That is more than twice as high as it is in both the US and the European Union.

Monetary Policy & FX

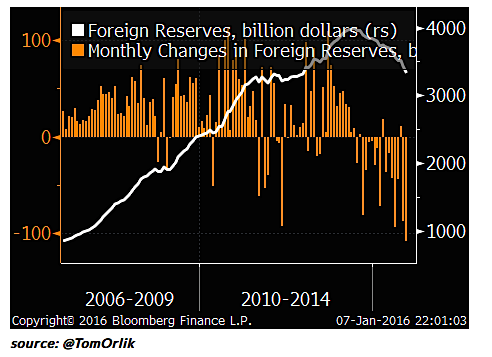

The PBOC has been very active trying to support the economy. It has cut rates 6 times since November of 2014. Likewise, it has been lowering its Reserve Requirement Ratio. At the same time, China has been selling its foreign reserves in an attempt to prevent excessive devaluation of the yuan (CNY). They are down more than $400 billion (from a peak of ~$4 trillion) since mid-2014:

FX is also a risk because China has a lot of USD-denominated debt. In mid-2015, non-bank borrowers held ~$1.2 trillion worth of it. This is an issue because Dollar debt becomes more expensive when USDCNY rises, which is exactly what the markets expect to happen.

Corruption Crackdown

China’s anti-corruption campaign is a step in the right direction. That said, it is a big political risk. High profile businessmen and officials have been disappearing while others are being investigated. Moreover, securities regulators have been cracking down on market manipulators, “ensnaring some of the nation’s most high-profile money managers and announcing more than 2 billion yuan of fines and confiscated gains” (source: BBG Brief). Critics of the campaign suggest that it may deter business while failing to address the corruption that exists amongst the ruling party.

Implications

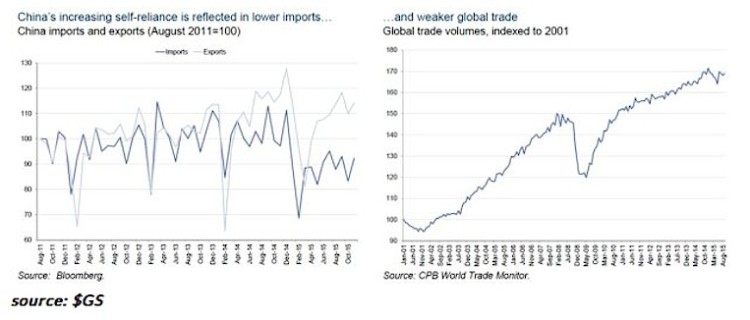

As investors, we should be concerned because China is one of the biggest economies and the world’s leading trader. Therefore, if China slows down then so will global growth:

China is also important because it is a massive source of demand for many commodities. Thus, its weakness is spreading to undiversified economies such as Russia, Brazil and South Africa. Recessions in those countries might not carry over to the rest of the world. Nevertheless, it is important to consider the amount of debt they have taken on since the financial crisis. In the US, credit is already tightening. If borrowing costs rise for the emerging markets, especially China, then we may see a wave of defaults with untold consequences.

Thanks for reading.

Twitter: @sobata416

Get more research and analysis from Richardson GMP

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.