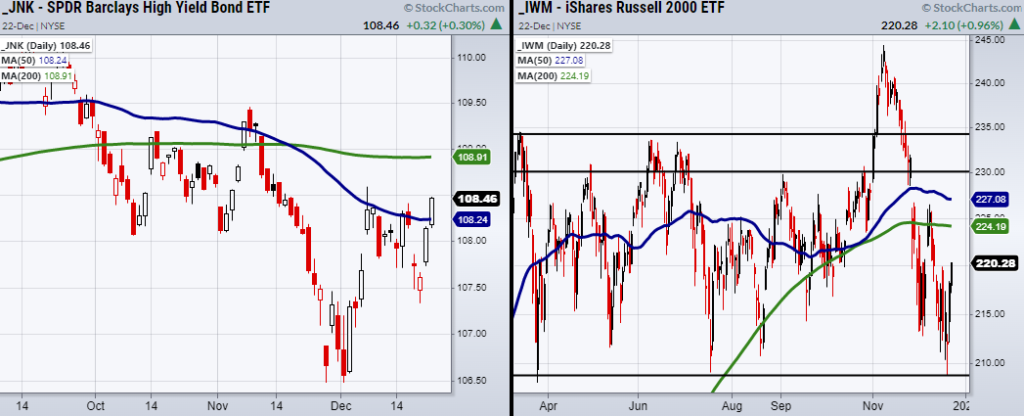

High yield corporate bonds ETF (JNK) clears its 50-Day moving average at $108.24, but sits in a pivotal resistance zone.

Along with JNK the major indices are sitting near overhead resistance from recent highs or in the case of the Russell 2000 (IWM), the middle of the trading range.

At the moment, investors’ appetite to push JNK back over its major moving average is a positive sign even though we are running right into resistance.

Although the major indices including the S&P 500 (SPY), Dow Jones (DIA), and Nasdaq 100 (QQQ) have struggled near highs, they have also refused to fully break down.

This poses a tough situation for investors who are looking for decisive price action.

With that said, should people be loading up on trades now that we’re fairly close to new highs or should we wait for further confirmation?

The right answer would be to wait for confirmation with a breakout to new highs, however, the large-cap and small-cap indices are trading very differently and thus can be traded with a different perspective.

Since the large-cap indices are close to highs it makes sense to wait for them to clear main resistance or at least know that any trade taken could be very volatile.

On the other hand, trades taken in the small-cap space have better risk as IWM still has space to move before hitting resistance from its highs or the average high of its range near $230-234.

Therefore, taking trades related to the small-cap IWM index have the best risk to reward and momentum.

However, now that the week is almost over with the markets closed on Friday in observance of Christmas, it’s best to take very small positions or wait until next week.

Watch Mish’s latest appearance on Fox Business!

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 470 resistance area.

Russell 2000 (IWM) 224 resistance.

Dow (DIA) Needs to hold its 50-DMA at 356.12.

Nasdaq (QQQ) 401 next resistance area.

KRE (Regional Banks) 65.46 new support.

SMH (Semiconductors) 315 main resistance. Sitting in choppy area.

IYT (Transportation) 268.93 the 50-DMA pivotal area.

IBB (Biotechnology) Needs to clear 155.

XRT (Retail) Like this to hold over 87.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.