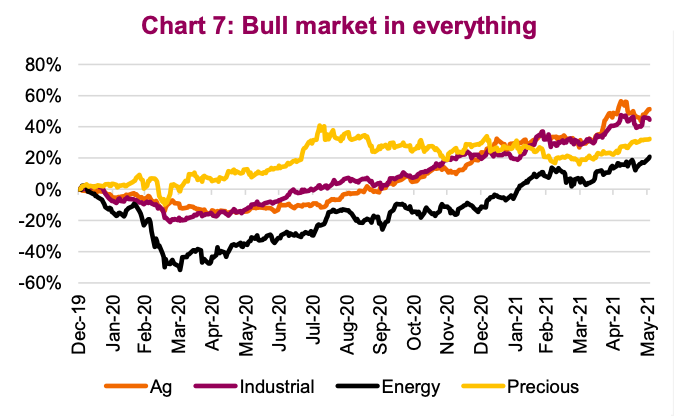

Broadly speaking, all commodities have overcome pre-pandemic levels by a large degree.

Looking at the featured chart for today (above), we can see respective period returns over the past year by commodity types. It’s no wonder that inflation concerns are creeping into the market narrative given this much price appreciation.

With some commodities at, or near, all-time highs, we’re not surprised with the growing chatter of a commodity supercycle.

Commodity Supercycle? Here’s some perspective…

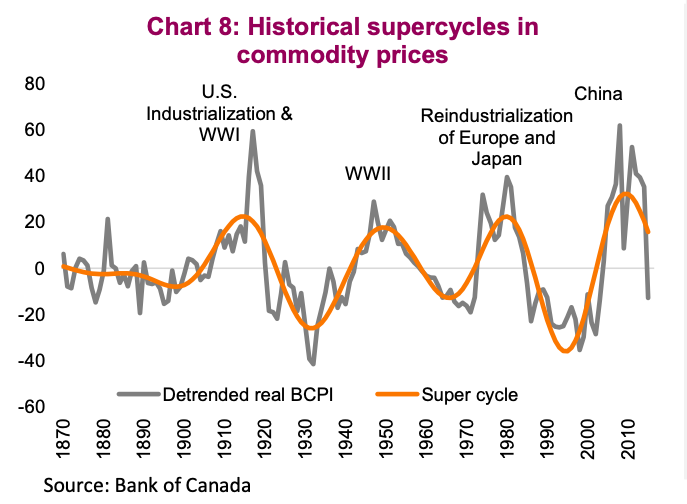

Supercycles are rare and long lasting, and historically share a few common characteristics. Supercycles require a sizable and sustained rally in commodity prices from a fundamental shift in demand overtaking supply that is too slow to respond. Going back the past 130 years, there have been about 4 supercycles as detailed in Chart 8.

The upswing phase in supercycles results from a lag between unexpected, persistent and positive shocks to commodity demand in conjunction with a slow-moving supply response. Current demand is being driven by the cyclical recovery of the economy following the vaccine rollout, increased infrastructure spending in many countries as well as shifts in environmental policy.

Importantly, the deceleration in China’s “old economy” will also prove to be a strong counterforce to offset the acceleration in industrial production in developed economies. The sustainability of the current demand upswing is also in question, given an expected shift in consumer demand for services rather than ‘hard’ goods. Economic re- opening does not equal a multi-year sustained increase in commodity demand, a pre-requisite for a commodity supercycle.

Many of the most dramatic commodity prices increases are due to a combination of both higher-than-expected demand and supply issues. A prime example is the oil embargo in the 1970s. The current logistical mishaps, whether they be too few sawmills, shipping constraints or boats getting stuck in a canal, appear rather transient. Time will cure them, bottlenecks just slowed things down a bit. Inventories for many commodities remain healthy, with plenty of product available.

Past commodity cycles have also benefitted from a depreciation of the U.S. dollar. Is this a prerequisite? Not necessarily, but it certainly helps. For the cycle to continue in a meaningful way, you likely need the U.S. dollar to continue to lose value. This also drives inflation risks and together with it rising bond yields, which beget a potential shift in monetary policy that could quickly derail the commodity comeback.

The story for each commodity is rather nuanced and idiosyncratic. Copper is one example of a metal that could be a more durable bull market, but the rationale behind the popularity of Dr. Copper has nothing to do with lumber prices or the price of tea in China. No doubt it’s been a good time for commodity exposure and a healthy home country bias, but we’d question characterizing it as a supercycle to endure for years to come.

The critical aspect is that the demand surprise may not be as enduring as some expect and we expect the supply issues to resolve over the course of the year. We still like commodity exposure given the potent structural backdrop for real assets, but more in a tactical sense.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.