Since August, gold prices have been weakening following a pandemic fueled, fear rally in equities.

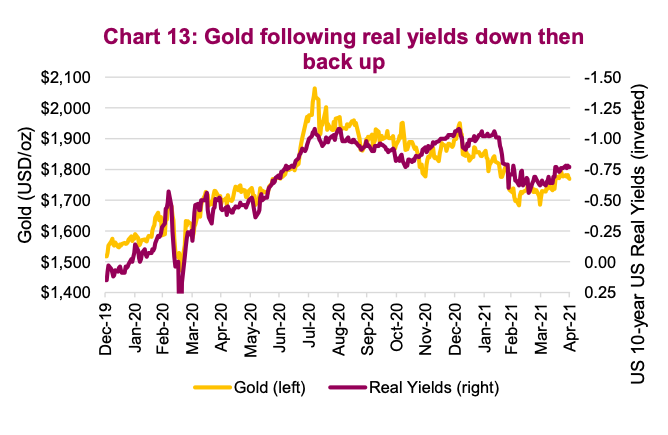

At the start of the pandemic, bond yields were falling as growth expectations vanished, giving gold a boost.

Then, starting in the summertime, nominal bond yields began outpacing inflation, causing real yields to rise. (Real Yield = Nominal yields – inflation) This put downward pressure on the price of gold, which tends to move inversely to real yields.

At the same time, there was also an expectation of reflation in the economy due to vaccine advancements. However, inflation has remained muted because of slack in the economy and deflationary forces left by the pandemic.

Hopefully now with the worst behind us, it is not only growth but inflation that is becoming more certain.

The unemployment rate in the United States is 6.0%, almost double the pre-pandemic levels (but falling). Jerome Powell reiterated this week the Federal Reserve (FED) is seeking “maximum employment”, which would likely allow CPI to go above 3%. The FED also wants to avoid a “taper tantrum”. This bodes well for real interest rates to move higher in the medium-term.

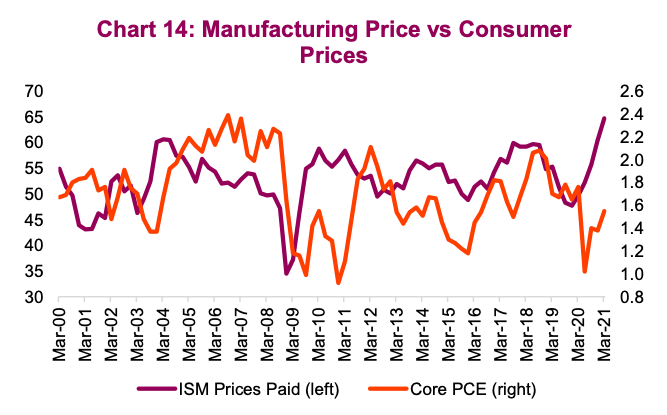

Although Core PCE inflation has been slow to react, ISM manufacturing prices paid have been quickly moving higher. This leaves a gap for core inflation to close by moving higher. See chart below.

There are many other green-shoots of inflation that don’t show up in Core PCE such as: stocks, base metal prices, lumber… Precious metals typically have two functions: one is as a store of value and second is for industrial and retail consumption. Gold and silver are primarily used as a store of value because of their high cost.

There is now a competing store of value asset, Bitcoin, or more broadly speaking cryptocurrency. Widely debated whether this is a real asset or not. It is gaining popularity supporting its place in a diversified portfolio and there is finite supply.

Because of its narrow industrial uses, some economists value gold as 1 / T, where T is trust in the market or system.

Modern Momentary theory which is backed by printing money and paying it off in the future by printing more money is part of the thesis supporting the rally we have seen in both crypto and the prices of precious metals.

Precious metal prices were a value-add asset class early in this pandemic-induced market, as bond yields moved to historic lows. Coupled with benign inflation, this provided a solid backdrop for a rally in prices.

As we move into the next phase of the recovery, we believe inflation expectations to grind higher. Together with sustained accommodative monetary policy from central banks, it should provide the backdrop for another upward move for precious metals.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.