Today, I share my continued caution to Corn Bulls.

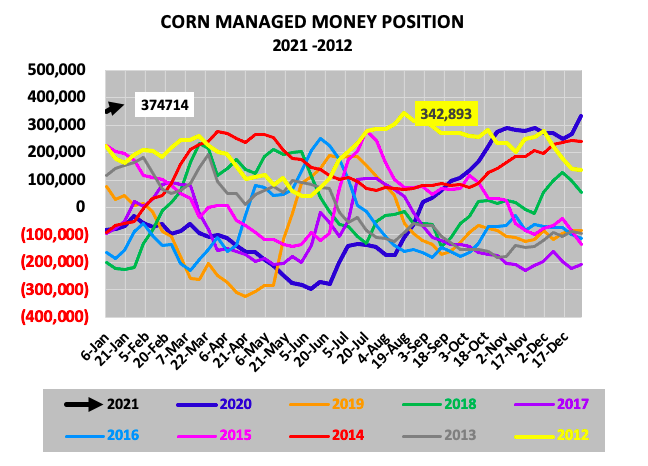

Friday’s Commitment of Traders report showed Managed Money long positions in corn (as of only Tuesday’s close) increasing to +374,714 contracts. It now officially exceeds the maximum length the Money held in 2012 (+$8.40 per bushel corn futures).

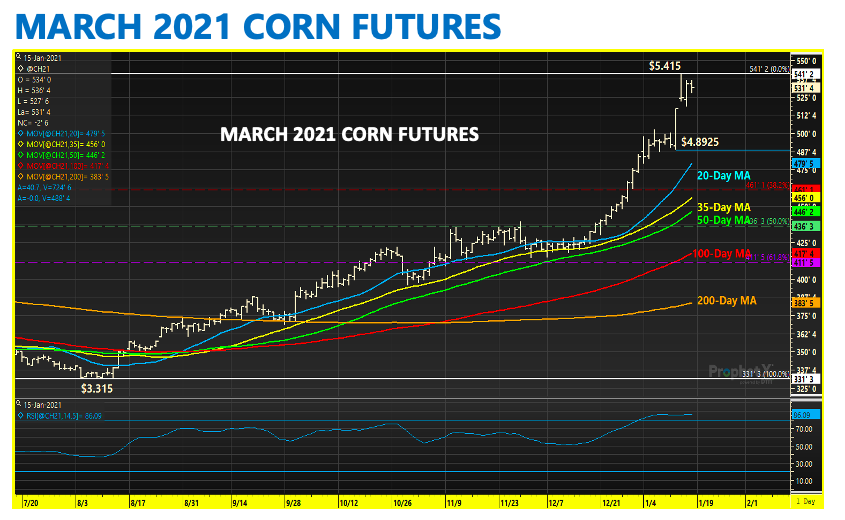

Therefore, it goes without saying the “money” is still the driving force in this market. Clearly a weak U.S. Dollar, talks of additional U.S. stimulus, Crude Oil rallying back to nearly $54 per barrel (highest since 2/20/21 and COVID-19 lockdowns), as well as, Goldman Sachs talking this week of the return of a “structural Bull market in commodities” has all helped propel significant outside investment back into a number of U.S. commodities.

I will add however the Gross Ethanol Crush margin dropped to its lowest level this week (-22 cents per gallon for February) since the COVID-19 low on March 31. Ethanol prices are no longer keeping up with the rally in corn. I continue to hear from analysts that we have yet to see any true signs of “demand destruction” at these higher price levels. I disagree whole-heartedly with that assessment.

I have said it for weeks… can corn continue to rally? Yes. However the money has to stay active and Corn Bulls will need to continue to see a long tail to the U.S. corn export sales season. Current supply/demand doesn’t justify $6.00 March corn futures. Historically, that’s reserved for sub-8.0% stocks-to-use ratio type figures. However you have some in the market, pushing that narrative (Feltes, Ag Resources). Expect continued price volatility and more heart-throbs.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.