CURRENCIES

Euro: Greece is back in the news.

Eurozone finance ministers held an emergency meeting on Monday to discuss the possibility of further debt relief for Greece, aiming to reach a deal by May 24th, when they meet next.

At present, Greece’s creditors are at a stalemate. Further, Brussels needs to release bailout funds to Athens. Greece has had three international bailouts. At the end of 2015, its debt was 177 percent of GDP. Would it ever be able to repay this debt without relief, and would Germany agree to debt relief? The whole situation is in a pickle.

As for now, last week produced a shooting star candlestick for the Euro, and the break out of 114-114.50 has so far proven to be false. This Wednesday, that resistance was attacked again, once again unsuccessfully. Friday saw the Euro testing its 50-day moving average (112.94).

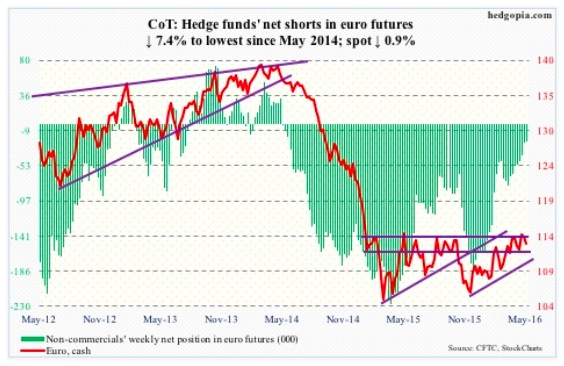

Weekly indicators in particular are grossly overbought, and odds favor the euro proceeds to unwind these conditions.

COT data: Currently net short 21.9k, down 1.7k.

US Dollar Index: The Bank of Japan’s aggressive quantitative easing (QE) program has expanded Japan’s money supply threefold.

In October 2011, a U.S. dollar bought 75.54 in Japanese yen. By June of last year, the yen had weakened to 125.85. Then it started to rally, rising to a low of 105.52 last week. The U.S. Dollar has weakened since that low, but the yen’s strength in the past year despite negative interest rates and oodles of QE money have to be rubbing Japanese officials the wrong way.

On Tuesday, Japanese finance minister Taro Aso warned that one-sided moves in the Japanese yen would not be tolerated. Should the ministry seek to weaken the yen, the dollar index is a beneficiary. The yen makes up 13.6 percent of the index.

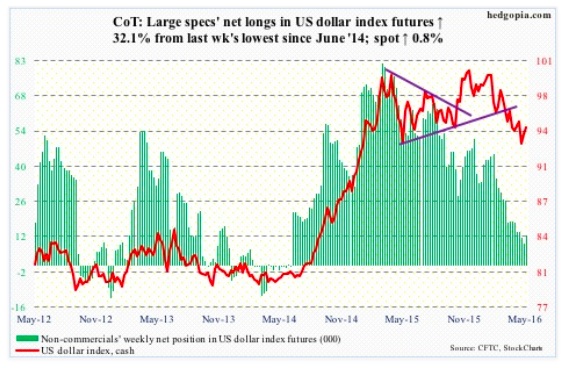

This week, dollar bulls built on last week’s hammer reversal candle. The 93.50 level has been defended, with shorter-term moving averages beginning to hook up. Weekly conditions are way oversold.

COT data: Currently net long 12.1k, up 2.9k.

Thanks for reading.

Twitter: @hedgopia

Read more from Paban on his blog.

The author may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.