An update on Eliminating Surprises with the Citi Surprise Index

In his 2016 State of the Union Address, President Barack Obama accused those claiming the American economy is in decline of “peddling fiction”. Few economic prognosticators have actually stated that the U.S. economy is in decline. However, many including ourselves have pointed out that economic growth has been declining for years and the key drivers of future growth – productivity and demographics – are quickly becoming economic headwinds. All the while, the nation’s ability to enhance economic growth by increasing an already burgeoning debt load is greatly limited.

We write this article to warn our clients and readers that recent Wall Street economic forecasts should be taken with a grain of salt. With GDP averaging below 1% for the last six months, it will not take much of an additional slowdown to put the U.S. in recession. Relying on overly optimistic economic forecasts could easily cause investors to miss signs of a recession and, as laid out in “Dear Prudence”, miss an opportunity to sell assets before a major drawdown. After reading this article, you may have a new appreciation for who is “peddling fiction”.

Citi Surprise Index Update

In “Eliminating Surprises Using Citigroup’s Surprise Index” we described the uniqueness of the Citi Surprise Index as a gauge of economic forecasting. In the article we advised that investors should focus on the magnitude and duration of forecasting errors to gain better insight into how well or poorly Wall Street economists are currently modeling the economy. Those two factors allow investors to gauge the grasp economists have recently had on the state of the economy. With this understanding, investors are better equipped to deal with economic surprises. For instance, when the Citi Surprise Index is consistently posting large positive numbers it implies that economists’ models are underestimating growth. When such a condition persists investors can have increased confidence that forthcoming economic data may be better than expected. The opposite is true when the Citi Surprise Index is consistently below zero.

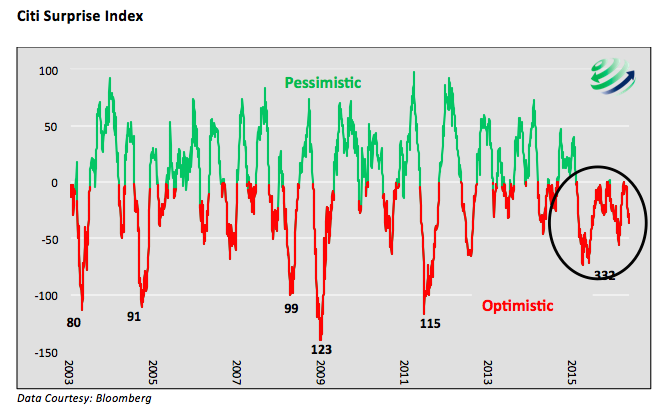

The following graph of Citi Surprise Index is an updated version of the one we originally published in November 17, 2015. Red lines show optimistic forecasts by economists and green lines pessimistic ones. The red line effectively denotes periods where subsequent data was worse than expected and the green line where subsequent data was better than expected. The numbers below some of the optimistic periods correspond to the number of business days that Citi Surprise Index was consecutively negative.

One may notice that the most recent data, circled above, does not look similar to the more common up and down intervals seen over the rest of the time series. In light of this, here are two factors worthy of your consideration:

1: The Citi Surprise Index has been negative for 328 of the last 332 business days, or 1.3 years. The current period is almost triple that of the longest stretch of negative readings since the index was first published in 2003. Typically the Citi Surprise Index rebounds into positive territory fairly quickly once a trough is reached, making the recent behavior inconsistent and concerning as compared with prior experiences.

2: During this recent string of negative numbers the Citi Surprise Index has averaged almost -30, implying that economists are not just slightly off the mark. The consensus of professional forecasters are consistently badly missing the mark by overestimating the strength of the economy.

Peddling Facts

Our takeaway from this unique period of Citi Surprise Index weakness is that economists are struggling in an unprecedented way to understand and model the economy as effectively as in the past. They have continually overestimated economic activity for 16 months and counting.

As the economy strays close to recessionary levels and equity valuations climb to historically extreme levels, we warn you to question Wall Street economic forecasts. While this Index is not a forecasting tool it does provide unique context to help estimate the potential accuracy of Wall Street economists. Given their recent track record, their accuracy leaves a lot to be desired.

At 720 Global, we state opinions based on data and facts, most of which are supplied by the U.S. government. We have no political agenda and no reason to peddle fiction. Unfettered by our business model we tell you exactly what we think with regards to the data and history. It doesn’t necessarily mean we will be more accurate, but it does mean we are a voice of reason and one that should be considered when the so called “smart money” is not so smart. These are not normal times; treating them as such will likely turn out to be a grave error.

Thanks for reading.

More from Michael: La Nina Puts Agriculture Sector In The Spotlight

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.