Our team has spoken at well over 100 client events over the past five years and, by far, the most common question we’ve encountered relates to the loonie – or Canadian Dollar currency.

Many of the inquiries have been about whether to exchange money “now or in a month’s time” – typically asked by those planning to escape the Canadian winter!

Based on the anything goes nature of the currency market over a short-term period, we can’t offer much value attempting to answer that question.

However, from a portfolio-management perspective, currency matters—especially the Canadian Dollar for Canadians.

In this article we share our currency research views and outlook, with a focus on the Canadian Dollar / US Dollar (CAD/USD) exchange rate and the many portfolio and asset allocation implications for investors.

Let’s take a multi-pronged approach to analyzing the Canadian Dollar…

Brief History of our Currency Views

We have been pro-U.S. dollar exposure for about seven years now. This is evident in our North American dividend portfolio in which we’ve maintained a near-maximum U.S. allocation, and in our Managed Portfolio asset allocation service with its healthy U.S. allocation.

Moreover, this was initially a contrarian view, which many investors may not remember. In 2011, the U.S. had a government shutdown, saw its credit rating downgraded and the Federal Reserve pile on quantitative easing. And let’s not forget, oil was $100 a barrel. Oh, those were the days! At that time the more crowded trade was certainly to be bearish on the USD and bullish on the loonie. But price matters and, at the time, the loonie was trading at roughly par with the USD.

Fast forward to today, and the narrative may not be the complete opposite but the pendulum has certainly swung materially. Oil prices are now much more muted. Plus, there is the pipeline capacity issue which is negative for the CAD. The cooling Canadian housing market combined with a record level of consumer indebtedness are additional reasons to be pro USD over the CAD.

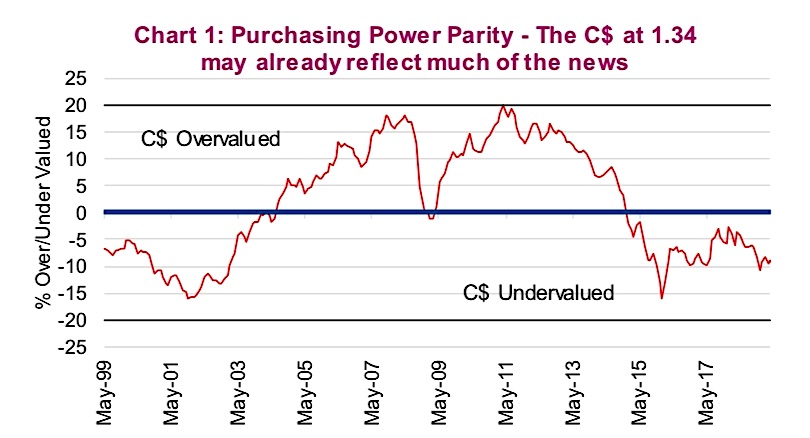

Then there is the U.S. economy, which just posted the lowest unemployment rate in almost half a century. Bond yields remain higher in the U.S. by a good margin, again favouring USD over CAD. But just like in 2011, price matters. Chart 1 depicts the purchasing power parity (PPP) of the CAD versus the USD. Now, as an economist who also manages money, I will be near the front of the line pointing out that a PPP currency valuation model can be offside for many years. Nonetheless, CAD is clearly not overvalued and the degree of undervaluation provides a margin of safety given the factors mentioned above.

Tempering our Short-Term View

We have started to undertake some minor currency hedging and/or reducing U.S. dollar exposure. This is based on:

- The fact that the CAD is somewhat undervalued, which either provides a CAD-buying / USD-selling point, or at least less risk in case we are wrong;

- Our view that global economic growth, which has been slowing over the past year, appears to be stabilizing and could at least partially re- accelerate during the second half of 2019; and

- The fact that sometimes data that should move the currency market simply doesn’t, which often means the easiest path is in the other direction.

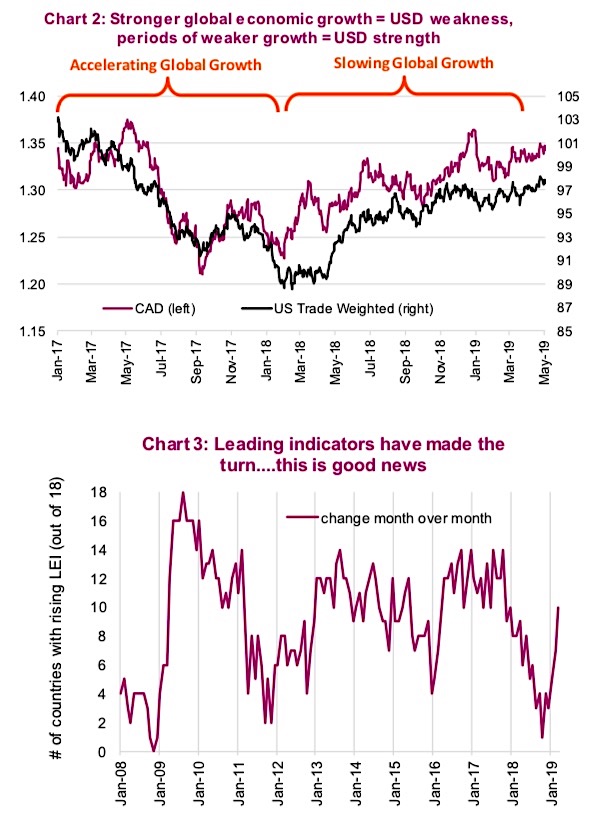

When global growth accelerates, this is usually negative for the USD and

positive for other currencies, including the CAD. The USD is somewhat of a safe-haven currency, so when growth is good, investors are usually inclined to add risk. Plus, from a global trade basis, Emerging Markets, Europe, Canada, Australia and Asia, all tend to benefit from higher trade activity. The U.S. is a more insulated economy so when global growth slows, it’s good for the USD, and when global growth accelerates, its bad for the USD. (Chart 2).

There is growing evidence that global economic growth, which has been slow in recent times, may be turning more positive again. Data from China has been improving, indicating among things the rise in credit, which had been absent for much of 2018. And leading indicators are now rising in 10 of the 18 major economies we monitor in our model (Chart 3).

Despite a strong U.S. labour report on May 3, the USD showed some weakness. This should have been positive for the greenback. A good rule of thumb: when the data supports a move in a given market and it goes the other way, there are other factors trumping that specific data. We believe the near-term path for the USD may be lower. Of course this recent flare up of the trade war may temper or delay this move somewhat.

But Don’t Forget, the USD is a Great Diversifier

While we may have a more tempered view of the USD versus the CAD in the near term, USD exposure can serve as a strong risk diversifier for Canadian investors. Simply put, global growth is strong and investors have a risk-on appetite – this is good for the TSX and the CAD. Since most Canadian investors have lots of CAD and TSX exposure, these are good times.

However, when growth slows and investors’ appetite tilts more towards risk-off, it’s negative for our home market and currency. Fortunately, having some USD exposure helps smooth out this ride. And if there is a bear market or global recession on the cards in the next few years, your USD exposure will likely be a benefit for your portfolio.

Conclusion

We still like USD exposure in our portfolios, but more as a diversification tool as opposed to a returns enhancer. Looking at how markets are reacting to the flare up between the US and China over trade, which has the USD rising against CAD, one can easily see the diversification benefit. With this pop in the greenback, trimming USD exposure may prove prudent.

Source: all charts are sourced to Bloomberg & Richardson GMP

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.