The recent failures of Silicon Valley Bank, Signature Bank, and First Republic and the poor performance of other regional banks serve as a reminder of the underappreciated risks of investing in bank stocks.

It’s not just the inherent banking risks that should make investors selective in buying bank stocks. The historical relative performance of bank stocks should also cause consternation for investors.

Key Takeaways

- Fractional reserve banking allows banks, not the Fed or government, to create money.

- Banks typically only have an approximate 10% equity cushion supporting their assets.

- Such leverage creates bankruptcy risk if banks are not hedged properly for interest rate and credit risk.

- Bank stocks have underperformed conservative sectors and the broader S&P 500.

- Despite the broad risks, there are good banks that can be investment worthy.

Fractional Reserve Banking

All money is lent into existence.

Read that sentence as many times as it takes to grasp. Its understanding is critical to understanding the U.S. banking system.

Despite what the media or financial pundits may say, banks, not the Fed or government, create money!

Under the fractional reserve banking system, on which America’s financial system operates, money is “created” via loans. Here is a simple example:

- You deposit $1,000 into a bank.

- Your neighbor borrows $900 from the same bank to buy a TV from Costco.

- The bank holds the remaining $100 as reserves.

- Costco deposits the $900 into its account at the same bank.

- The bank turns around and lends $810 of Costco’s $900 deposit.

- The cycle continues as money multiplies despite the actual cash in the financial system remaining at $1,000.

Whether or not your neighbor pays back the $900, you and Costco have a combined $1,900 in your accounts. In this case, the $900 the bank created via the loan to your neighbor is new money out of thin air.

Fractional reserve banking, as we diagram, works well until there is a bank run and or enough loans are defaulted upon or lose sufficient value.

Bank Balance Sheets

We examine the aggregate balance sheet for all U.S. commercial banks to take fractional reserve banking to a working level and appreciate why small and mid-sized banks are struggling.

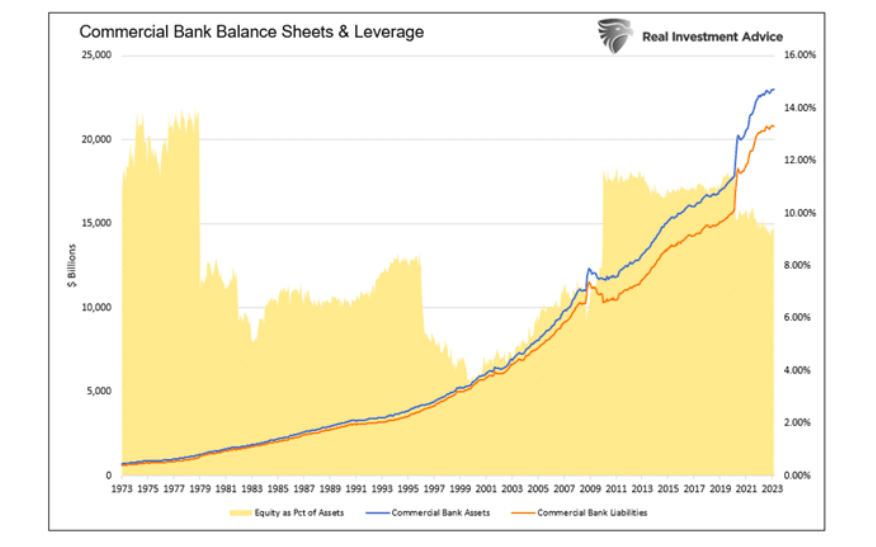

As the graph shows, commercial banks hold about $23 trillion in assets against $20.8 trillion in liabilities. The difference, $2.2 trillion, is the banking sector’s equity. The yellow shading represents the implied leverage ratio. As it shows, banks collectively hold less than 10% of equity versus their assets. We break down the assets and liabilities in the pie charts below to recognize why such high leverage can be problematic.

Decomposing Assets and Liabilities

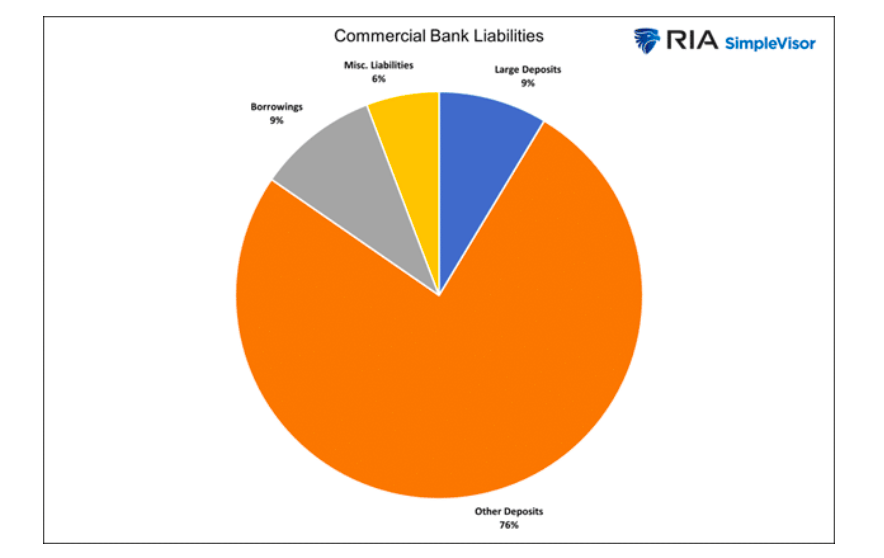

Commercial bank liabilities are mainly small and large deposits. The rest of the funding comes from the debt markets, other banks, and the Fed at times.

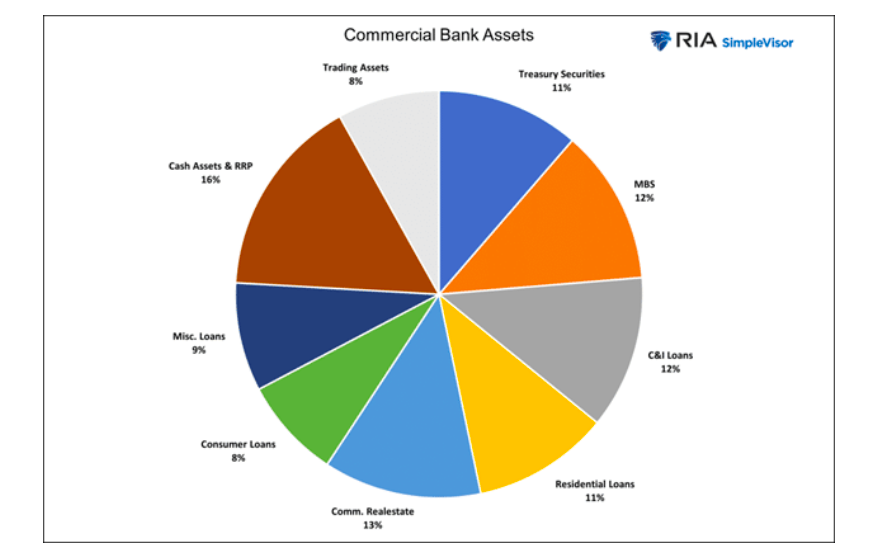

Bank assets are often diversified across numerous types of loans and securities. Some of their assets, like Treasury securities and MBS, are very liquid. On the other hand, some of the loans and real estate debt are illiquid.

Liquidity allows us to assess how fast and costly a bank can sell assets if needed. About half of the collective assets are liquid and can be sold quickly and with little cost. A good number of the remaining assets can be sold or securitized and sold, but the process may take a little time and cost money. Some assets are entirely illiquid and could take quite a while to sell.

When the value of a bank’s assets or liabilities changes, equity provides a cushion. Today, bank stockholders are questioning whether some banks have enough equity cushion. If losses exceed a bank’s equity, the bank is essentially bankrupt. As we noted earlier, for an average bank, that entails a 10%+ loss on its assets.

Leverage is Dangerous

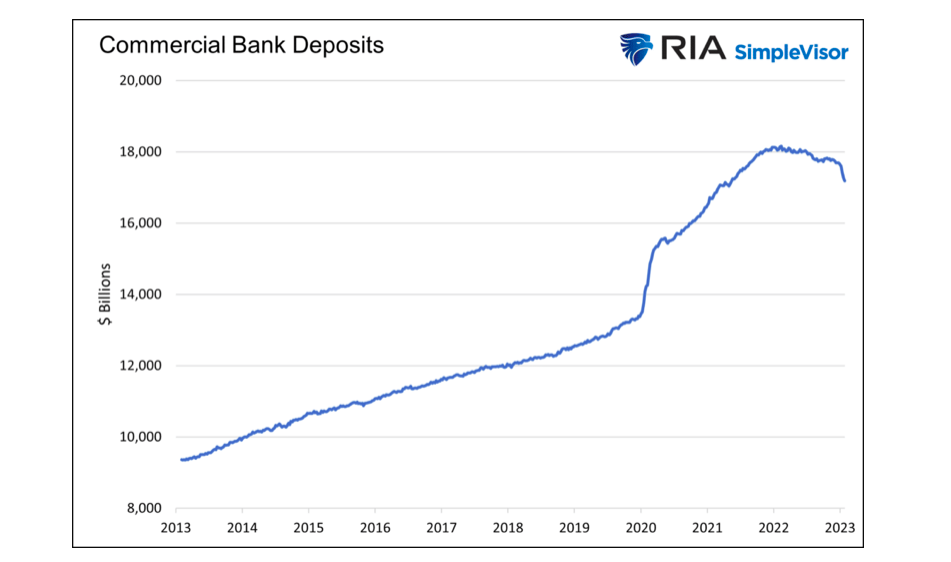

The graph below shows that commercial bank deposits have fallen by approximately $1 trillion over the last year. Hence, banks must source new deposits, borrow money, and sell assets to compensate.

Fleeing deposits started the problems for Silicon Valley Bank and others. They also spurred a second problem. Many banks price assets on their balance sheet at the price they acquired them. Due to higher interest rates, the current value in almost all cases is less than they paid.

Many banks require cash to replace deposits. As such, they have options. They can raise new deposits, which entails paying customers over 4% versus the paltry near 0% they currently pay depositors. Or they can sell assets. A collective leverage ratio of 10 to 1 means it only takes a 10% loss on a bank’s assets to wipe out its equity cushion. Risk-free U.S. Treasury notes and mortgages lost about 20% of their value in 2022. Since getting new deposits was not feasible for Silicon Valley Bank, it had to sell assets and recognize losses more significant than its equity cushion.

Digital Bank Runs

Bank runs are dangerous for the highly leveraged banking sector. Such is why the Fed acted quickly to support banks. Further, bank runs are often psychological events and are not necessarily rational. We put First Republic, which was fundamentally solid, in that camp.

Concern over a bank’s viability can quickly snowball into default. Unlike prior bank runs, depositors can wire funds 24/7 from a bank in seconds. As a result of a digital bank run, Silicon Valley Bank collapsed as its customers withdrew about $42 billion, representing a quarter of its deposits in days.

Unlike the financial crisis, today’s bank issues are a function of higher interest rates/lower bond prices and not credit losses. As a result of faulty accounting rules enacted during 2008, the Fed, bank regulators, and many banks did not adequately address lower bond prices due to higher interest rates. Hedging interest rate risk was costly from an accounting perspective and, therefore, not fully encouraged by the management of many banks.

The key takeaway is that bank runs, and leverage are risks that all banks and, therefore, bank stockholders take. Bank runs are not always rational. It appears falling stock prices, and not bank fundamentals, are driving depositors to move money from some banks.

Past Performance

Investing is always a risk-reward proposition. Almost any risk is worth taking but only at the right price. Therefore with a better understanding of bank risks, does the historical performance of the bank sector warrant taking the risk?

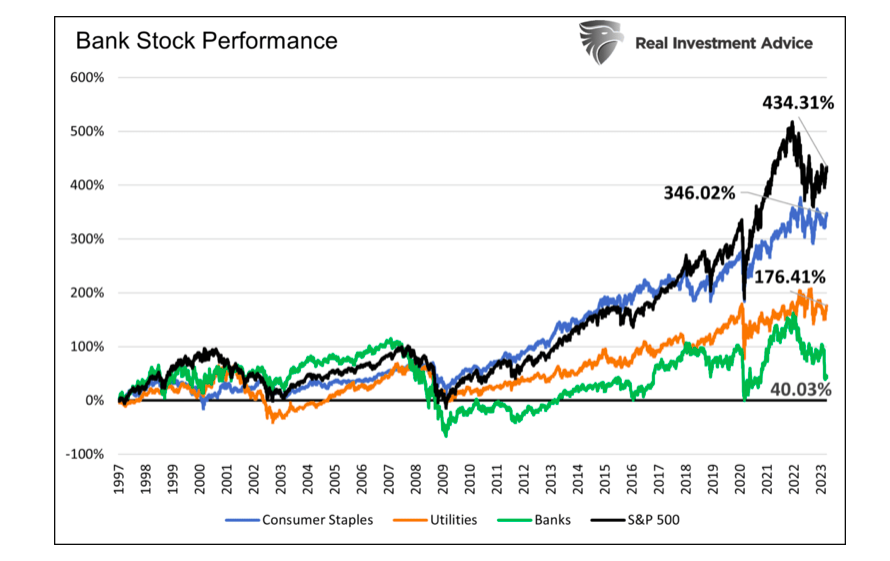

The graph below compares price returns on the KBW Bank Stock Index versus the S&P 500 and the conservative S&P Utilities and Staples Index. Since 1997, the KBW bank stock index has returned 40.03%, or 1.47% annually, well below the market and the conservative sectors mentioned above. More stunning, since 1997, the average yield on a risk-free 2-year U.S. Treasury note was 4.98%, over three times the return on risky bank stocks.

Summary

Banking is risky and subject to rational and irrational bank runs. That doesn’t mean investors should avoid bank stocks. Instead, potential bank stockholders must carefully assess whether the expected returns account for a bank’s leverage, degree of risk-taking, and hedging and factor in how sticky their deposits genuinely are.

Like any business, there are good banks and bad banks. JP Morgan, for instance, has proven to be very well managed. During the financial crisis, they hedged well against loan losses. Such risk awareness and hedging agility allowed them to buy assets from troubled institutions at steep discounts. Similarly, they are benefiting from the latest banking crisis. JP Morgan stock is up over 700% since 1997. Said performance bests the performance of the banking index and the S&P 500.

Twitter: @michaellebowitz

The author or his firm may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.