The modest strength in the U.S. Dollar Index over the last several years has prompted many ETF investors to “hedge” their overseas currency risk. This can be easily accomplished by purchasing a specialized fund that owns a basket of international stocks alongside short positions in the host country’s currency.

These funds have proven to be quite successful during periods of currency devaluation, but can become burdensome when the trend reverses. This post is dedicated to unearthing the fundamentals behind these currency hedged ETFs and how they have performed more recently.

KNOW WHAT YOU OWN: CURRENCY HEDGED ETFs

Reviewing The Playing Field – David Fabian

The largest ETF in this space is the WisdomTree Europe Hedged Equity Fund (HEDJ), which has $14.7 billion allocated to a basket of 126 large-cap stocks in the Euro-zone. Included in this mix are dedicated short positions in the euro currency, which are intended to act as a boost if the euro depreciates relative to the U.S. dollar.

HEDJ charges an expense ratio of 0.58%, which is significantly more expensive than traditional international ETFs. The Vanguard FTSE Europe ETF (VGK) charges just 0.12% for an unhedged basket of stocks in this same genre. Nevertheless, the specialized nature of these currency hedged ETFs certainly warrants a premium in its cost structure.

Another top fund in this class is the Deutsche X-trackers MSCI EAFE Hedged Equity ETF (DBEF). This fund takes a similar (albeit broader) approach by incorporating both developed and emerging market exposure via the well-known EAFE index.

This ETF contains 932 holdings, short positions in multiple currencies, and a reasonable expense ratio of just 0.35%. Furthermore, DBEF just recently won the ETF.com 2015 “Best ETF Of The Year” Award as a result of its popularity and industry-leading structure.

Lastly, it’s worth noting that this style of ETF is available in single-country exposure as well. The WisdomTree Japan Hedged Equity ETF (DXJ) was the first fund to successfully test this model and has over $10.1 billion in assets. This ETF carries an expense ratio of 0.48% and of course has benefitted from the unprecedented central bank devaluation in the Japanese yen over the last several years.

Practical Perspective – Aaron Jackson

As central banks fight to devalue their currencies and lift their stock markets, these ETFs are a tool for foreign ETF investors to capture those returns.

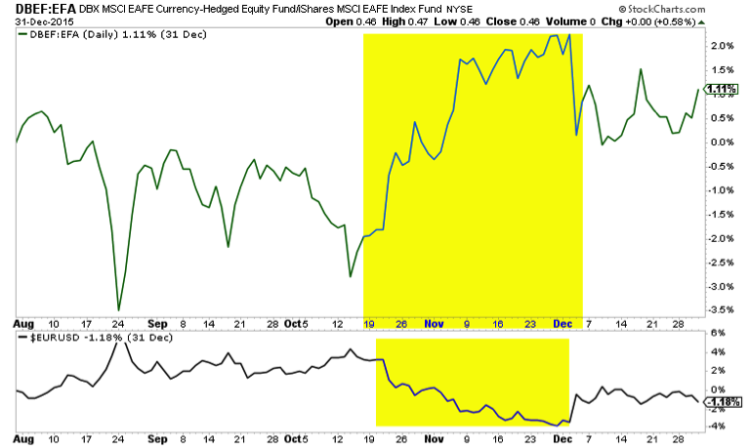

We can see the most notable performance difference between DBEF and the EAFE Index ETF (EFA) was when the euro dropped 6% from mid October until December. This highlights the key benefit of currency hedging ETFs.

As enticing as this sounds, it’s not easy to know when a currency is going to make a major move. Also, with Central Banks trying to control the markets, we really have no idea what lies ahead. Neither do they.

The risk is of course that the we’re wrong on currency direction. Note July 2013-June 2014. The Euro’s strength led to outperformance by EFA.

At the end of the day, choosing between currency hedged and non currency hedged ETFs can be difficult. However, when deciding to invest we can use trends to decide which is best.

Taking a look at the current technical structure in DBEF we see a declining price trend.

The ratio of DBEF to EFA remains trendless for now. If the ratio were to break the 2015 lows, we could say EFA is preferably to DBEF. We’re not there yet, so there is no real edge.

Shifting our attention to Japan, hedged fund DXJ is in a downtrend in price and relative to its unhedged counterpart EWJ.

The ratio of DXJ:EWJ also recently completed a major topping pattern. For the foreseeable future, we can expect EWJ to continue to outperform DXJ.

Conclusions

- Currency Hedged ETFs can be very useful tools if you think a country’s currency is going to fall significantly.

- Predicting market direction can be very difficult. Sometimes, there is no right answer.

- Using trend analysis can help give you an idea of whether to use a hedged fund or not.

Thanks for reading!

This article is part of a series co-authored by David Fabian (fmdcapital.com) and Aaron Jackson (northstarta.com). Each week we will be unlocking the secrets to some of the most talked-about exchange-traded funds in the market. The goal is to better understand what you own or elevate new ideas to the forefront of your watch list.

Twitter: @fabiancapital @ATMCharts

Neither author holds a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of each other or any other person or entity.