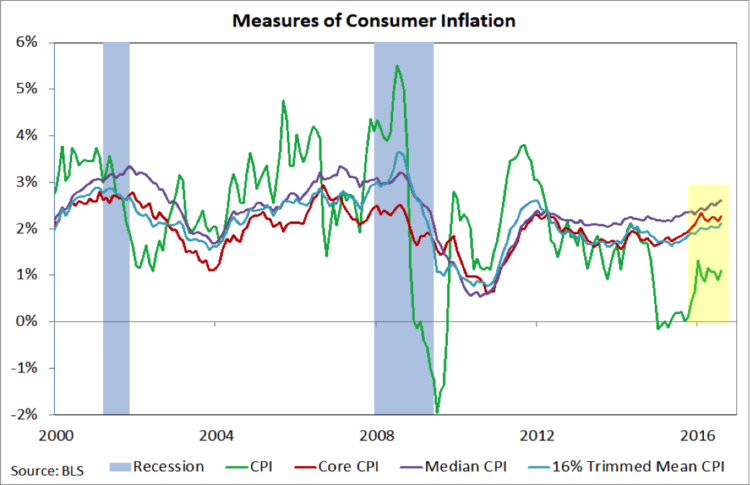

Inflation trends, too, have moved higher. Overall CPI inflation remains low, but more stable measures of pricing pressure are moving higher. The yearly change in the median CPI has moved to its highest level since January 2009.

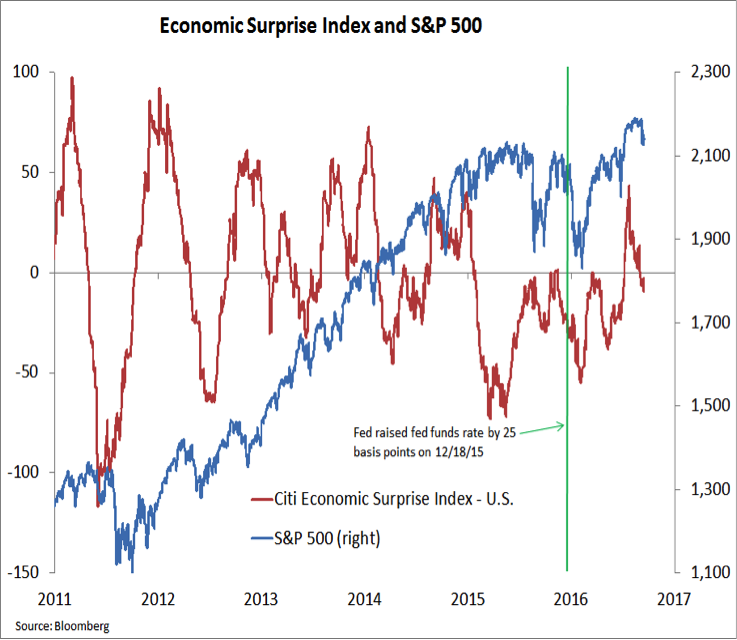

While we are still not seeing robust growth, the tone in the economic data has improved dramatically since the Federal Reserve raised rates in December. Then, economic data had consistently fallen short of expectations for a year, and negative surprises were mounting in December as well. Now, the economy has shown a renewed ability to provide upside surprises (although there is little evidence that forecasts as a whole have gotten any better). Like the up-tick in bond yields, the improved tone in economic data has been a global occurrence.

Also read: Central Banks Return To The Spotlight

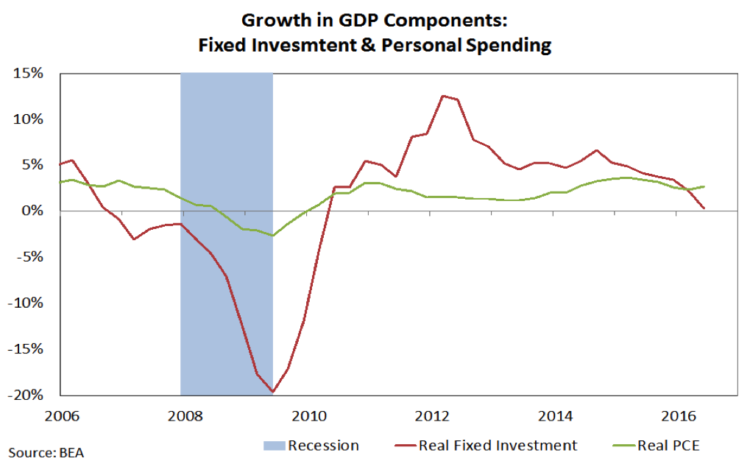

An obvious sticking point for the economy remains fixed investment. But the downward trend seen there was in place back in December. The headwind that has come from inventory de-stocking could soon abate and growth in personal spending has up-ticked slightly over the past year.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.