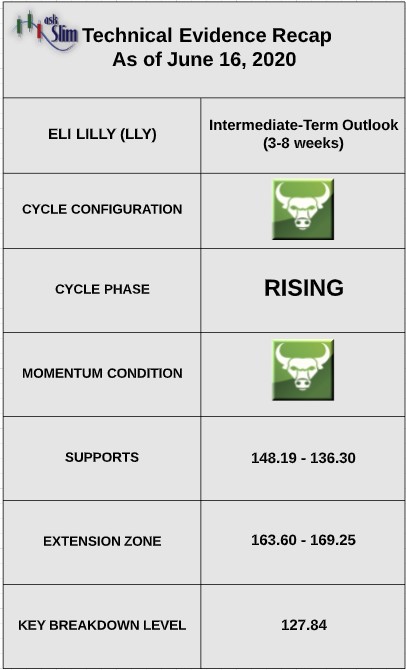

Eli Lilly Stock Chart (LLY) with “Weekly” Cycle Analysis

On Tuesday, Eli Lilly (LLY) announced that its breast cancer drug, Verzenio, met its primary endpoint as part of a Phase 3 drug trial in reducing the risk of breast cancer recurrence.

This news sent Eli Lilly up more than 18% midway through Tuesday’s trading session. Let’s review our weekly cycle analysis.

At askSlim we use technical analysis to evaluate price charts of stocks, futures, and ETF’s.

We use a combination of cycle, trend and momentum chart studies, on multiple timeframes, to present a “sum of the evidence” directional outlook in time and price.

askSlim Technical Briefing:

LLY is in a rising phase on the weekly. Weekly momentum is currently negative, but it is likely to turn back up. The next projected intermediate-term low is due in August.

On the upside, there is a Fibonacci extension zone from 163.60 – 169.25. On the downside, there are rising intermediate-term supports from 148.19 – 136.30. For the bears to regain control of the intermediate-term, we would need to see a weekly close below 127.84.

askSlim Sum of the Evidence:

LLY is in the late stages of a rising phase on the weekly. We see limited near-term upside. There is a likelihood that the stock tests the rising intermediate-term supports beginning at 148 by August.

Interested in askSlim?

Get professional grade technical analysis, trader education and trade planning tools at askSlim.com. Write to matt@askslim.com and mention See It Market in your email for special askSlim membership trial offers!

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.