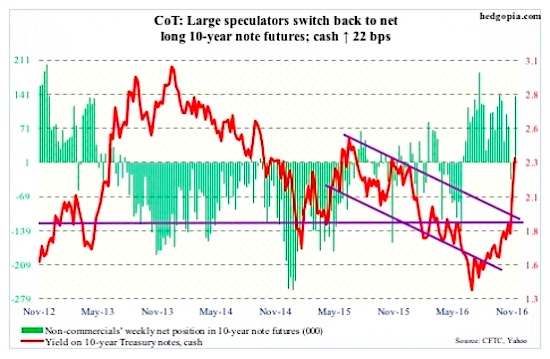

10-Year Treasury Note Futures (non-commercial holdings): Currently net long 137.4k, up 209.1k

The bond market has swiftly priced in higher inflation. The post-election treasury yields rally has been impressive, but questions remain about its sustainability. Just look at the 10-Year Treasury Bond Yield (INDEXCBOE:TNX). The U.S. economy is in its eighth year of expansion, although growth remains subdued.

On a 12-month rolling total basis, the federal deficit has been rising since January this year – from $405.3 billion to $587.4 billion in September. In the past, deficit was as high as $1.5 trillion in February 2010. As a result, issuance of Treasury notes and bonds peaked at $1.7 trillion in June that year. Last month, issuance was $476 billion.

If president-elect Trump succeeds in pushing through his big infrastructure spending plan, deficit in all probability will continue to rise, which then means more Treasury issuance. The 5-year, 5-year inflation expectation rate – up from 1.89 percent on November 8 (election day) to 2.06 percent two sessions later, before backing off to two percent – is sniffing inflation.

The rub in all this is debt. Federal debt stood at $19.4 trillion in 2Q16; interest payments were at a seasonally adjusted annual rate of $471.7 billion – about on par with $456.6 billion five years ago. Between the periods, debt went up by $5 trillion; the 10-year yield, however, went from 3.2 percent to 1.5 percent, which made all the difference insofar as interest payments were concerned.

The 10-year yield bottomed at 1.34 percent on July 6 this year, closing the week at 2.34 percent – up 100 basis points in four months. In 2Q16, as a share of federal debt, interest payments comprised 2.43 percent. Simplistically, if we add 100 basis points to this, 2Q16 interest payments would have gone up by $193 billion.

The debt load is simply too big – and heading higher – for markets to allow a persistent rise in interest rates without substantially hurting the economy.

For further reference, here’s a look at 30 Year Treasury Bond Yields (INDEXCBOE:TYX) vs COT positioning:

Thanks for reading.

Note that the change in COT report data is week-over-week. Excerpts of this blog post originally appeared on Paban’s blog.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.