If the volatility in stock market indices during the past two weeks has left you wondering whether it’s time to turn bearish, we’d encourage you to wait for more evidence. Today we look at the NYSE Composite (INDEXNYSEGIS: NYA) as part 1 of 2 (the S&P 500 is next).

So far, the correction appears very much as a correction should, on both an emotional and a technical level.

Certainly the recent swings have made intraday trading feel at moments like drinking from a fire hose, and the quick moves can make it hard to spot safe entries on larger time frames too.

From now forward, any bullish trades should be chosen very carefully and with smaller positions than usual.

But until we see a real breakdown of support, along with a series of lower highs and lower lows, the trend (the trader’s friend) is still upward.

Another development we would like to see before turning bearish on stocks would be for the bond markets to find stability. When it appears that the decline in bonds is finding an area to pause or correct upward, that will give markets more confidence in shifting assets from equities into bonds, which should contribute to an equity decline. That inflection might occur around March 2019 if the Fed continues raising interest rates as expected between now and then.

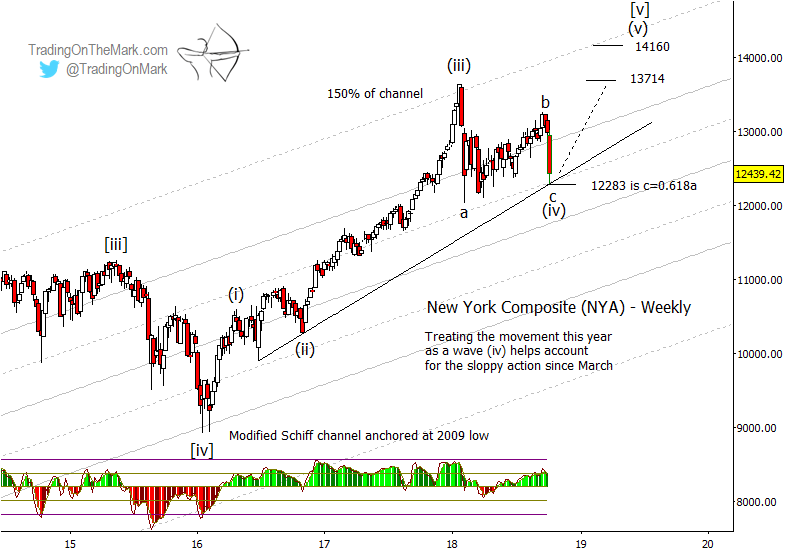

This is why we have been telling subscribers not to jump onto bearish positions too quickly. Stepping back to look at a multi-year chart of the New York Composite Index (NYA), we see that despite putting in a lower high last month, the series of important lows during the past year still represents a rising series of supports.

Moreover, the form of price action during the past year has been exactly what an Elliott wave technician would ask for, with wave ‘c’ of a correction stopping at the Fibonacci 0.618 measurement relative to wave ‘a’.

We also appreciate the elegance of NYA finding support at a major Fibonacci measurement while also bouncing from a prominent trend line. There were several reasons for buyers to step in right at that spot.

In volatile conditions, traders of all experience levels can benefit from charts that show the areas where turns are more probable. Trading On The Mark helps subscribers stay on top of the moves with twice-daily updates for the Dollar Index, Euro futures, the S&P 500, crude oil, treasury bonds, and gold. Between now and October 31, new subscribers can lock in savings of 15% on all of our services. The coupon code for the special offer is “fractal”.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.