Cisco Systems (NASDAQ: CSCO) traded 6% higher on Thursday morning.

The company posting earnings that beat Wall Street expectations for revenue and earnings, demonstrating it was continuing to deliver on its “software as a service” business model.

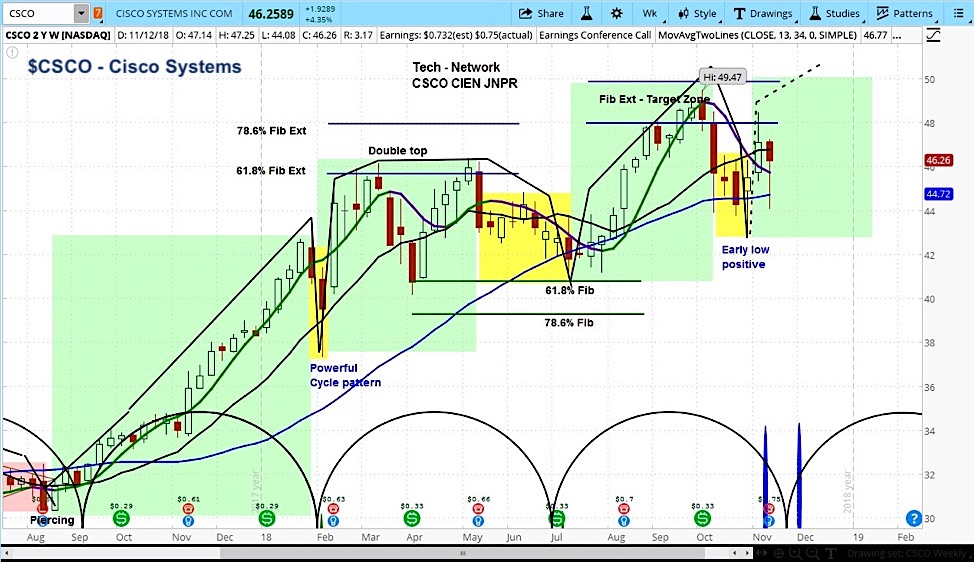

Given its positive technical patterns, we see additional upside for this stock.

This stock has bucked a negative trend in the tech sector.

Looking at the market cycles for CSCO, our analysis is that it is in the rising phase of its current cycle.

As it is early in this cycle, we believe there is still room for the stock to run. Our near-term target is a test of recent highs near $50.

Cisco Systems (CSCO) Stock Weekly Chart

The networking and telecommunications company reported earnings per share of $0.75 and total revenue of $13.1 billion, compared to analyst estimates of $0.72 and $12.9 billion. Cisco also nailed its guidance, projecting $0.71-0.73 for Q4, with the average analyst estimating $0.72.

Speaking of their competitive advantage, CEO Chuck Robbins explained that, “We are fundamentally changing the industry. We’re building an architecture that is designed to securely connect any user on any device on any network to any application running anywhere.”

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.