Watching shares of Uber Technologies Inc., (NASDAQ: UBER) fizzle since their first day of trading, we’re left wondering if we’re seeing the waning days of the Kardashian effect in the stock market.

Just as the Kardashians have spent the last decade-plus being famous for—well—being famous, a handful of stocks have ridden a wave of momentum to ever-higher prices.

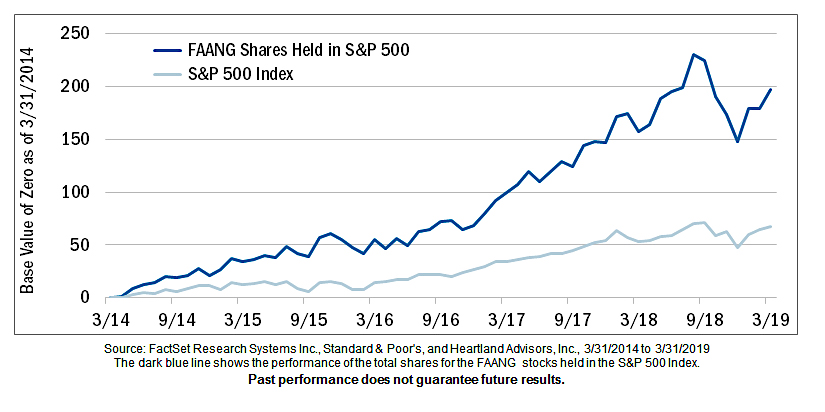

First it was the FAANGs*, as shown in the chart above. Facebook (NASDAQ: FB), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), Netflix (NASDAQ: NFLX), and Google / Alphabet (NASDAQ: GOOGL)

More recently, it’s been several IPOs—which brings us back to Uber.

With a trunk full of debt and no clear path to profitability, investors pulled their noses up at the ridesharing tech company for good reason.

We are encouraged by the new attitude and believe it could mark a return to investors paying attention to fundamentals: like the price you pay for a business.

This article is by Bill Nasgovitz, Chairman and portfolio manager.

*FAANG stands for Facebook, Inc., Apple Inc., Amazon.com, Inc., Netflix, Inc., and Google (Alphabet Inc.)

Disclosure: Past performance does not guarantee future results.

Investing involves risk, including the potential loss of principal. There is no guarantee that a particular investment strategy will be successful.Value investments are subject to the risk that their intrinsic value may not be recognized by the broad market.

The statements and opinions expressed in this article are those of the presenter. Any discussion of investments and investment strategies represents the presenters’ views as of the date created and are subject to change without notice. The opinions expressed are for general information only and are not intended to provide specific advice or recommendations for any individual. Any forecasts may not prove to be true. Economic predictions are based on estimates and are subject to change.

As of 3/31/2019, Heartland Advisors on behalf of its clients did not hold Alphabet Inc., Amazon.com, Inc., Apple Inc., Facebook, Inc., Netflix, Inc., and Uber Technologies Inc. Statements regarding securities are not recommendations to buy or sell. Portfolio holdings are subject to change. Current and future holdings are subject to risk.

Definitions: S&P 500 Index: is an index of 500 U.S. stocks chosen for market size, liquidity and industry group representation and is a widely used U.S. equity benchmark. All indices are unmanaged. It is not possible to invest directly in an index.

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.