This Is What Increasing Fear Looks Like

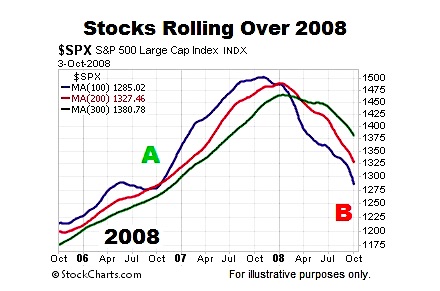

The chart below shows the S&P 500’s 100-day moving average (blue), 200-day (red), and 300-day (green) during the transition from a favorable period to an unfavorable period (2005-2008). As you can see, 2008 confirmed a deep move lower for the S&P 500 (INDEXSP:.INX), as bull market trend indicators turned “lower”.

Moving averages allow us to focus on longer-term trends rather than inevitable day to day volatility.

Charts cannot predict the future; they simply help us better understand the odds of good things happening relative to the odds of bad things happening. The left side of the chart above shows a more favorable look with blue, the fastest moving average, on top and the slopes of all three moving averages are positive (bullish trends). The right side shows a lower probability look with blue, the fastest moving average, on the bottom and the slopes of all three moving averages are negative (bearish trends).

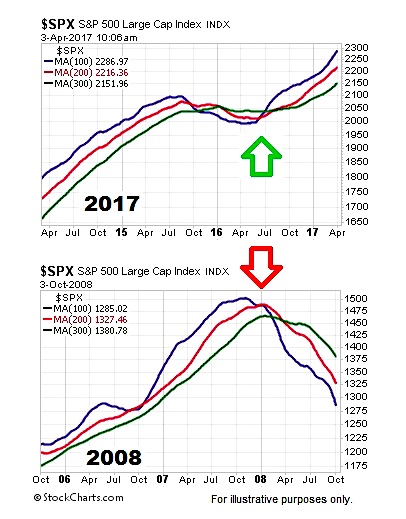

How Does 2017 Compare To The 2007-2008 Peak?

The charts below allow us to look at markets through an unbiased lens. Reviewing the trends below requires no discussion of politics, the Fed, or our personal views on any topic. Do trends in 2017 look more like a favorable period (point A in first chart) or an unfavorable period (point B in first chart)? Clearly, the bull market trend indicators are still moving higher in 2017.

A Major Shift Has Occurred In The Markets

This week’s video covers three important developments and provides a big picture historical context (1980-2017). Like the charts above, the charts in this week’s video speak for themselves.

Let’s take a look at the current trends on some key stock market sectors & indices…

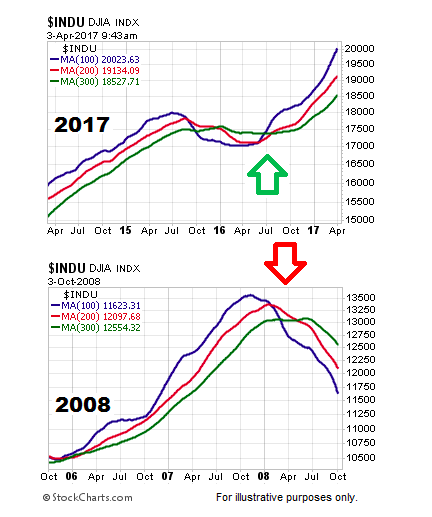

Dow Jones Industrial Average

Does the Dow Jones Industrials (INDEXDJX:.DJI) look more like a favorable period or unfavorable period? You can decide using the charts below.

continue reading this article on the next page…