In most bull markets, stock market sectors like Energy and Financials matter. Meaning, they are performing in-line (or sideways) as the stock market rises and economy floats along.

Sounds like easy street, but it’s rather simple. If the economy is doing well and consumers are spending and lending (Financials), and tourism and travel/transportation are strong (Energy), then there is a semblance of economic harmony.

As my posts so often do, this one will simply share a couple of chart images to make people think about the broader market and implications. My goal is to empower investors with insights that they may not otherwise think about. And make them bite-size.

Today we look at two charts: Energy and Financials. Both are important to the economy and recovery outlook. This is somewhat of a piggy-back on my last blog about the coronavirus “shift” in the economy. In short, these two sectors are lagging and are likely pointing to further economic pain ahead.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

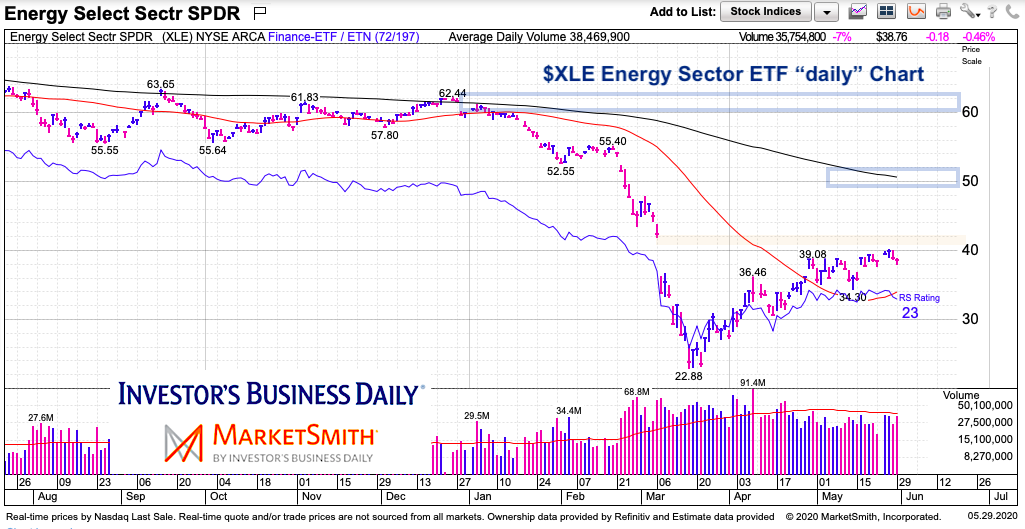

$XLE Energy Sector ETF “daily” Chart

The Energy Sector ETF (XLE) is still trading sideways within a gap-fill area. Filling that gap may provide impetus for another leg higher. BUT it’s worth noting that XLE is nearly 25% below its 200 day moving average and nearly 35% below its 2020 highs. And this is after a broad-based rally… not a good look for the broader economy looking ahead.

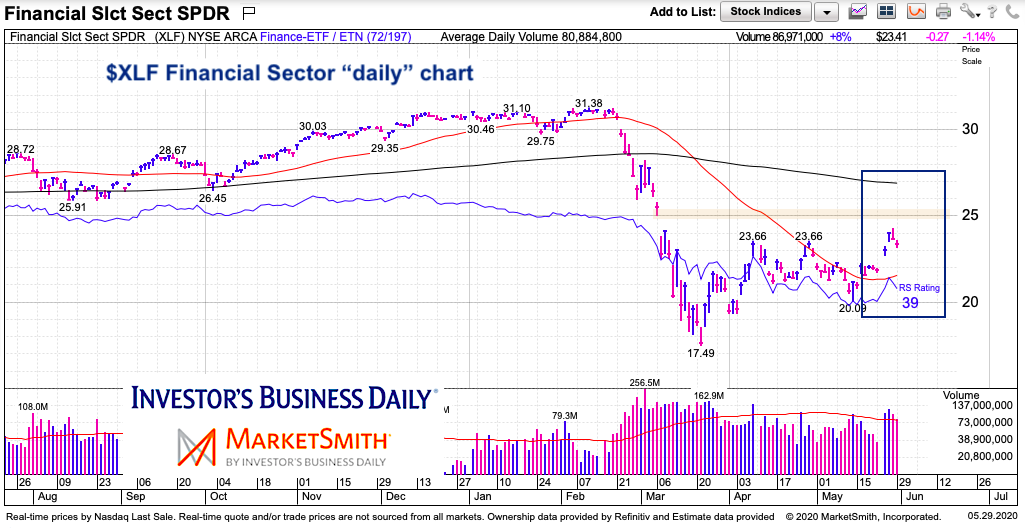

$XLF Financials Sector ETF “daily” Chart

The Financials Sector ETF (XLF) is trading between its 50 day and 200 day moving averages. It is trading just below a gap-fill resistance area.

Another major laggard, the Financials are still nearly 25% off the 2020 highs. As traders, we must follow the price action. But we can also understand that this type of performance is not indicative of a “around the corner” economic recovery.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.