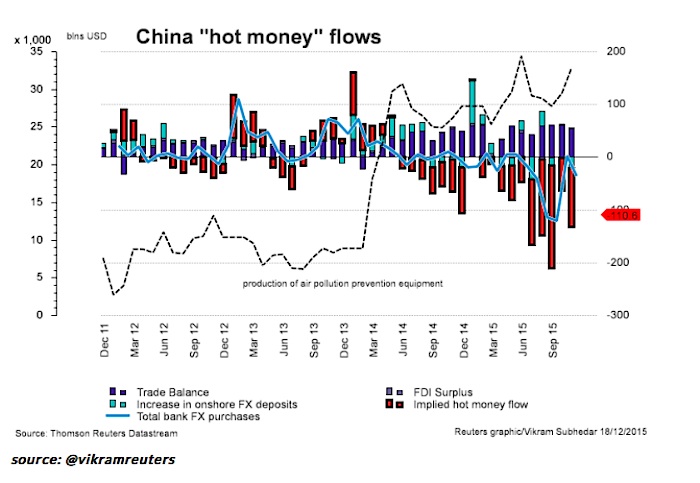

It seems as though every day we are inundated with news out of China. Investors are already concerned. The offshore renminbi (CNH) is more international than the onshore one (CNY), which is tightly managed by the government. As such, the rising spread (CNH-CNY) between the two may be indicative of mounting skepticism about China’s economy and the Chinese markets. Likewise, capital is fleeing the country as hot money flows have accelerated:

In the following sections we will attempt to analyze China and to determine its biggest risks. Lastly, we will try to answer the following question: does it matter to us?

Chinese Markets

As the first week of trading in 2016 came to and end, the Chinese markets had already been halted twice. Newly minted circuit breakers, which have since been suspended, were triggered as the CSI 300, China’s main equity index, fell 7% on two separate occasions. The first catalyst was a rumor that the regulators were going to suspend a short sale ban that has kept a reported ~$185 billion off the market. Subsequently, they decided to extend the ban in order to calm the markets. The second driver was a significant devaluation of yuan by the People’s Bank of China (PBOC). China has also backtracked on that move. Basically, the Chinese markets are confusing…

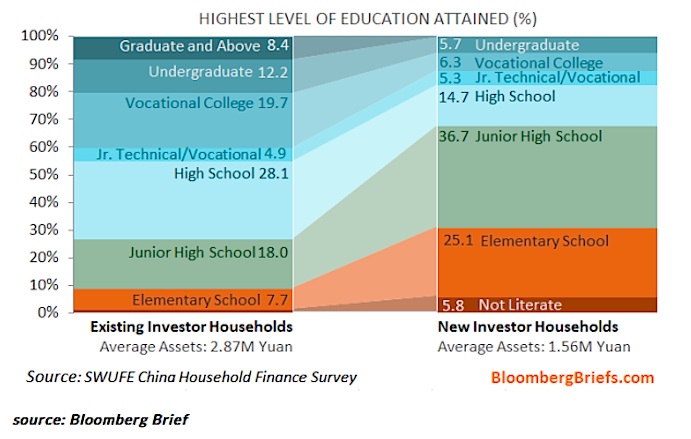

That said, the volatility is not surprising considering how unsophisticated China’s market is. One university study found that 2/3 of the new investors at the end of 2014 did not have a high school diploma:

Along the same lines, individuals account for at least 80% of trading on the mainland exchanges. In other words, there are many speculators and few investors. China’s markets are undeveloped and relatively unimportant. Nonetheless, they may offer some clues into consumer sentiment and the government’s ability (or inability) to control the economy.

Economy

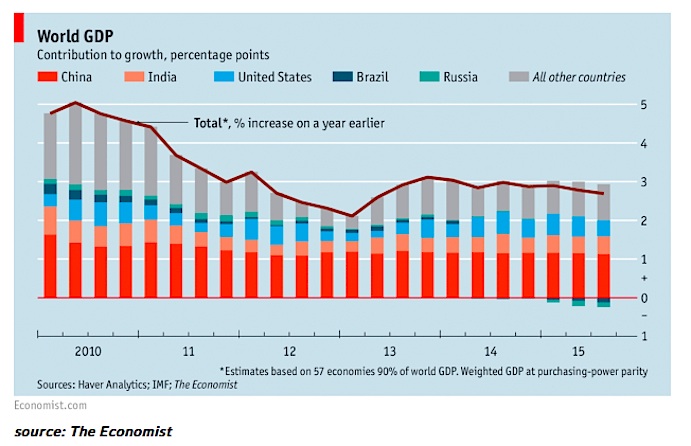

It is hard to determine whether China is more capitalist or communism. Either way, it remains an indispensable part of the global economy. In nominal terms, China is the world’s second biggest economy with a GDP of ~$10.3 trillion. However, in terms of Purchasing Power Parity-adjusted GDP (PPP), it has surpassed the US. Moreover, it accounts for ~40% of global PPP-adjusted GDP growth:

In regards to trade, China is the world’s biggest player. In 2013, it led the world in exports ($2,209 billion) and was the number two country for imports ($1,950). The combined value of its trading amounted to $4,159 billion, marginally higher than the US’ $3,909 billion.

Debt

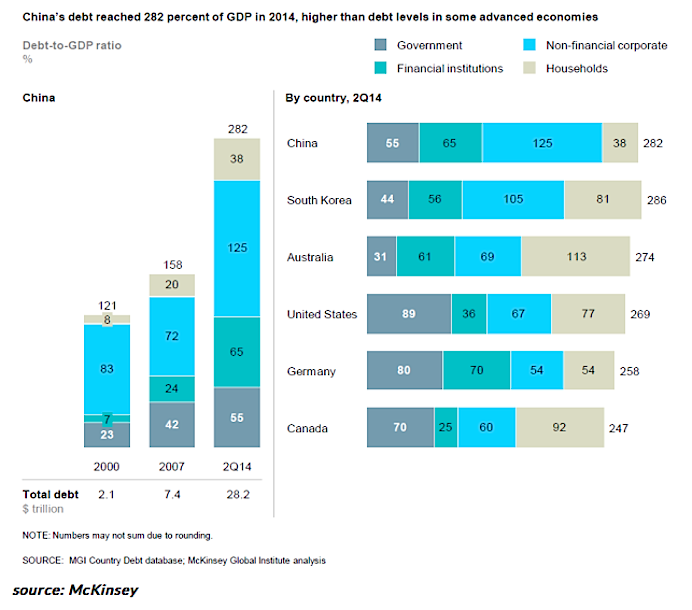

China’s aggregate debt level is one of the highest in the world. On the surface it may not seem very high; China’s government debt to GDP ratio is 55%. To put that in perspective, the US and Japan are at 89% & 234%, respectively. Even so, it is always prudent to consider a country’s debt composition. When we take into account China’s non-financial corporate debt (125% of GDP), financial institution debt (65%) and household debt (38%) the picture looks quite different. The grand total is an astounding 282% of GDP, or $28.2 trillion:

The rate of debt growth is also a concern. Non-financial corporate debt, increased from 72% to 125% of GDP from 2007 to 2Q14, a 73.6% increase.

China’s debt load is a global risk because of how tightly managed its economy is. The government has allowed unprofitable companies to stay in business. As such, defaults have been very limited. At some point, China will have to let these companies fail. Otherwise, it will suffer as a result of high debt servicing costs (~30% of GDP).

Overcapacity

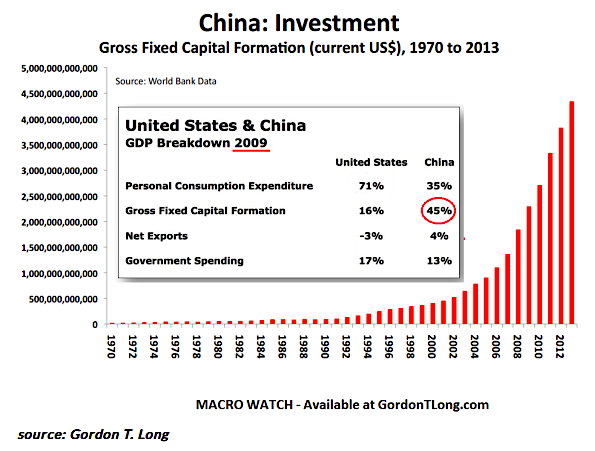

Government investment has been a big part of China’s economy. Massive amounts of stimulus went into factories, leading to overcapacity in sectors such as coal and steel. This is making it very difficult for companies that operate within those sectors to make profits – both domestically and abroad. Fiscal stimulus also went into housing and infrastructure, which are both clearly overbuilt. Despite the overcapacity, gross capital formation still represents ~45% of GDP:

continue reading on the next page…