Commodity ETF

The data is very compelling, however investing in corn, wheat or soybeans is not for the average investor. To help overcome the difficulties and traps that typically torment inexperienced commodity investors, we sought an ETF that might replicate such an investment in the commodity markets.

We were only able to identify 1 ETF of acceptable size and liquidity standards, Invesco’s PowerShares DB Agriculture Fund (DBA). However, DBA is not a pure play on the 3 aforementioned commodities. In fact the 3 commodities highlighted above only account for 37.5% of DBA. The other 62.5% of DBA is comprised of the following: Cotton, Sugar, Coffee, Live Cattle, Feeder Cattle, Lean Hogs, and Cocoa.

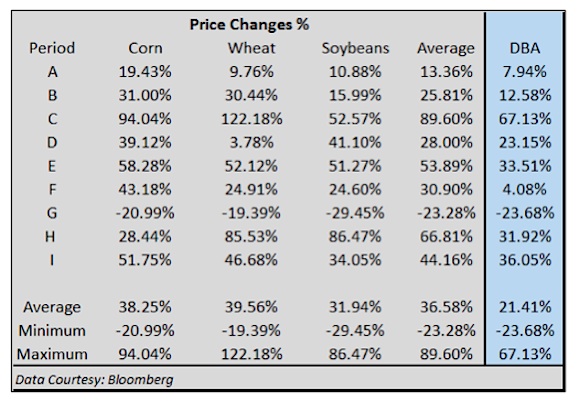

To measure DBA’s value as a substitute for investments in corn, wheat and soybean futures, we applied DBA’s current commodity allocation and recreated prior performance as if the allocation had been fixed since 1965. The table below compares DBA’s hypothetical performance to that of the aforementioned crops in the prior table. While clearly not a perfect substitute it has been a reasonable surrogate.

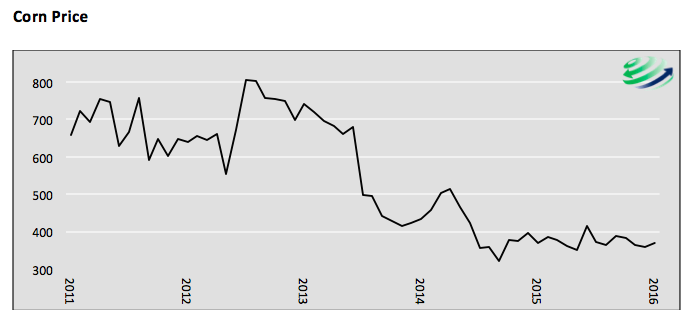

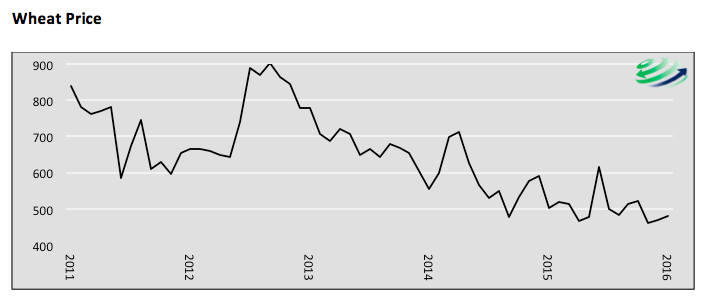

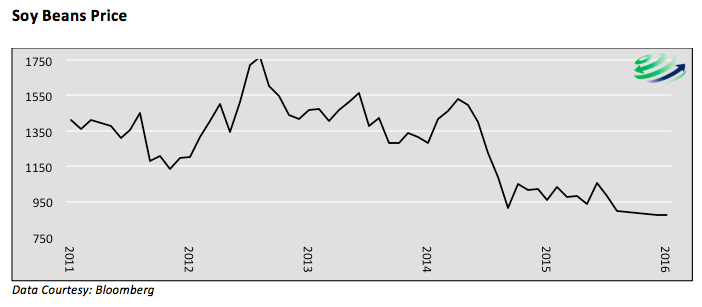

Shown below are 5-year price graphs for corn, wheat, and soybeans. Note the current price of each respective commodity is below 1-, 3- and 5-year ago levels. While price is not necessarily an arbiter of cheapness, it does provide additional comfort to those looking to take advantage of a potential transition to a La Nina Cycle.

Corn Prices Chart

Wheat Prices Chart

Soybeans Prices Chart

Concluding Thoughts

This article presents a time and weather tested variable with a great track record for predicting the appreciation of certain crop prices. Its prior results lead us to believe that corn, wheat, and soybean prices as well as the price of DBA could rise if the current El Nino transitions to a La Nina as many professionals expect.

This is not a recommendation to bet the farm, so to speak, on commodities. The data we have supplied does not guarantee a positive return. Period G, from above, for example produced poor results despite a transition from the strongest El Nino at the time to a strong La Nina.

Our objective is to offer idea generation that fits the mold for a prudent investor looking to expand investment opportunities into what appears to be value plays. Therefore, in conjunction with the evidence offered by this rather durable climate cycle, there is the opportunity to acquire agriculture related assets at tempting valuations. It goes without saying but bears repeating anyway – do your homework on the many variables that affect crop prices and fully understand the risks entailed before transacting.

More from Michael Lebowitz: “The Downside Of Corporate Stock Buybacks“

Twitter: @michaellebowitz

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.