“What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so.” –Mark Twain

2019 has been a year of investment milestones:

The U.S. economic expansion entered an unprecedented 11th year.

Real median household income moved further into record territory.

The S&P 500 (and a host of other stock market indexes) made new all-time highs.

And Baird celebrated its 100th anniversary, and I marked the completion of two full decades in this industry (and at Baird).

The world is full of challenges of which to be mindful. For many, though, it has been a good year – there is much to be thankful for and many blessings to count.

An annual outlook piece can provide a useful opportunity to pause and catch our breath as we consider where we have been and where we may be heading. Done well, these pieces provide a chance to take stock of the recent past and with gained perspective, allow the road ahead to come into some focus.

Done poorly, they can lock in narratives about what the future holds and (apologies for shifting the metaphor) act more as anchor than rudder. Not knowing what the future holds does not preclude setting out on the road or charting a course across open water. We can gain perspective. We can navigate risks and opportunities. We can adapt as uncertainties become realities.

The path forward is not always clearly defined and staying true to it can be difficult. This effort is further complicated by the endless stream of stories and anecdotes that bounce around our social media echo chambers, usually providing more confirmation than useful context. In a world awash with data and indicators, perspective is a rare commodity.

Imagine an autumn walk through the woods in southeastern Minnesota. Successfully navigating the trail requires both a sense of what might lie ahead and the discipline not to get unduly distracted by each individual leaf that lies in the path. Keeping perspective in the face of noise is a challenge for a hiker and for an investor. As the quote from Twain suggests, the greater risk is not the uncertain future, but misplaced confidence about where we have been and where we are going.

For nearly two decades, our process at Baird has been to lean on the weight of the evidence as we navigate uncertainty. This approach allows us to cast a view about what might lie ahead and yet adapt when the inevitable unexpected happens. Without it, we risk losing the path or being blown off course.

After discussing in broad strokes our outlook for 2020, we will review each of the areas covered in the weight of the evidence providing perspective about what is being seen now and what seems likely to unfold as we move forward. We will conclude with a discussion about what might lie ahead from a portfolio management perspective as we conclude a decade of remarkable strength and leadership from US large-cap stocks.

We encourage you to strap on your pack, lace up a sturdy pair of boots, and select a stout walking stick as we prepare to head back onto the path. After all, the greater part of the joy is in the journey.

2020 Stock Market Outlook:

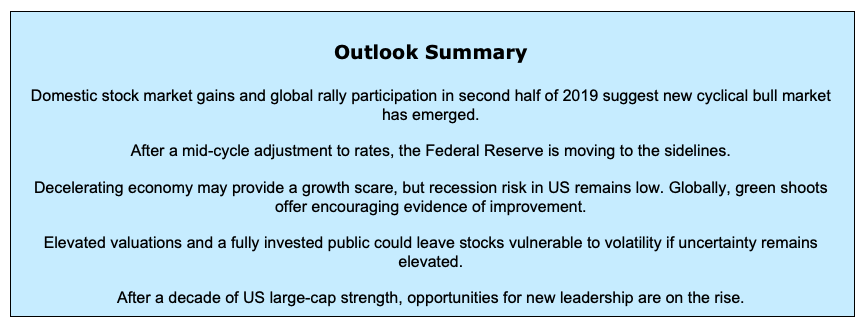

In considering the outlook for 2020, a primary concern is the health of the underlying trends in the stock market and economy. In our 2019 outlook we made the case that a cyclical bull market was likely to reemerge in the second half of the year. With the Q4 upgrade to the weight of the evidence and new stock market highs being made on a global basis, that scenario appears to have unfolded.

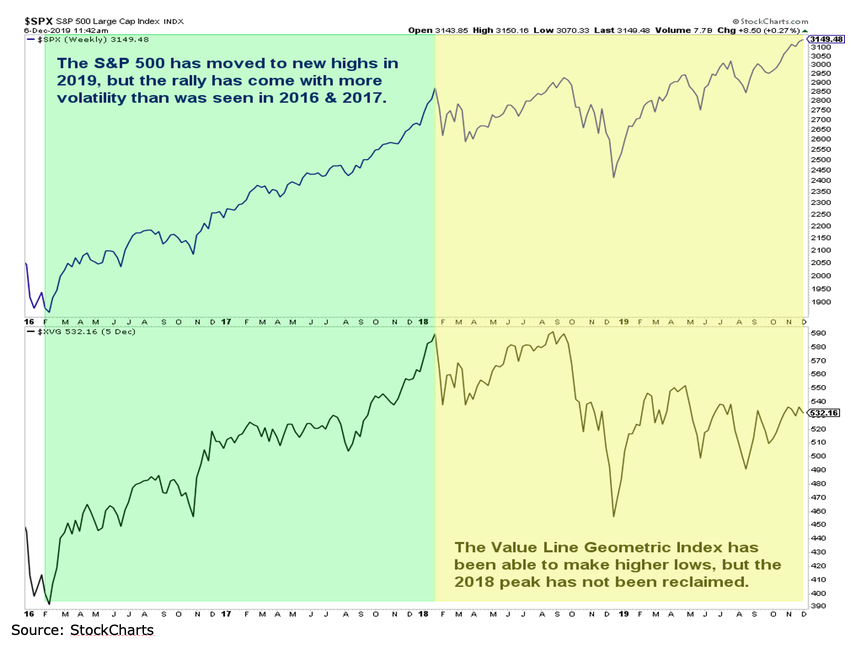

The breadth of gains in 2019 across multiple asset classes is reminiscent of the gains seen in 2017. While the 2017 gains built on strength that emerged in 2016, the 2019 ascent was set up by weakness in 2018.

From its February 2016 low to the January 2018 peak, the S&P 500 was up over 50% with little by way of weakness along the way. While the S&P 500 has made new highs since that January 2018 peak, the pace of ascent has slowed, draw-downs have been more significant and volatility has risen.

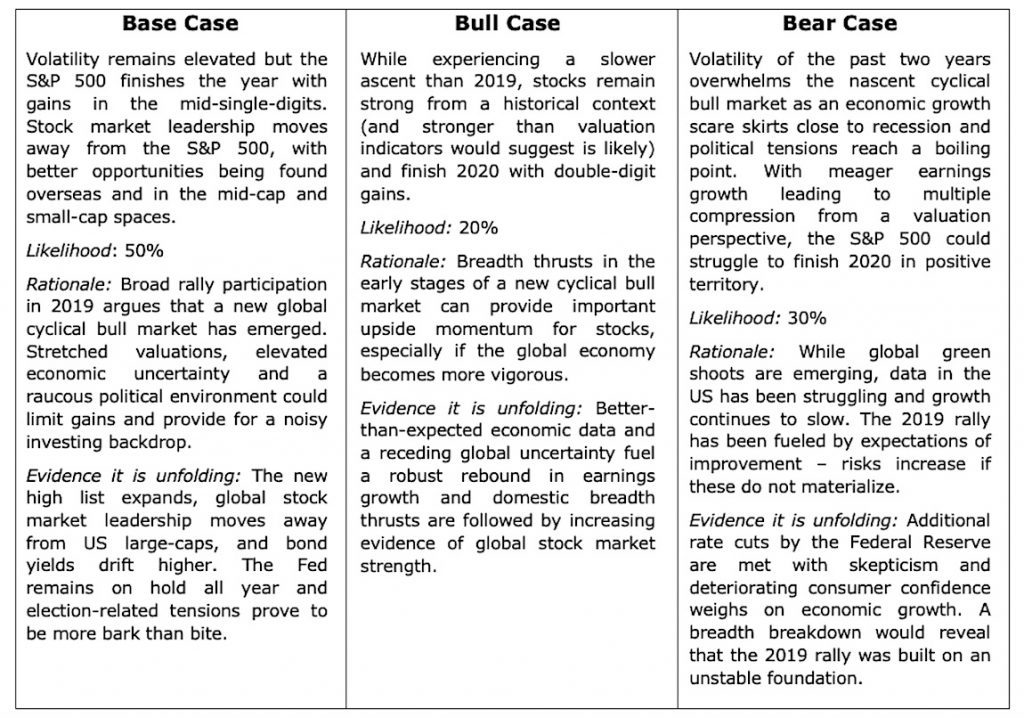

Our outlook suggests the upward trajectory for stocks (at home and around the world) is likely to continue in 2020, though the volatility-free environment of 2016-2017 may be too much to expect at this point.

We note that our base case (mid-single-digit gains for the S&P 500 in 2020) falls well within the range of outcomes being expressed by strategists at other firms.

The emerging consensus of views is clustered around the historical average is not surprising.

What may be surprising is that the average across time tends not to be observed in any individual time period.

The plain truth of the matter is that the base case expressed by us and others is not likely to be realized. From our perspective, the distribution of risks at this point suggests slightly more likelihood that the deviation will be to the downside than to the upside.

If that indeed happens, we would expect to see it reflected in the weight of the evidence which will remain our guiding light as the year unfolds.

continue reading on the next page…