Since the post-financial crisis era began more than a decade ago, record low-interest rates and the Fed’s acquisition of $4 trillion of the highest quality fixed-income assets has led investors to scratch and claw for any asset, regardless of quality, offering returns above the rate of inflation.

Financial media articles and Wall Street research discussing this dynamic are a dime-a-dozen. What we have not heard a peep about, however, are the inherent risks within the corporate bond market that have blossomed due to the way many corporate debt investors are managed and their somewhat unique strategies, objectives, and legal guidelines.

This article offers insight and another justification for moving up in credit within the corporate bond market.

For our prior recommendation to sell junk debt based on yields, spreads, and the economic cycle, I suggest reading our subscriber-only article Time To Recycle Your Junk. If you would like access to that article and many others, you can sign up for RIA Pro and enjoy all the site has to offer with a 30-day free trial period.

Investor Restraints

By and large, equity investors do not have guidelines regulating whether or not they can buy companies based on the strength or weakness of their balance sheets and income statements.

Corporate bond investors, on the other hand, are typically handcuffed with legal and/or self-imposed limits based on credit quality. For instance, most bond funds and ETFs are classified and regulated accordingly by the SEC as investment grade (rated BBB- or higher) or as high yield (rated BB+ or lower). Most other institutions, including endowments and pension funds, are limited by bylaws and other self-imposed mandates.

The large majority of corporate bond investors solely traffic in investment grade, however, there is a contingency of high-yield investors such as certain mutual funds, ETFs (HYG/JNK), and other specialty funds.

Often overlooked, the bifurcation of investor limits and objectives makes an analysis of the corporate bond market different than that of the equity markets. The differences can be especially interesting if a large number of securities traverse the well-defined BBB-/BB+ “Maginot” line, a metaphor for expensive efforts offering a false line of security.

Corporate Bond Market Composition

The U.S. corporate bond market is approximately $6.4 trillion in size. Of that, over 80% is currently rated investment grade and 20% is junk-rated.This number does not include bank loans, derivatives, or other forms of debt on corporate balance sheets.

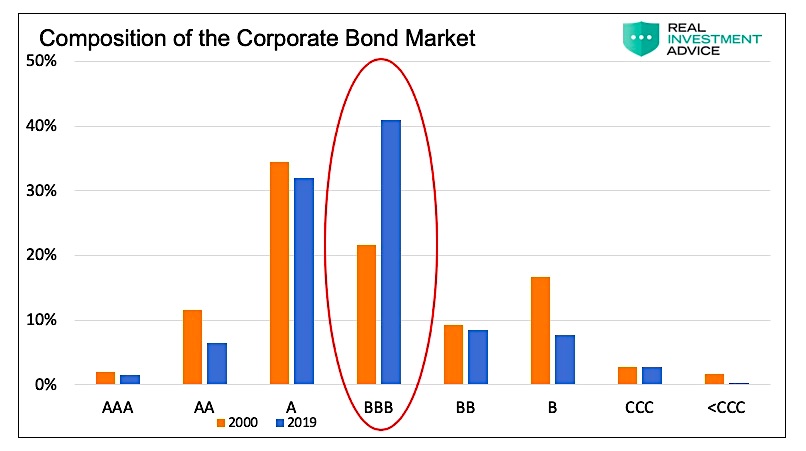

Since 2000, the corporate bond market has changed drastically in size and, importantly, in credit composition. Over this period, the corporate bond market has grown by 378%, greatly outstripping the 111% growth of GDP. The bar chart below shows how the credit composition of the corporate bond market shifted markedly with the surge in debt outstanding.

As circled, the amount of corporate bonds currently rated BBB represents over 40% of corporate bonds outstanding, doubling its share since 2000. Every other rating category constitutes less of a share than it did in 2000. Over that time period, the size of the BBB rated sector has grown from $294 billion to $2.61 trillion or 787%.

The Risk

To recap, there is a large proportion of investment grade investors piled into securities that are rated BBB and one small step away from being downgraded to junk status.

Making this situation daunting, many investment grade investors are not allowed to hold junk-rated securities.

continue reading on to the next page…