After a smoking hot week for the stock market, we sifted through the data and present you with 3 key takeaways and data points:

- Earnings growth is more robust than it seems.

- Valuations create opportunity.

- PPI says inflation gone = Opportunity.

Overall Economic Overview for Stock Market

You might not have realized, but over the past 5-6 months, the Federal Reserve has increased interest rates by only 25 basis points.

Today’s market update is particularly insightful as it distills the current opportunity into three informative charts.

This week marked a significant moment in economic data, potentially altering the prevailing view. The focus is shifting from the likelihood of further rate hikes to discussions about when rate cuts might occur. The balance of risk and reward is now tilting favorably, as the Federal Reserve’s priorities transition from juggling inflation concerns to concentrating more on the economy’s health. Looking ahead, we anticipate a series of rate cuts throughout 2024.

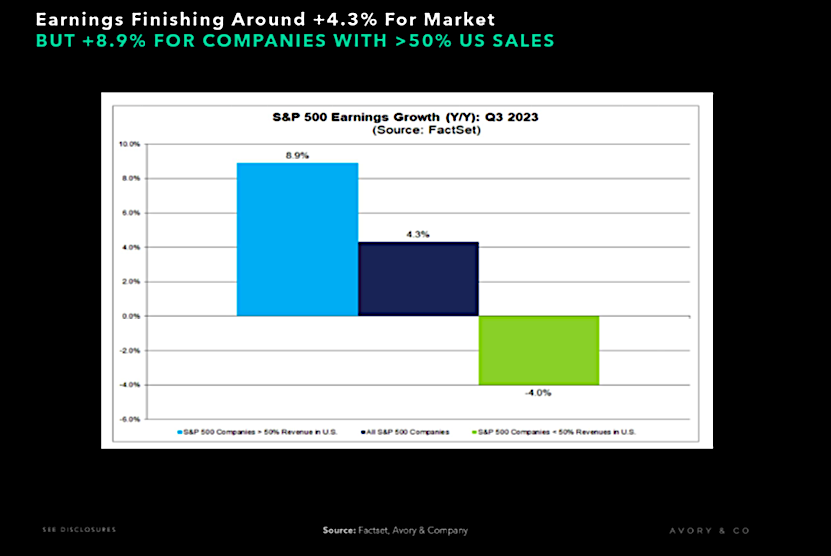

US Focused Companies Grew Earnings +8.9% This Quarter…

Earnings season is pretty much wrapping up, and it looks like the market’s earnings growth is landing at about +4.3%. Considering all the noise about the economy and rate changes, that’s pretty good. But here’s something interesting: companies that make at least half their money from the US have seen their earnings jump by +8.9%. That’s a solid hint that the US economy is doing better than you might think.

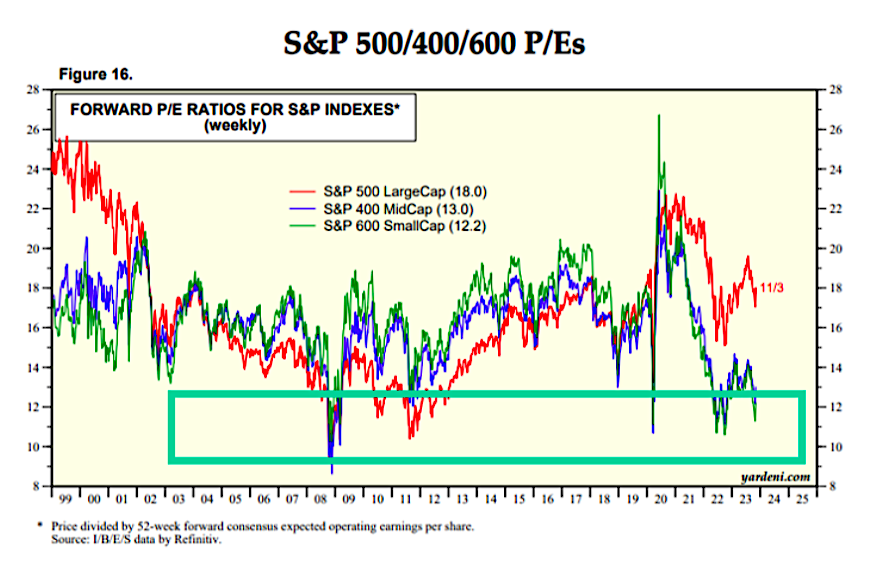

Small and Mid-Cap Companies Valuation Multiple Near 2008 Lows… Showing Fear + Opportunity At Hand.

Valuations remain attractive, especially beyond the world’s biggest companies. Small and mid-cap stocks, with market caps between $1B and $15B, are trading at levels close to the 2008 financial crisis lows. This opens up a lot of opportunities in the market, within companies that have significant scale, durability, and strong market positions.

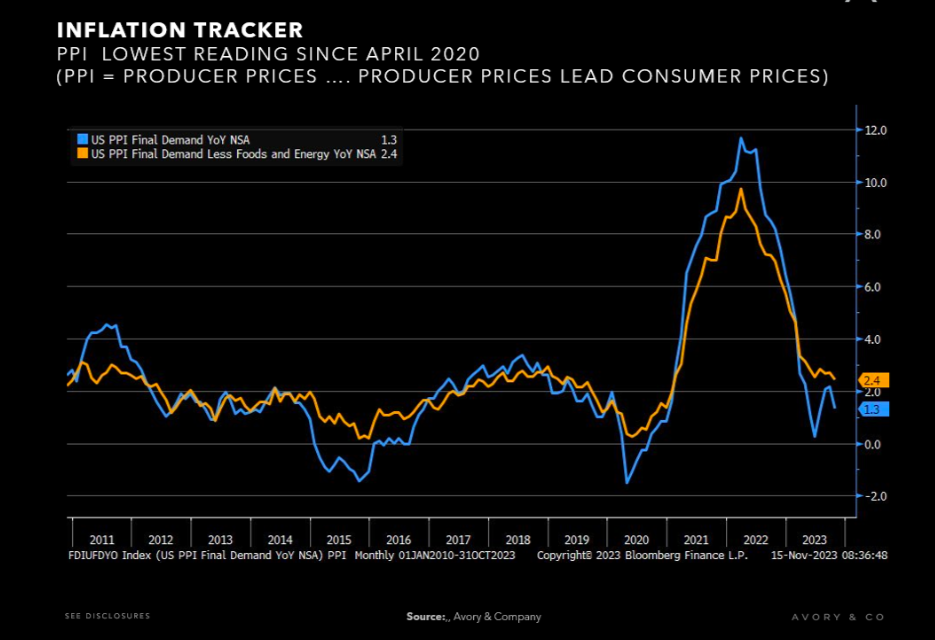

All While Inflation Comes Down At The Fastest Pace in History…

Closing out today, let’s talk about the latest Producer Price Index (PPI) report. This index is often seen as more crucial than the Consumer Price Index (CPI) since it usually predicts consumer prices, with a lag time of about 4-6 months. The latest PPI report showed a month-over-month decrease of 0.5%, the lowest since April 2020, which was during the initial COVID-19 price collapse.

Twitter: @_SeanDavid

The author and/or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.