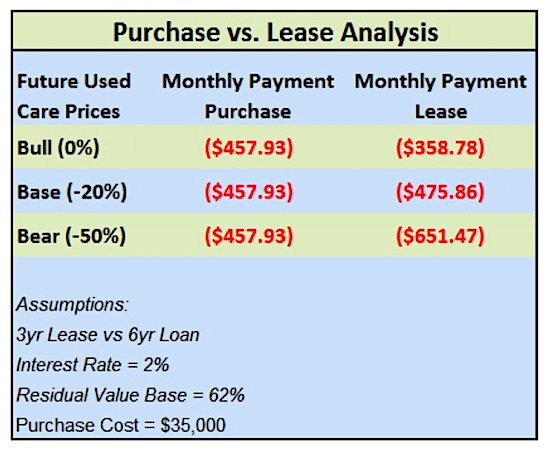

The impact of the used car market on leasing can be seen through the purchase versus lease analysis table shown below. A decline in used car prices (residual values) as is currently forecast dramatically alters lease payments, eliminating leasing as a lower-cost alternative. The bull, base and bear case for used car prices below is based on forecasts from Manheim/Morgan Stanley.

In response to weaker car sales, dealers have slashed prices by the most since the last recession. The auto sector, which represents over 20% of retail sales, is an important economic barometer.

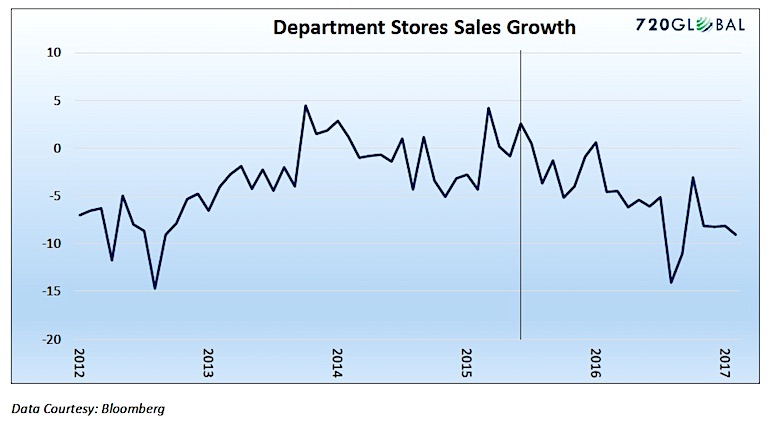

Department Stores

The travails of department stores in recent months have been well-covered. Stores closings and down-sizing stems from weakness in consumer spending but has been rationalized by the “Amazon effect” and preferences for on-line shopping. As recently observed by Evergreen/GaveKal, it’s not the “Amazon Effect”, it’s the “Healthcare Spending Effect” as the average family of four pays $26,000 in healthcare costs. The other problem with the “Amazon” excuse is that, while store traffic has dropped, all department stores have functional, secure websites that consumers can access as easily as Amazon’s web site. According to the Department of Commerce, retail sales for the past 12 months totaled $4.9 trillion of which $403 billion or 8.2% were online. Amazon’s total sales of $150 billion were approximately 3% of total retail sales. Needless to say, there is more to the story than Amazon stealing market share.

On-line retailers are making it hard for department stores to maintain market share but the Amazon narrative sounds more like an attempt to downplay the real problem. Squeezed by weak income gains, higher healthcare and education costs, and the burdensome load of debt from years past, consumers simply have less money to spend and appear less inclined to spend what they do have on apparel and other department store goods. Further, they have little propensity to borrow to consume more. Since January 2016, department store sales (year over year) declined in every month except two. A continuation of these trends has major implications for retail stalwarts like Macy’s and Nordstrom as well as commercial and retail real estate.

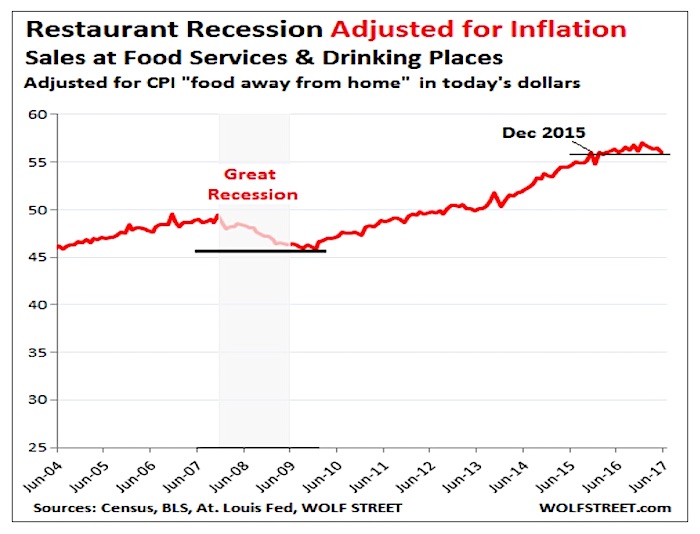

Restaurants

Restaurants face similar issues as retailers with problems extending across all categories of the food service sector except the high-end segment. Restaurant same store sales have experienced 17 consecutive months of year-over-year declines. According to the July 2017 Restaurant Industry Snapshot, Black Box Intelligence reported: “These are the weakest two-year growth rates in over three years, additional evidence that the industry has not reversed the downward trend that began in early 2015.” Adjusting for inflation further clarifies the difficulties the sector faces. Wolf Richter at Wolfstreet.com adjusted sales at food service and drinking places for inflation (as shown below) and found that sales, as reported in June 2017, are up only 22% from the post-recession lows and have been stagnant since December 2015.

Not going out to eat is one of the easiest ways to tighten a household budget. The decline in restaurant sales seems to reinforce the increasingly tepid state of consumption.

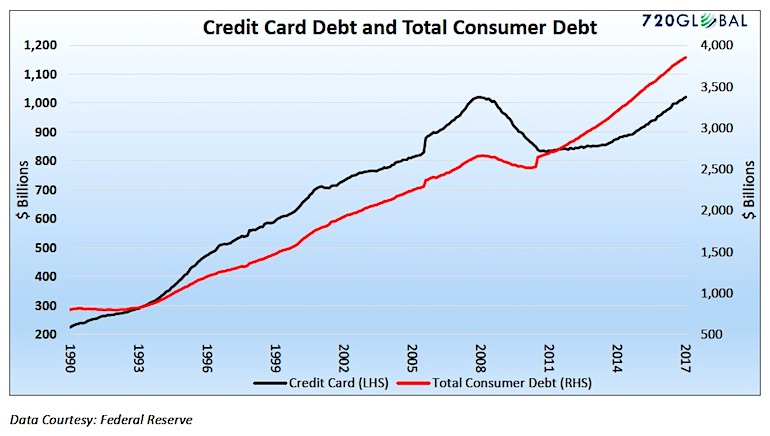

Consumer Credit Outstanding – Record Highs

Evidence of a challenged consumer drowning in debt continues to build. Credit card debt recently hit a record high at $1.02 trillion, and total consumer credit, which includes auto and education loans and excludes mortgages, is fast approaching $4 trillion.

Economist Joel Naroff, President of Naroff Economic Advisors, elaborated on the weak consumer: “One of the clearest indicators that households are spending cautiously is the softening of big-ticket purchases… households are maintaining their lifestyles by reducing their savings rate and that is likely restraining spending on discretionary goods.”

Summary

The growth of public and private debt is occurring at a rate faster than wage growth or economic growth. Debt remains the single most important factor in assessing the outlook for the U.S. economy. The business cycle has become incredibly dependent upon the credit cycle which has been hi-jacked by monetary policy. More borrowing leads to better economic growth in the short term, but eventually the music stops, debts must be repaid, and the painful process of deleveraging begins.

Central bank interventions have imprudently disrupted the normal cycle and likely extended it. Unless the Fed can somehow remove human decision-making from the equation, the swings in business cycles remains a permanent feature of the economic system no matter how disfigured from bad monetary policy. What seems to be taking place in the economy today is consumers nearing a point of maximum debt accumulation or consumption exhaustion. Their willingness or ability to take on more credit is slowing and is beginning to become a drag on consumption.

Our assessment of the amount of debt outstanding in conjunction with what we are observing on new and used car lots, at department stores and restaurants offers some indication that we may be near a turning point in the credit cycle. This does not necessarily mean that a recession is imminent but if our concerns are valid, it certainly raises the probability of an economic downturn and quite possibly a catalyst to reverse the direction of asset prices. Given these dynamics and current market valuations, we continue to urge investors to proceed with caution.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.