This article is a collaboration between between Arun Chopra (@FusionPtCapital) and Aaron Jackson (@ATMcharts).

We caught a big data point this week across the NYSE Composite (INDEXNYSEGIS: NYA). The NYSE stock only advance-decline line has hit the highs.

Traditionally, advance-decline lines are viewed as a leading indicator of breadth and liquidity in the market. From this vantage point, liquidity is back and the market looks good moving forward.

We’ve also seen market breadth and momentum indicators such as the McClellan Summation Index go from extreme oversold to extreme overbought.

This is very similar action to what we saw at the 2016 low.

Given that, let’s look at some ETFs that offer another view of momentum in the markets.

The S&P 500 high beta index relative to the S&P 500 low volatility index has broken the Q4 downtrend. So while low volatility names are leading the markets to new highs, high beta names are catching up somewhat.

In the coming weeks and months, this is something bulls want to see risk appetite improve, have this move higher and break the 2018 trend.

MTUM is an ETF full of mid to large cap stocks showing momentum factors. No doubt, Q4 absolutely broke this strategy.

We have to consider portfolio turnover here. 3-6 months ago this thing was dominated by FANG type names. We all know what happened next. Now, healthcare and consumer staples are dominating ownership. We can expect construction to get shaken up again until new clear trends emerge in the markets.

112ish is worth watching to see if the momentum strategies get working again. Strength here is something we’d like to see, but again due to fund construction this isn’t something we need to see.

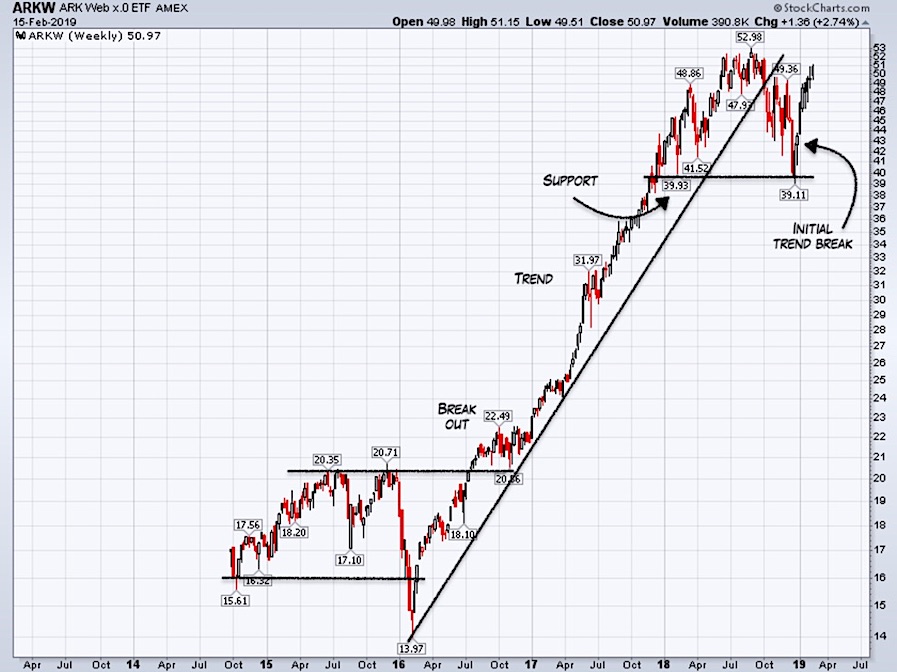

ARKW is full of software and mobile computing names. As we can see this has been in a very strong uptrend since the 2016 low. Simply put, the uptrend was so strong it couldn’t maintain that rate of change forever. That said, the trend has been so strong we can expect it to continue in time.

While we see breadth and liquidity making big moves, we don’t quite have trend and momentum back. It’s worth keeping an eye on these ETFs as well as market bellwethers to see if they get going again. We’ll need them to make new highs in the S&P 500.

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.