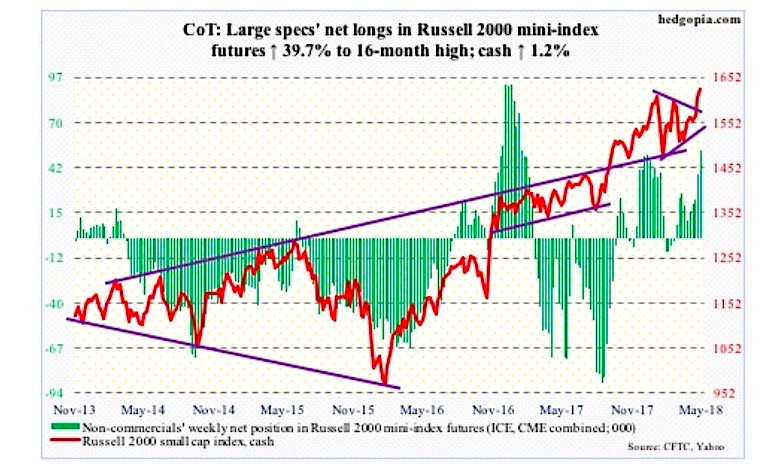

The following chart and data highlight non-commercial commodity futures trading positions as of May 15, 2018.

This data was released with the May 18 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

The chart below looks at non-commercial futures trading positions for the Russell 2000. For the week, the Russell 2000 Index cash) rose +1.2%.

Here’s a look at Russell 2000 Index futures speculative positioning. Scroll further down for commentary and analysis.

Russell 2000 Index Futures: Currently net long 53.3k, up 15.1k.

Small-caps continue to outrun their mid- and large-cap peers. This week, the Russell 2000 Index (1626.63) broke out to a new high. Of major US equity indices, it is the only one to do so after peaking late January.

Non-commercials were right to aggressively add to net longs last week. This week, they added more.

In the ETF land, flows were mixed, with iShares Russell 2000 ETF (IWM) losing $126 million in the week to Wednesday and iShares core S&P small-cap ETF (IJR) gaining $271 million (courtesy of ETF.com).

If the breakout is genuine, technicians would expect the Russell 2000 to rally another 11 percent in due course. For now, breakout retest is the path of least resistance.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.