Stocks finished strongly positive on the day after starting off in the red with a lower gap open.

This was a bullish follow-through day after buyers staged a reversal last Friday.

We’re not out of the woods yet, the S&P 500 still has plenty of recent supply to break through in this 272 to 274 area, but today was certainly a near-term constructive showing.

If you think this market can continue higher, here are a few stocks with strong technicals emerging from tight patterns under 52w and all-time highs:

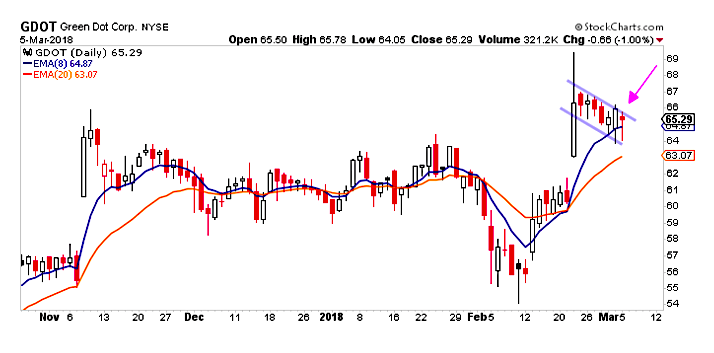

Green Dot Corp (GDOT)

$GDOT has been pulling back and flagging for 7 days after a 10% breakout move on February 22nd.

Neurocrine Biosciences (NBIX)

$NBIX surged through a cluster of about 12 days worth of highs and is quickly back to approaching new all-time highs.

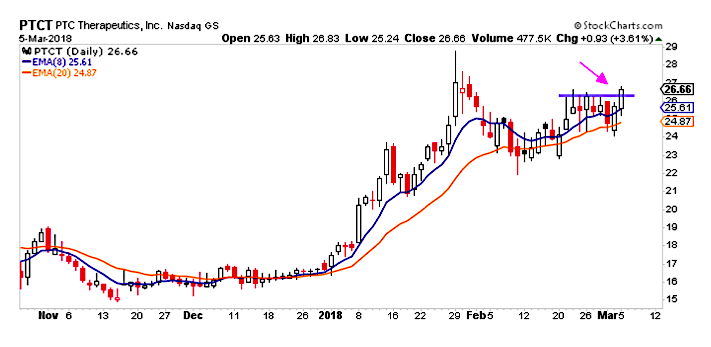

PTC Therapeutics (PTCT)

$PTCT has been carving out a range around this 25 level and just today it’s breaking to new 7 days highs.

SS & C Technologies (SSNC)

$SSNC has that inverted head and shoulders look and today it saw some nice range expansion over this multi-week 51 resistance area.

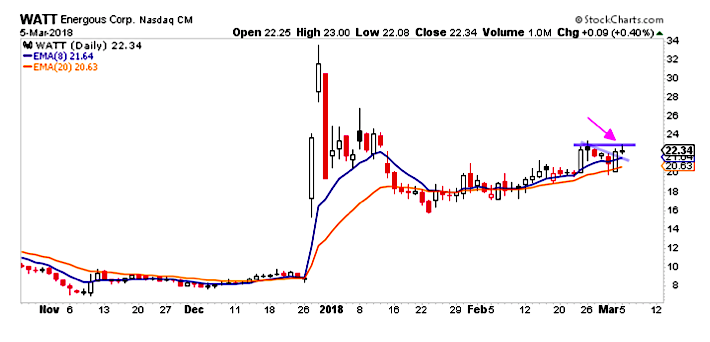

Energous Corp (WATT)

$WATT is one of the few setups on this list that did not close the day strongly near highs. The pattern overall is still valid and intact so watch for a second breakout attempt over $23 to set this one in motion.

Hopefully, these ideas find you well and as always, your own due diligence is recommended for specific timing and trade management.

All of the stocks above were pulled from our weekly qualified list of stocks. You can learn more about how we find them and get access to the weekly list here.

Twitter: @EvanMedeiros

The author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.