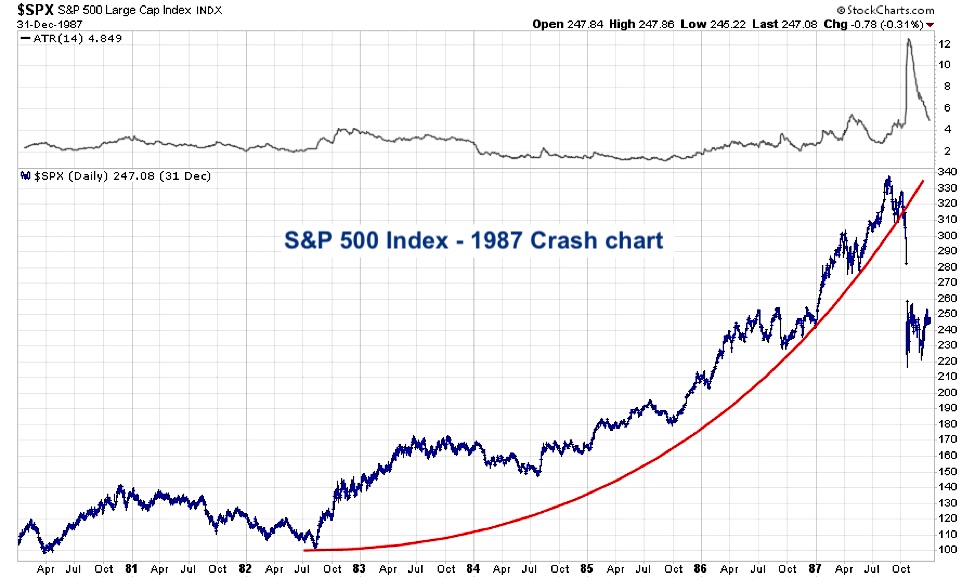

The 1987 stock market crash, better known as Black Monday, was a statistical anomaly, often referred to as a Black Swan event.

Unlike other market declines, investors seem to be under the false premise that the stock market in 1987 provided no warning of the impending crash.

The unique characteristics of Black Monday, the magnitude and instantaneous nature of the drop, has relegated the event to the “could never happen again” compartment of investors’ memories.

On Black Monday, October 19, 1987, the Dow Jones Industrial Average (DJIA) fell 22.6% in the greatest one-day loss ever recorded on Wall Street.

Despite varying perceptions, there were clear fundamental and technical warnings preceding the crash that were detected by a few investors. For the rest, the market euphoria raging at the time blinded them to what in hindsight seemed obvious.

Stock markets, like in 1987, are in a state of complacency, donning a ‘what could go wrong’ brashness and extrapolating good times as far as the eye can see. Even those that detect economic headwinds and excessive valuations appear emboldened by the thought that the Fed will not allow anything bad to happen.

While we respect the bullish price action, we also appreciate that investors are not properly assessing fundamental factors that overwhelmingly argue the market is overvalued. There is no doubt that prices and valuations will revert to more normal levels.

Will it occur via a long period of market malaise, a single large drawdown like 1987’s Black Monday, or something more akin to the crashes of 2001 and 2008? When will it occur?

I do not have the answers, nor does anyone else; however, I know that those who study prior market drawdowns are better prepared and better equipped to limit their risk and avoid a devastating loss.

History provides us with the gift of insight, and though history will not repeat itself, it may rhyme. While I do not think a 1987-like crash is likely, we would be remiss if we did not at least consider it and assign a probability.

Fundamental Causes

Below is a summary of some of the fundamental dynamics that playeda role in the market rally and the ultimate crash of 1987 and Black Monday.

Takeover Tax Bill

During the market rally preceding the Black Monday crash, corporate takeover fever was running hot. Leveraged Buyouts (LBOs), in which high yield debt was used to purchase companies, were stoking the large majority of stocks higher. Investors were betting on rumors of companies being takenover and were participating in strategies such as takeover risk arbitrage.

A big determinant driving LBOs was a surge in junk bond issuance and the resulting acquirer’s ability to raise the necessary capital. The enthusiasm for more LBO’s, similar to buybacks today, fueled speculation and enthusiasm across the stock market. On October 13, 1987, Congress introduced a bill that sought to rescind the tax deduction for interest on debt used in corporate takeovers. This bill raised concerns that the LBO machine would be impaired. From the date the bill was announced until the Friday before Black Monday, the market dropped over 10%.

Inflation/Interest Rates

In April 1980, annual inflation peaked at nearly 15%. By December of 1986, it had sharply reversed to a mere 1.18%. This reading would be the lowest level of inflation from that point until the financial crisis of 2008. Throughout 1987, inflation bucked the trend of the prior six years and hit 4.23% in September of 1987.

Not surprisingly, interest rates rose in a similar pattern as inflation during that period. In 1982, the yield on the ten-year U.S. Treasury note peaked at 15%, but it would close out 1986 at 7%. Like inflation, interest rates reversed the trend in 1987, and by October, the ten-year U.S. Treasury note yield was 3% higher at 10.23%. Higher interest rates made LBOs more costly, takeovers less likely, put pressure on economic growth and, most importantly, presented a rewarding alternative to owning stocks.

continue reading on the next page…