This article was written by Derek Benedet.

One would think given low unemployment, rising wages, still low interest rates, high confidence and a rising wealth effect (thanks to a stock market at record highs and rising home prices) the consumer should be in the sweet spot in terms of spending. Yet we are pestered with such news as Sears declaring bankruptcy and many retailers falling on hard times.

Weakness can also be seen in the aggregate data, including the recent miss in U.S. retail sales, the fourth consecutive miss relative to tempered consensus expectations. It’s hard not to be a little concerned about the health of the consumer. We see less spending in restaurants, department stores, and gasoline stations.

Big ticket items, namely Motor vehicle sales fell another 3 percent in June with seasonally adjusted annual pace now at just 16.41 million, this compares to a cycle high of 18.3 million in June of 2016. Sales are now negative on a year over year basis.

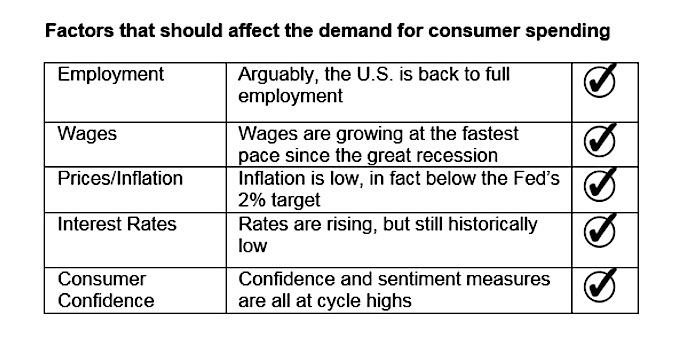

Examining the factors that affect consumer spending (see chart above), the consumer should be given an A+. Unemployment is low, wages are growing, inflation remains in check, interest rates are low and confidence is high. The wealth effect should be in high gear. Consumers should be willing to spend more when stocks are making all-time highs and widely held assets such as housing are rising.

With this A+ report card, why is this not transferring into a boon for all retail and consumer stocks? In this first installment of a two-part series, we will dig into this disconnect. Initially from a macro perspective and next week discussing changing behavior with portfolio management implications.

Credit is growing, but there are cracks

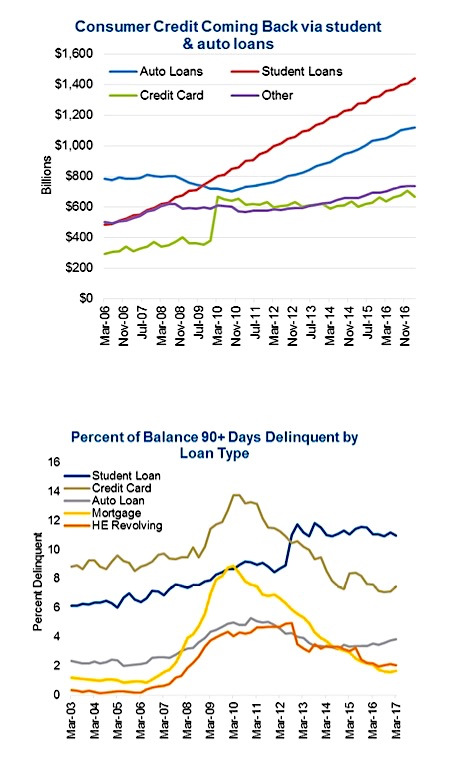

Credit expansion is moving in the right direction, higher. Unfortunately most of it is being driven by auto and student loans (1st chart below). During the past year, consumer credit expanded by $218 billion, yet 68% of this ($149B) was from expansion in auto and student loans. Rising auto credit certainly helps the auto industry, but not much beyond this sub-industry. And student credit expansion, well that won’t help Sears. We’re certainly not seeing the type of pre-crisis behavior where consumers borrowed heavily to finance their healthy appetite of regular consumption.

Not surprisingly, it’s where we see decent growth that delinquencies remain high (2nd chart above). Student loan delinquencies remain at a high level, though that has flat-lined over the past few years. Auto loan delinquencies are moving higher, as well as a small increase among credit cards. With rates as low as they are, the absolute level is still quite a bit lower versus pre-financial crisis levels. We’re not too concerned with these levels, but a meaningful acceleration would be cause for worry.

The great divergence

The elephant in the room is the $478 billion e-commerce behemoth. Amazon (NASDAQ:AMZN) is the largest retailer by market cap in the world. Online sales growth has been tremendous, as has Amazon Prime Subscriber growth. We have seen a 53% growth in U.S. E-commerce sales in 2016. Its dominant position is only increasing. The recent push into fresh food (Whole Foods acquisition) gives notice that industries previously thought to be safe are not. Doing 35 transactions per second, with a 9.8% conversion rate for those who visit the site, that’s 3 to 4 times that of Walmart online. Amazon is the clear winner, and the gap, for now, is only growing.

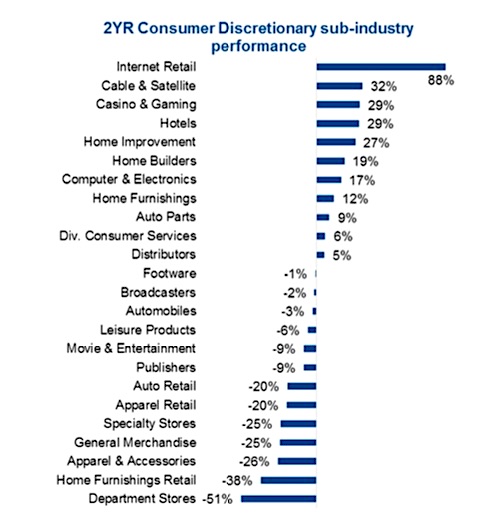

Digging deeper into the Consumer Discretionary sector (NYSEARCA:XLY), we looked at sub-sector performance over the past two years. There is a clear line between the ‘winners’ and the ‘losers.’ While Amazon has nearly doubled, department stores have been cut in half. (see chart below)

There is a clear separation among consumer stocks. Home improvement and home furnishings continue to do quite well. Many non-brick and mortar consumer industries also have been performing decently including leisure, gaming and travel names.

Looking at the industries that are benefiting from consumer spending, it’s evident that the consumer is still spending on discretionary goods, casinos, hotels, cruise lines and entertainment companies are all performing stellarly. Perhaps the days of the big ticket items are over and it is now more about experiences. We will be expanding more on this change next week.

Deep value or an attractive trap

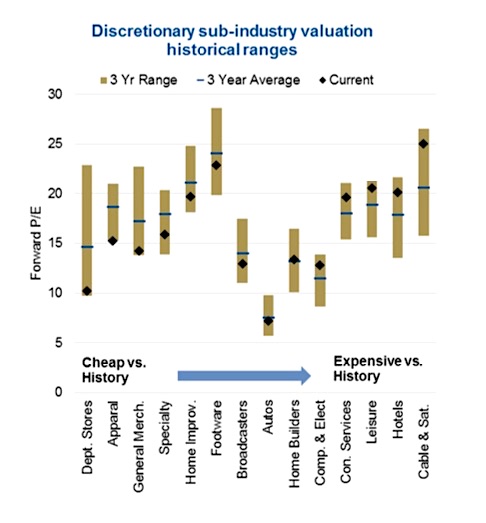

From a valuation perspective, department stores and apparel retailers are trading at historically low levels. Has the death of the department store been greatly exaggerated? Maybe, we’ll see data that points to the contrary this earnings season, but Macy’s, Nordstrom, Kohl’s and J.C. Penney continuing to report declines in comparable sales, it’s clear that these businesses will need transformational change to compete and thrive in the current market place. So is there value in the sector? The next chart below shows the three-year range in forward P/Es across a number of consumer sub-industries. Among the cheapest vs. historical average levels are Department Stores, Apparel, General Merchandise and Specialty retailers. On the opposite end of the spectrum, Internet Retailers, Hotels, Cable and Leisure names are all currently trading at elevated valuations.

What’s the verdict?

The consumer is healthy, but the choice of how and where to spend their money has changed. This has disrupted many traditional business models and helped others.

Stay tuned to next week’s edition of Market Ethos where we will expand on our thoughts on the change in consumer behaviour and how we are positioning our funds to these secular changes. Thanks for reading

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.