An astute client of mine emailed me with a question:

“I am concerned about this currency war that is going on with the US dollar. Are there any preventive measures that we should be looking at now to lessen the impact that this will have on the US dollar and also the economy?”

Great question.

First, let me briefly explain the concept of currency wars and why they happen. Then I’ll talk about the impacts on the US dollar and our economy. And I’ll end with how I invest in a deflationary environment where the US Dollar remains strong.

My first experience with a currency war was back in the late 1980’s when I was a rookie broker with Edward Jones. Japan (which had been an economic powerhouse up to that point) began to struggle to maintain their rate of growth. Their economy was slowing and the usual counter measures weren’t solving the problem, because the more successful Japan was economically, the stronger their currency became. A stronger currency makes your goods and services more expensive on a relative basis. So the solution, they felt, was to devalue their currency so that their products would become more competitive internationally and they would attract more customers. In essence, they were waging economic warfare against their competitors by manipulating the value of their currency.

The problem with currency wars is that when one country devalues their currency it makes their competitor’s products more expensive. If your country is strong and growing economically then it can withstand its products being slightly more expensive…at least for a while. If the quality is the same, more orders will start going to the companies and countries with the lowest overall cost. The result (they believe) is that the ‘strong’ country will see their growth slow over time as the ‘weak’ country gains more orders because their cost is less.

In the end, I believe that this logic is flawed and I believe that history proves it. Japan has pursued this course of action for almost 35 years now and they still have not been able to solve their lack of growth issue. The core problem they are fighting is not the value of their currency (not monetary policy), it is structural in nature. They are fighting demographics and government policies (like social welfare) that limit their flexibility. By the way, these structural problems are now affecting most developed countries around the world and there aren’t any simple answers.

Second, let me talk about the impacts the US dollar and our economy.

Currencies always trade on a relative basis, so if the value of the Japanese currency goes down, the value of the US Dollar goes up. I believe that a strong currency is a good thing generally. A strong US Dollar allows us to get ‘more for our money’ in goods and services. The downside is that a strong dollar makes our products more expensive for countries (like Japan) to buy. So a strong currency creates a headwind for U.S. companies that export products around the world, while helping those U.S. companies that buy materials oversees but mainly sell to U.S. consumers.

That is what I mean when I say that when another country devalues its currency relative to the US Dollar, it imports DEFLATION to the U.S. Since oil is priced in US Dollars, the deflationary effects of foreign currency de-valuation are easy to see in this chart:

As you can see in the chart, the price of oil has plummeted almost 70% in the last year or so. That has hammered the energy industry and resulted in cutbacks and layoffs, although it has helped consumers with lower gas prices. Some argue that consumers will spend those extra dollars and thus it will help the economy but I disagree. First, the amount of income spent on fuel is very low and inflation in things like rents continue to pressure the average consumer. Second, consumers aren’t dumb—we know things in the economy aren’t going that well and we are concerned so we naturally tighten our belts and reduce what we spend.

So currency wars around the world are definitely impacting us here in the U.S.

Third, I’ll explain the strategies I am with my investments.

Let’s face it; in country after country around the world, growth is slowing. China, the ‘engine’ that used to power the global economy has slowed significantly and is still slowing further. It used to be growing at 7% a year, now it may be growing at only 4%. Japan still can’t sustain growth and Europe (apart from the UK) is fighting to keep their domestic growth positive. Canada, one of the hardest hit energy-related countries, is already technically in a recession and is dealing with a housing crisis on par with what the U.S. experienced in 2007.

Remember, deflation makes it harder for companies to continue to grow their revenues and their profits. When growth slows, the price of a growth company’s stock goes down. Deflation is especially apparent in the materials, energy and industrial sectors. Even retiree-income favorites like utility companies (as a sector) were down almost 10% the first half of 2015.

So how do we invest in a deflationary environment where the US Dollar remains strong?

There are two types of investments that do well in a deflationary environment where growth is slowing. They are US Treasury Bonds (USTs) and cash. That’s why I continue to have healthy positions in the 20+ Year Treasury Bonds ETF (TLT) and Vanguard Extended Duration Bonds ETF (EDV).

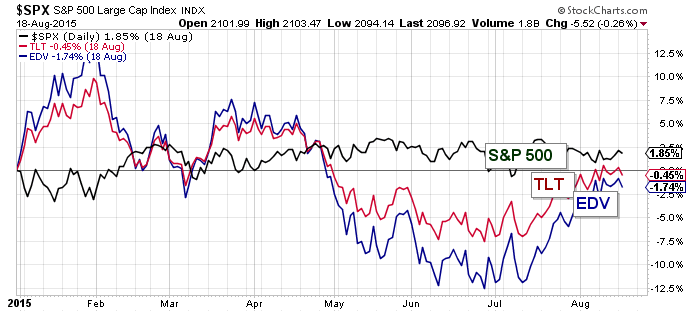

These positions were hit hard in the second quarter but I believe that they are showing their worth as it becomes more and more apparent that the Federal Reserve will not be raising rates in September (and probably not in December either). As you can see in the chart below, the S&P 500 year-to-date is up 1.85% whereas TLT is down -0.45% and EDV is down -1.74% (as of market close 8/18). Notice that toward the end of June they were down significantly more.

But look at what has happened lately. Over the last month, bonds ETFs TLT and EDV are outperforming the S&P 500. It is my convictions that as economies continue to slow and currency wars continue that these positions in bonds will continue to outperform the S&P 500.

These are difficult times for investors. Have a great week and stay focused.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.