The following is a recap of the December 9 Commitment Of Traders Report (COT) released by the CFTC (Commodity Futures Trading Commission) looking at COT data and futures positions of non-commercial holdings as of December 6.

Note that the change in COT report data is week-over-week. Excerpts of this blog post also appear on Paban’s blog.

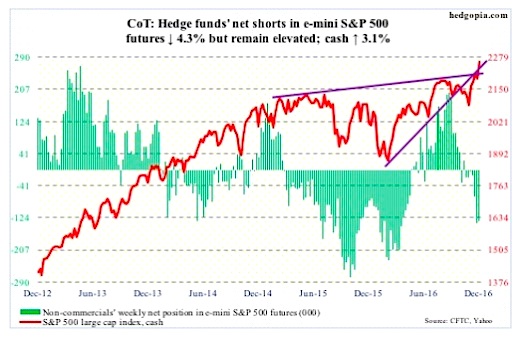

E-mini S&P 500

Yet another week, and yet another all-time high for the S&P 500 (INDEXSP:.INX). The Trump rally marches on. Wednesday’s 1.3-percent jump took out the previous high 2214.1 of five sessions ago. Bulls would now be looking to defend this the next time the cash weakens. In the last two sessions last week, they were able to defend three-month support at 2190-ish.

There is giddiness in the air.

Both the Dow Industrials and Transports rallied to new all-time highs. For proponents of the Dow Theory, this is a buy signal. Whatever that means. On a trailing 12-month basis, the S&P 500 is trading at north of 22x operating earnings – so let us not even talk about valuation support.

That said, momentum is intact, and the crowd has decided the U.S. election has changed the risk-reward dynamics. In the latest week, Investors Intelligence bulls were 58.8 percent – the highest since February last year. The NAAIM (National Association of Active Investment Managers) exposure index was at 101.6. The chips have been pushed to the middle of the table. All good so long as another party is willing to pay a higher price (the greater fool theory).

The risk in all this is that nouveau investors will be left holding the bag when the music stocks. Traders tend to be flexible and hopefully will dodge the bullet.

In the week ended Wednesday, $4.5 billion moved into SPY, the SPDR S&P 500 ETF. In the prior couple of weeks, $3.4 billion was redeemed (courtesy of ETF.com).

Also in the week through Wednesday, $2 billion came out of U.S.-based equity funds (courtesy of Lipper).

December 9 Commitment of Traders data: Currently net short 133.3k, down 6k.

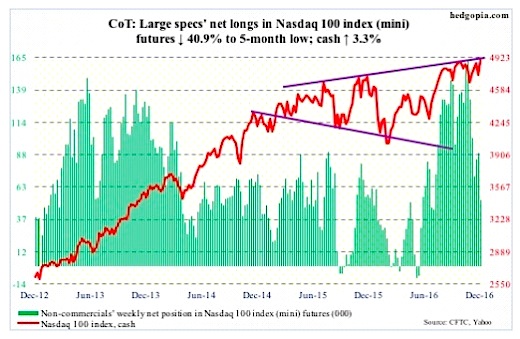

Nasdaq 100 Index (mini)

The saga continues. Even as the S&P 500, Russell 2000 and Nasdaq composite rallied to fresh highs this week and a Dow Theory buy signal was flashed, the Nasdaq 100 refuses to join the party. Sort of. It still has not posted a new high. The last one was on October 25 (4911.76).

That said, it did rally 3.3 percent this week – past its 50-day moving average, and past resistance at 4840.

The problem continues to be flows. In the week ended Wednesday, QQQ, the PowerShares Nasdaq 100 ETF, lost $2.6 billion (courtesy of ETF.com). Since Mr. Trump was elected president, $885 million has been redeemed.

December 9 Commitment of Traders data: Currently net long 52.7k, down 36.5k.

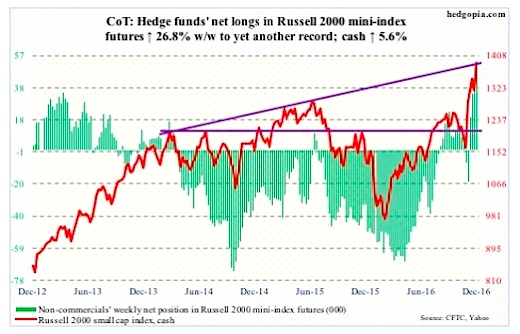

Russell 2000 mini-Index

From post-Thanksgiving Friday to Thursday last week, the Russell 2000 index declined 2.8 percent. Turns out that was a pause to refresh. From that low, it then rallied six-plus percent. Wednesday’s low successfully tested the post-Thanksgiving high. In other words, buyers are showing up where they are supposed to – technically speaking.

It has all come down to technicals right now. In a late-cycle economy, there is no fundamental basis for an index to surge 20 percent in a month – north of 16 percent post-Trump win – which is what the Russell 2000 has done.

On this basis, as overbought as the cash index is, momentum is yet to break, although flows are beginning to weaken.

In the week ended Wednesday, IWM, the iShares Russell 2000 ETF, lost $327 million. This came on the heels of inflows of $5.3 billion in the prior three (courtesy of ETF.com).

That said, non-commercials accumulated net longs to yet another record. Plus, IWM short interest jumped 6.2 percent in the November 16-30 period to a 14-month high, and these shorts probably got squeezed.

December 9 Commitment of Traders data: Currently net long 49.4k, up 10.4k.

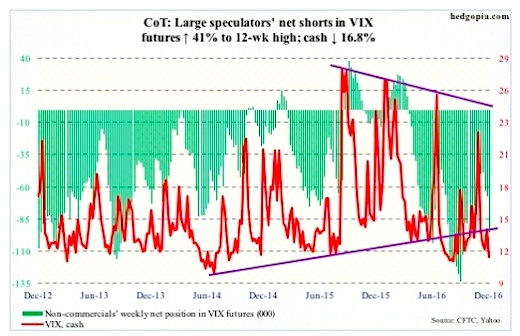

VIX Volatility Index

Intra-day Wednesday, the VIX Volatility cash index (INDEXCBOE:VIX) dropped to 11.33. This was the second straight sub-12 reading. But by close, it rallied to 12.22, up 3.7 percent. The S&P 500 jumped 1.3 percent in that session. Quite a divergence. This was also a session in which the CBOE put-to-call ratio dropped to a complacent 0.46, matching the low of June last year.

Thursday saw the same phenomenon, with the spot Volatility Index dropping to 11.3 intra-day but closing up 3.4 percent to 12.64, the S&P 500 rallying 0.2 percent and the Put to Call ratio at 0.5. Come Friday, the VIX dropped seven percent to close at 11.75, with the P2C ratio at 0.53.

At Wednesday’s lows, the VIX-to-VXV ratio dropped to 0.75, before rising a tad. By the end of the week, it stood at 0.77 – well into oversold territory, and a fourth straight week in that zone.

The rubber band is stretched.

December 9 Commitment of Traders data: Currently net short 95.4k, up 27.7k.

Thanks for reading.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.