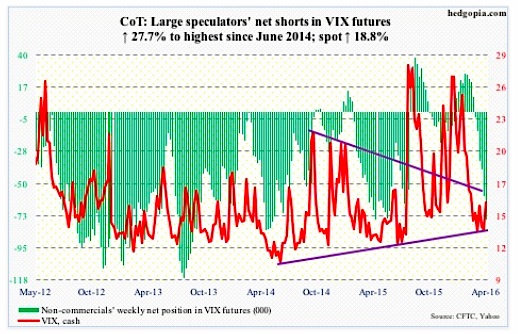

VIX: Spot Volatility Index (VIX) has essentially gone sideways for six weeks now, and needs to get over 16 to break out of range.

The time is perfect for that to happen, with both 10- and 20-day moving averages slightly pointing up. The weekly chart has tons of oversold conditions remaining to be unwound. Friday, the VIX jumped to 17.09 intra-day before pulling back to close at 15.70, just under its 50-day moving average.

Similarly, in four of the six weeks leading up to this week, the VIX-to-VXV ratio came in at sub-0.80, with the March 14th week producing a reading of 0.782 – a one-year low. The other two weeks were in the low 0.80s. This week, the ratio jumped to 0.85. If history is guide, it is not done moving up, and that means more volatility ahead for the stock market.

April 29 COT Report Data: Currently net short 75.9k, up 16.5k.

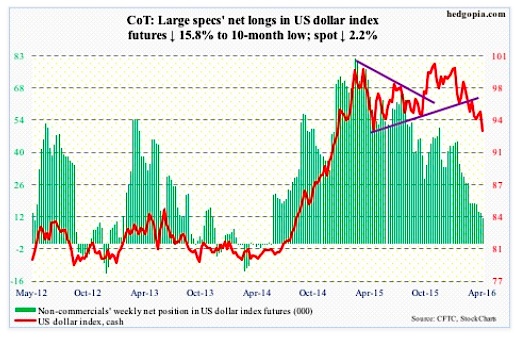

US Dollar Index: Blame the Bank of Japan for Thursday’s 0.7-percent slide in the US dollar index. The bank shocked markets by voting against more stimulus. The yen surged 2.4 percent, while the Nikkei collapsed 3.6 percent.

With this, the US dollar index (93.03) has lost support at 93.50, which goes back to January last year.

Non-commercials continue not to show any interest in adding to net longs of the dollar, which are at a 10-month low.

April 29 COT Report Data: Currently net long 11.3k, down 2.1k.

Euro: Eurozone bank lending grew 1.1 percent y/y in March, slightly faster than February’s one-percent growth. Recall that on March 10th the ECB said it would offer new loans to banks designed to boost lending, but that would not be forthcoming until June.

As well, Eurozone GDP expanded by 0.6 percent in 1Q16 – the fastest pace in a year, and up from 0.3 percent in 4Q15. Last but not the least, consumer price inflation fell by 0.2 percent in April, following a flat March.

For the week, the euro rallied two percent, and has room to move higher still on a daily chart. Resistance at 114-114.50, which goes back to January last year, provides the biggest hurdle. The currency closed the week right on that resistance.

April 29 COT Report Data: Currently net short 39.7k, down 7.3k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.