Consumption versus asset, which inflation would/should the Federal Reserve be focusing on?

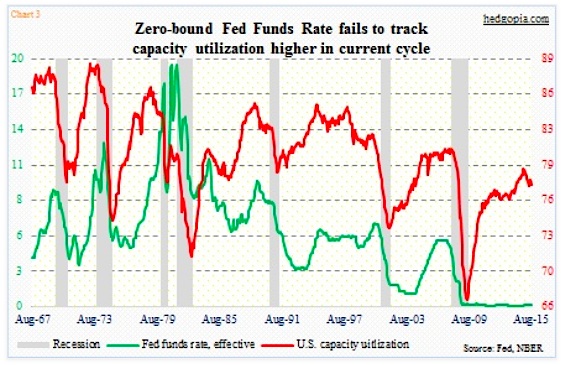

Even yesterday, retail sales in August hung in, up 0.2 percent month-over-month. At 2.2 percent, year-over-growth has decelerated from 4.9 percent a year ago, nevertheless it is growth, not contraction. Capacity utilization, however, has had negative annual growth the past four months. In August, the reading was 77.6, down from the cycle peak of 79.04. Historically, it is rare for the Fed to begin to tighten once utilization has already peaked and on its way down. With that said, it is also rare for Fed funds to remain near zero given where utilization is (Chart 3 below).

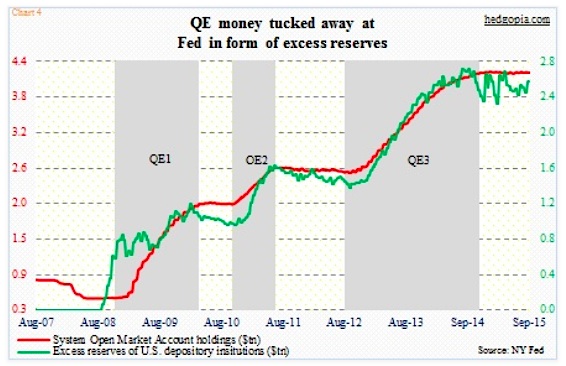

Makes one wonder, has the Fed missed a window of opportunity? Should they have moved while utilization was still rising? Maybe if we focus on utilization, but maybe not if we focus on the green line on Chart 2. One reason inflation – at least the one the Fed focuses on – is as low is due to a mismatch between demand and supply. Commodities are a perfect example of this. If end-demand was strong, U.S. banks would probably not be sitting on $2.6 trillion in excess reserves, earning a mere 25 basis points in interest (Chart 4 below).

That is the dilemma the Federal Reserve now faces. Continue ZIRP and run a risk of the status quo in which the red line in Chart 2 continues higher while the green line struggles to stay above the watermark or begin to tighten to possibly see the red line in Chart 3 continue lower. A ‘heads you win, tails I lose’ situation.

It is hard to guess how markets will end up reacting to the decision today. Here is a worse-case scenario: The long end of the yield curve rallies (interest rates go lower) if they hike, or stocks sell off if they don’t.

Thanks for reading!