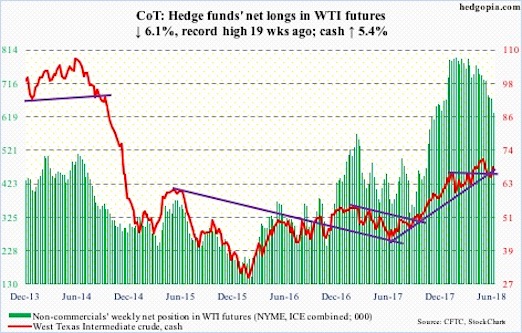

The chart and data that follow highlight non-commercial commodity futures trading positions as of June 19, 2018.

This data was released with the June 22 COT Report (Commitment of Traders). Note that this chart also appeared on my blog.

The chart below looks at non-commercial futures trading positions for Crude Oil. For the week, the Crude Oil rose by +5.4%.

Here’s a look at Crude Oil futures speculative positioning. Scroll further down for commentary and analysis.

It was a big week for Crude oil, as prices bottomed Monday and reversed sharply higher into week end.

Short covering or value buyers? Let’s look at the COT data…

WTI Crude Oil: Currently net long 630.1k, down 41k.

Crude Oil traders received a mixed report from the EIA last week. Gasoline and distillate oil stocks were up 3.3 million barrels and 2.7 million barrels respectively. Crude Oil imports also rose by 143,000 barrels per day to 8.24 million.

Crude oil stocks declined by 5.9 million barrels to 426.5 million to a 3 month low. Crude oil production was mostly flat at 10.9 million barrels per day. Ho hum.

Spot West Texas Intermediate Crude Oil peaked on May 22, 2018 at $72.90. But that marked the end of a bull leg higher as the price of WTI Crude declined as low as $64.22 over the following nine sessions. That low was briefly eclipsed on Monday but a rally quickly followed.

On Friday traders reacted to news that OPEC agreed to boost production by 1 million barrels per day starting next month – this was cheered by traders. But the reaction may be fleeting. Oil shot up nearly five percent on Friday. Short covering helped bulls recapture $66.50, a key toggle that may neutralize the selling. Crude closed the week at $68.58.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.