Well, it looks like AI (artificial intelligence) has not replaced everyone’s job just yet. Last week saw a surprisingly strong ADP employment report of 497k – double what economists were expecting.

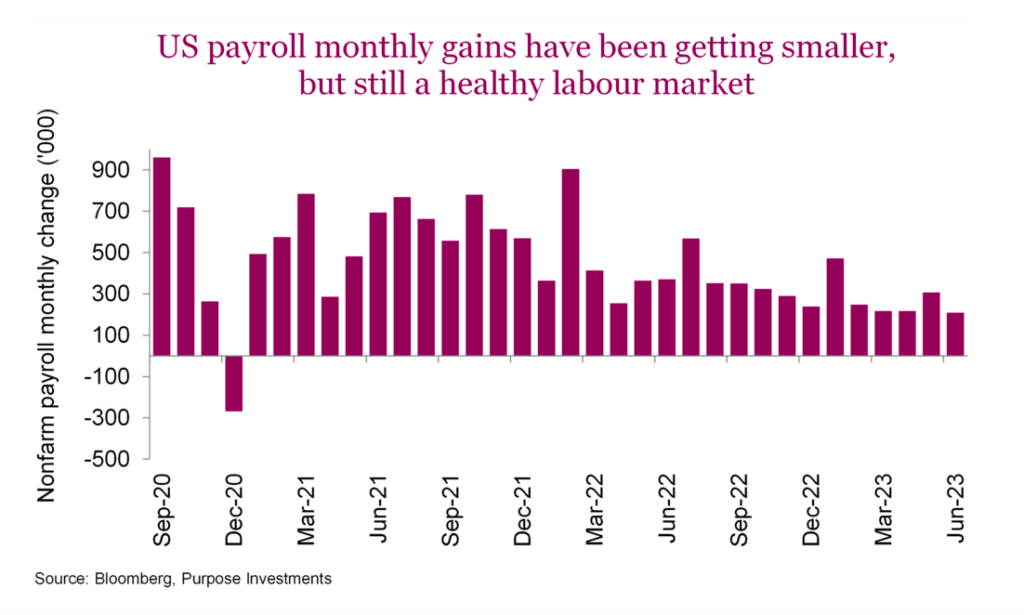

Then, on Friday, the U.S. Department of Labor reported non-farm payrolls of 209k, a bit below forecasts. Canada joined in too – with 60k new jobs in June, pretty much all over the place.

Let’s see if we can break it down.

ADP (Automatic Data Processing), is a payroll processing firm that many may have seen on their pay stubs over the years. This is a firm that handles payroll processing, mainly in the U.S. but also with some operations in Europe and Canada. People receive actual pay stubs from some 365,000 companies that use ADP’s services. This is big-data kind of stuff and sounds like a pretty good measure of employment. A few cautionary notes: June is often a more active month for hiring and while ADP data is seasonally adjusted, the June data could be slightly inflated. Also, ADP tends to be rather volatile from one month to the next. Nonetheless, the recent report clearly provides evidence of a healthy labor market.

The non-farm payroll data (NFP), often viewed as the more official measure, is a survey of a number of larger U.S. companies’ monthly hiring/firing activity. This one was a bit softer showing 209k new jobs, of which 60k were government jobs, while previous months’ readings were revised lower. NFP may be more stable but it is also revised a lot. While this one was a bit softer, there is still evidence of a labor market that is enjoying a good amount of strength.

Let’s not ignore Canada, which had a very strong report. But the Canadian data is borderline manic, so in this report, we will be focusing on the U.S. There’s no denying that if labour markets remain strong, a recession is unlikely.

Employment is a lagging indicator

When corporate margins start to come under pressure, companies react. Maybe the corporate retreat is on a tighter budget, hence travel may be reduced, or other discretionary spending is curtailed. One of the last levers to be pulled is laying off employees. Nobody ever wants to do it, it’s often expensive, and when business returns, it is expensive and/or hard to find good people. This makes layoffs one of the most lagged employment indicators, which have started to rise nonetheless. There have been 417k announced layoffs from January through May of this year. This has already surpassed the 361k total for all of 2022.

Other parts of the employment picture start to show signs of stress before the big headline numbers. Initial jobless claims is a weekly data series in the U.S. that often is one of the earlier movers when trends in employment are near. This has risen a bit over the past couple of months – but not to a material level.

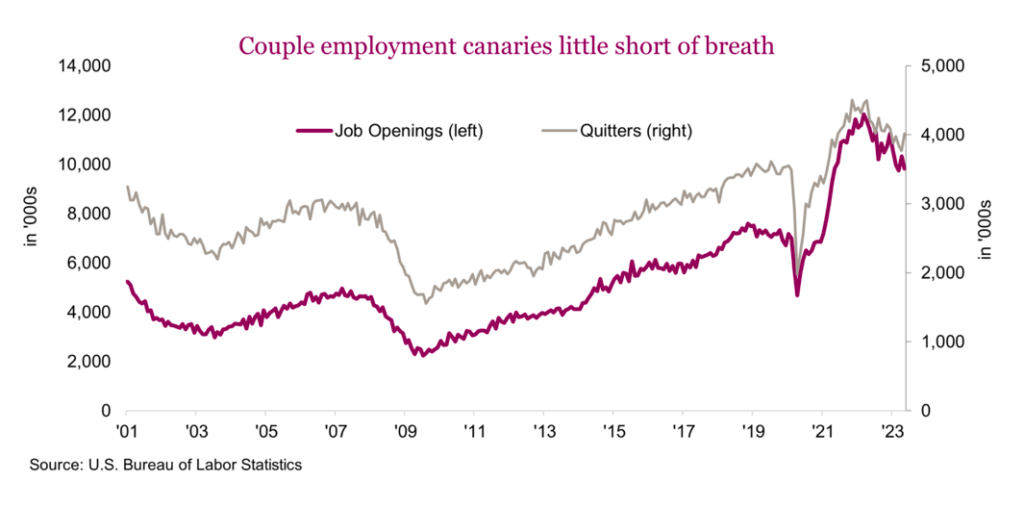

Since laying people off is often the last resort for a company, there are other signs on the hiring side. The number of job openings has been steadily falling. Naturally, one of the earlier employment levers a company will pull is to stop or slow hiring. There is additional anecdotal evidence that the quality of the job postings has fallen. This is being picked up in quit rates as well. If it starts getting harder to find a new job, people become less willing to quit their current post.

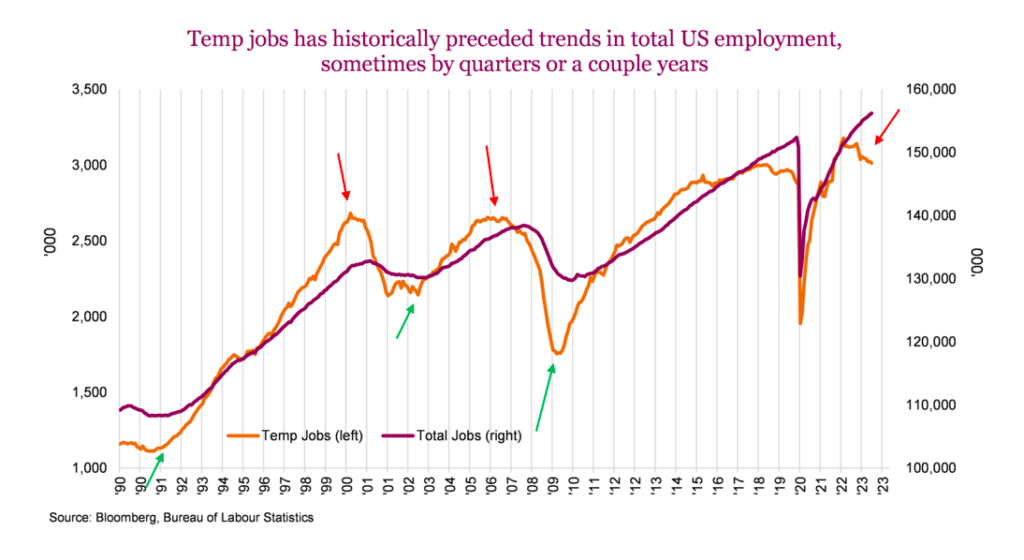

Perhaps one of the best leading indicators for turning points in the U.S. labor market is temporary workers. Again, it’s pretty intuitive, a company will lay off contract workers or not renew contracts before they start letting go permanent employees. Don’t take our word for it, just look at the data. We added an arrow for points when temporary workers experienced a trend reversal, red for a new downtrend and green for an uptrend. Clearly this precedes turning points in total employment, sometimes by a few months, and sometimes by a couple of years. Also, note that temporary jobs peaked in Q1 of 2022 and have been falling ever since.

Final thoughts

The labour market is relatively healthy on the surface which has certainly helped alleviate or push out recession risks for the moment. This is clearly good news. This has also lifted yields higher and raised the market’s view on how many more rate hikes we could see this year. But don’t forget, labour is lagging. And many of the underlying data measures that have historically been more timely, are showing softness. This may not be the best time to quit that full-time gig and become a contract worker.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.