The marketing spin on why you should invest in Emerging Markets (EM) is compelling. These countries are growing faster than developed economies, a trend that will likely continue for decades.

And in younger populations like these, the working class continues to expand.

They earn more, spend more and drive their respective economies. Contrast that with aging populations in the developed markets. If you’re looking for growth, Emerging Markets is where it is easier to find.

We do not disagree with the long-term demographic / growth argument supporting Emerging Markets. This equity category should always be on the radar of a well diversified and balanced portfolio.

However, we do not believe that Emerging Markets (EM) should have a permanent allocation.

Furthermore, at this point in time, the allocation to EM should be underweight or even no weight.

First, what is in Emerging Markets (EM)?

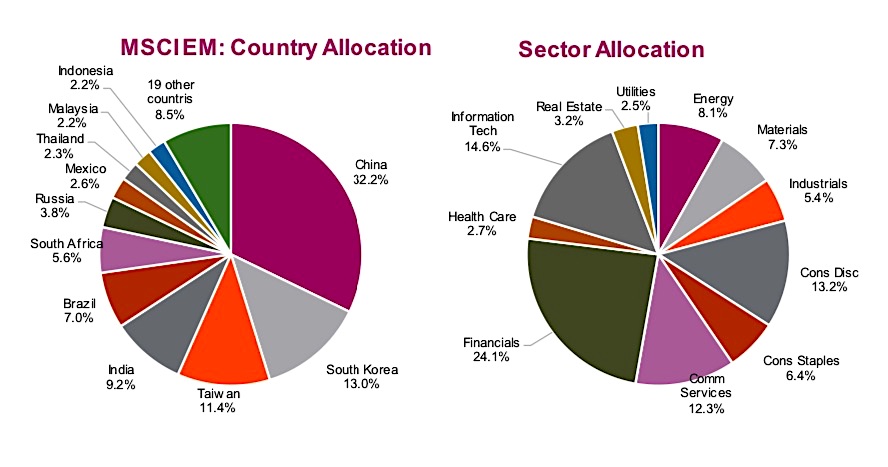

To start, there’s even disagreement on the nomenclature, as some call this sub-category of equities ‘Developing Markets’. We will rely on the MSCI Emerging Markets Index classifications: EM are markets of countries that are earlier on their development path based on socio- economic factors.

The two charts below provide some context on which countries are included and how the MSCI Emerging Market is currently weighted along with sector weights. The ETF EEM tracks this index.

Putting Emerging Markets into context

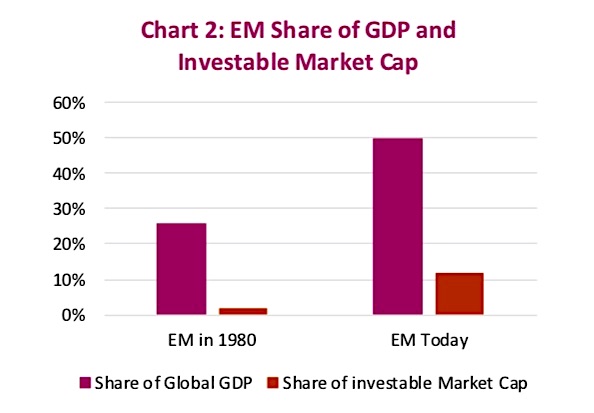

In 1980, Emerging Market economies accounted for about 25% of the global

economy. As these economies grew faster than developed economies, this

weighting has increased to almost 50%. This weighting is based on purchasing power parity GDP, the percentage is lower based on current market exchange rates at about 35%.

Regardless of the measurement approach, EM has grown to be a material component of the global economy. Despite this sizeable weighting, the EM equity weighting among investible assets remains relatively low at about 12%. This will likely increase over time as EM markets grow, which is the long-term opportunity. (Chart 2 below)

One factor that slows this trend is some EMs become Developed Markets (DM) over time. Nonetheless, with such a discrepancy between economic size and market size, this will likely narrow over time and support exposure to EM.

So why not now?

One of the simplest reasons is the stage of the market cycle. This global economic expansion has been going for about ten years now and while we don’t know when it will end, a bear market is likely in the cards in the next few years. Emerging markets do not react well when global economic growth slows: their markets tend to be much more sensitive. We would much prefer to be market or overweight EM earlier in a market cycle, not in the later innings.

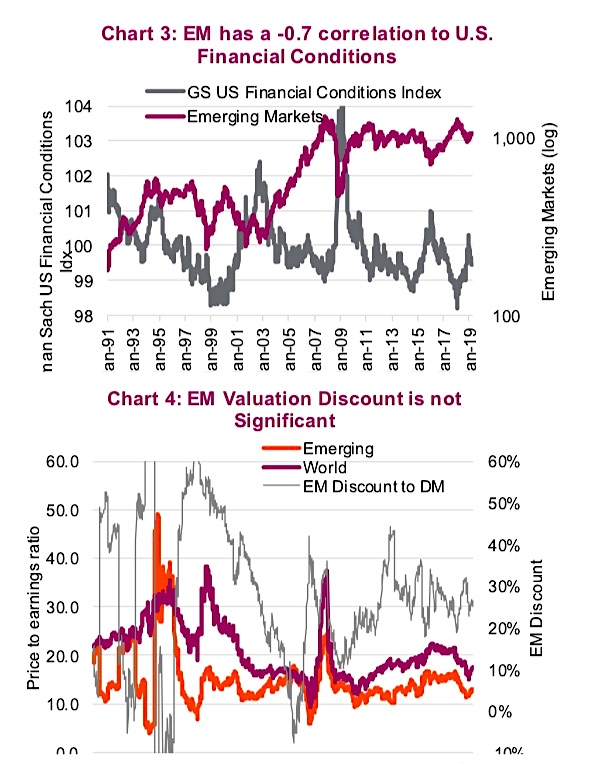

Financial conditions are tightening. For many years, we have had easing financial conditions globally and that has helped EM. While the trend has some bumps in it, the current trend appears to be for tightening financial conditions. This carries a strong negative correlation to the price performance of EM. (Chart 3 below)

There is not a significant valuation discount in EM from either a price-to-

earnings or price-to-book measurement. (Chart 4 above) The discount is currently about 25% based on relative PE ratios, which is pretty close to the long-term average. EM has been done very well vs DM when entering the trade at a higher discount.

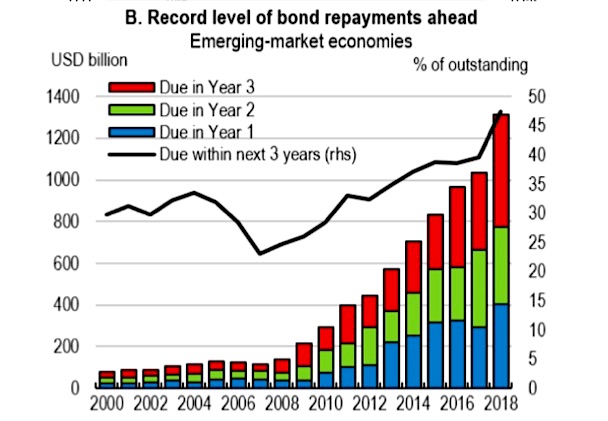

Debt is a rising concern at the corporate level in many emerging markets. The final chart on this page is from the recent OECD Economic Outlook and highlights how much debt repayment is due in the next few years among EM. Years of low global interest rates and easy monetary policy (QE) have contributed to a ballooning of EM debt. This isn’t an issue today, but if yields rise or the bond market becomes less enthusiastic about refinancing this debt or the global economy slows… this will become an issue fast.

Conclusion

We believe EM should be a long-term component in investor portfolios, but we simply don’t believe it needs to have a material allocation today. One factor that would have us reconsidering this view is if China really increased stimulus, but at this time that does not appear to be the most likely scenario.

Source: all charts are sourced to Bloomberg & Richardson GMP, the last chart is from the OECD Interim Economic Outlook 6 March 2019

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.