“How easy it is to get things done completely shapes what gets created” – Patrick Collison

One of the themes we follow closely is the transition to a cashless society.

As new payment processing technologies become adopted by consumers, transactions which have largely been conducted in cash are going digital.

Although this was slowly taking place pre-COVID, the pandemic seems to have accelerated this trend.

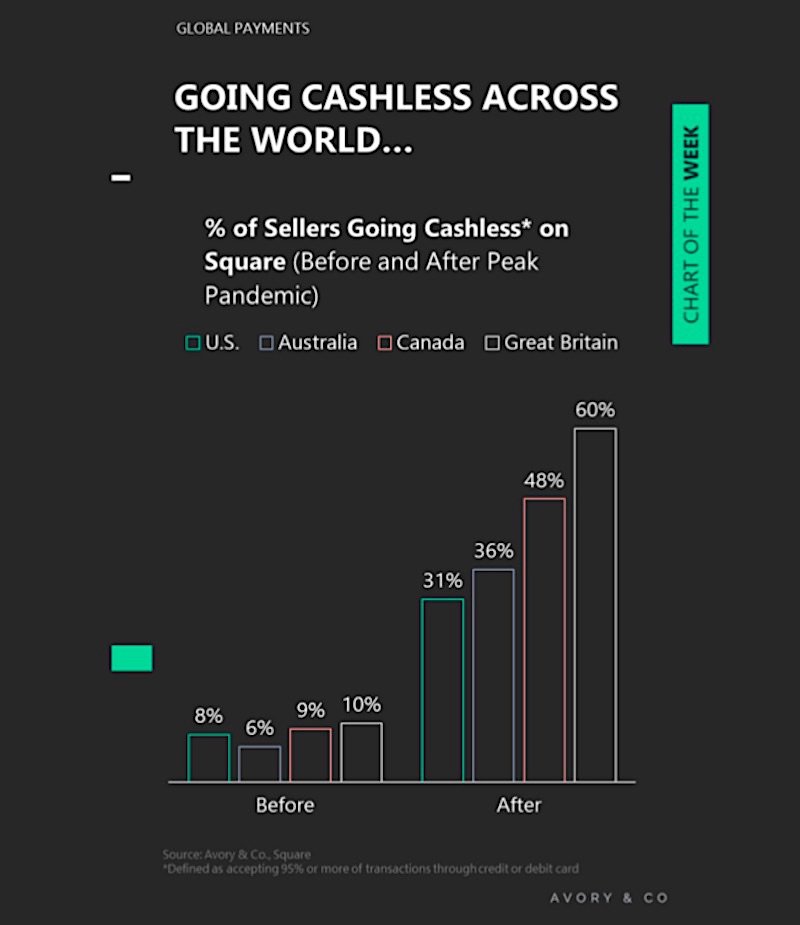

According to data from Square (SQ), the share of the sellers going cashless has seen a meaningful increase worldwide.

In the United States, this nearly quadrupled from 8% to 31%. In Great Britain, it grew ~60%.

The Opportunity In Payments

It helps to put this all into context. Today, cash’s share ranges from 20% for larger transactions to as high as 50% for small transactions. Additionally, Great Britain’s share of cashless sellers is almost twice that of the U.S.

There are many players in the space, each attacking different segments of the market. Companies like Chime are looking to revamp banking, while Stripe enables businesses to accept internet payments.

It’s interesting to think of how large the opportunity is. Aside from Square’s merchant business, Cash App continues to see strong adoption as it expands into other consumer services – earlier this year, Square received FDIC approval for their bank charter.

Twitter: @_SeanDavid

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.