British Pound ETF NYSEARCA: FXB – Elliott Wave Chart

The British Pound has been in a strong and persistent decline since February.

However, that trend lower is overdue for a pause and maybe even a corrective wave higher (Elliott wave).

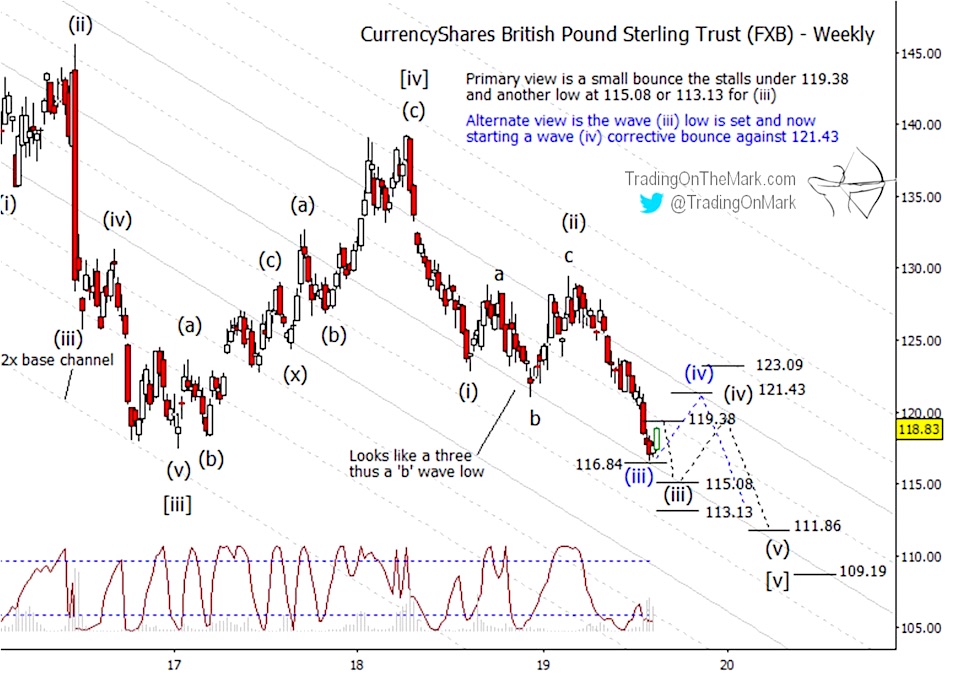

Here we look at the chart of the CurrencyShares British Pound Sterling Trust.

The Pound is still following the basic roadmap the we showed at See It Market in January, working its way downward in what appears to be the terminal wave [v] of an impulsive decline that began in 2014.

Inside wave [v], the downward count of sub-waves (i) and (ii) is essentially the same as what charted in the previous article, although the final stages of wave (ii) reached slightly higher than we expected.

The rapid decline since February is consistent with a third wave, and we have drawn two scenarios for the end of sub-wave (iii). Our main scenario is shown with gray labels, and it would have FXB reach a bit lower to test 115.08 or possibly 113.13.

However it is also possible to count sub-wave (iii) as already complete with its test of nearby support at 116.84. That’s the alternate scenario shown with blue labels.

The correction that would count as sub-wave (iv) could appear as either an upward or sideways pattern, and the resistance at 119.38 or 121.43 would probably contain it on the upward side.

We would prefer not to see FXB reach above the resistance at 122.88. If price exceeds that level, it would increase the prospects for the Pound low already being complete. The highest place where bears could still regain their footing with this wave count is at 123.72.

Price should eventually reach lower than the supports we mentioned for sub-wave (iii), but that move might not begin until late 2019 or sometime in 2020. In the meantime, bearish traders should manage their existing positions, and some traders might look for relatively quick bullish opportunities.

You can get even more charts and in-depth analysis by signing up for the Trading On The Mark free newsletter. In addition, at the end of every month one newsletter reader is chosen at random to win a four-week access package to our premium subscription service. This could be your winning month!

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.