This week we highlight the following market insights:

- Netflix issues strong report, but average revenue per subscriber left questions. Longer term, the right strategy.

- Is Tesla a car company or something more…

- Real estate touring trends.

Netflix Subscriber Growth Moves Higher, But….

Netflix’s recent performance was impressive, with the company reporting robust results that surpassed expectations. They added 6 million new subscribers, exceeding their initial estimates and general guidance. However, the situation at Netflix is somewhat intricate, as there are several factors contributing to its performance.

One of the factors involves the implementation of their free ad-tier plan, which, although promising, requires time to attract users and advertisers. This can quickly lead to strong user gains, but at lesser of a price point to fully paid premium users. We do expect ads to ramp. Additionally, Netflix’s crackdown on sharing has also resulted in a surge of new paid sharing users. This also impacts the average revenue per subscriber. These are leaving some concerns about the average revenue per subscriber. This metric has been affected by the two aforementioned factors that put pressure on it, as well as the rapid international growth, which often comes with a lower-priced plan.

Nonetheless, when looking at the bigger picture, Netflix remains a dominant force in the industry. The company’s ability to generate substantial profits and drive growth sets it apart from its competitors. Netflix is successfully adapting its business model to align with the changing demands of the world, capitalizing on streaming services, free-tier plans, and premium plans to cater to a wide range of customers. As a result, Netflix is carving out its own unique position in the market.

** Full disclosure, my firm (Avory) is an investor in Netflix at the time of this piece.

Is Tesla a Traditional Auto or Something More?

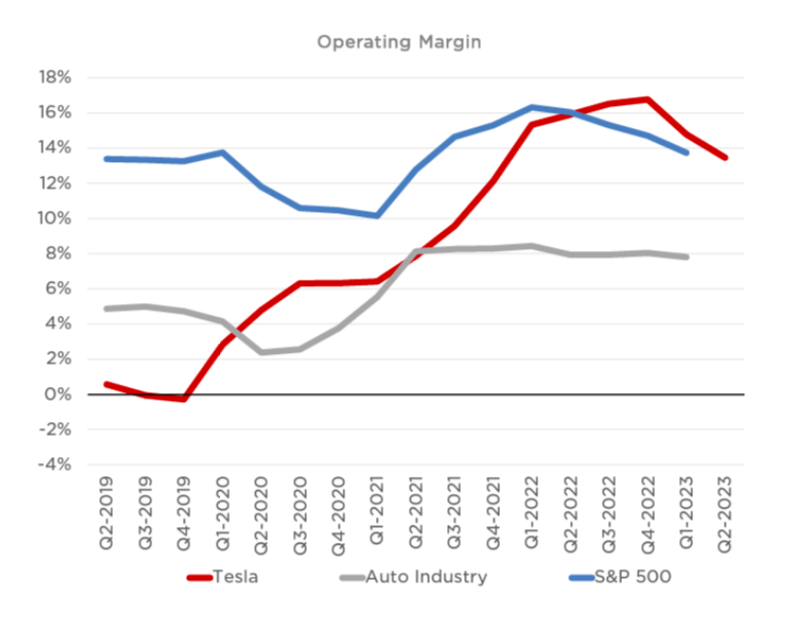

Tesla’s recent financial report has sparked a debate about whether the company should be considered a traditional car company or is it beyond that categorization with ai and self-driving. While some believe Tesla has moved past the boundaries of a standard auto company, concrete evidence supporting this claim is still pending.

For a considerable period, Tesla has maintained margins that exceed those of traditional auto companies. However, this situation is changing somewhat. They have made cost cuts this year with the narrative surrounding these cost cuts varying: some argue that it is a strategic move to gain a larger market share, while others believe it is a defensive measure due to economic factors like interest rates and lackluster demand for automobiles.

Nonetheless, there is a possibility that Tesla’s approach contains elements of both offense and defense. The company’s strong margins allow them the flexibility to make offensive moves, but they may also be taking defensive actions to navigate the challenging economic landscape.

In terms of recent performance, Tesla’s margins have reached their lowest point since 2019, indicating some challenges they are currently facing. As the situation continues to evolve, the true direction of Tesla’s strategy and its positioning within the automotive industry will become clearer. With valuations where they are the company will have to make those very clear.

Housing Demand Remains Firm…

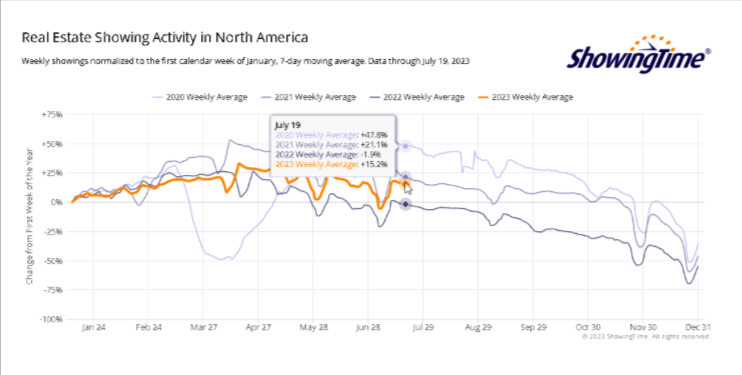

We’ve received the latest data on real estate touring, and the results are quite impressive. At this point in the year of 2023, compared to the same period in 2022, there has been an increase of 15% in the number of individuals touring homes with what is generally seen as the intention to purchase. While it’s true that this year’s figures have not yet reached the peak levels seen in 2021 and 2020, the current growth is still quite noteworthy. The upward trend in real estate touring indicates positive momentum and suggests a strong interest in the housing market this year. This data is using Zillows company ShowingTime, which is the largest touring app in the country.

This is not a recommendation to purchase or sell any securities mentioned. This is for educational purposes only.

Twitter: @_SeanDavid

The author or his firm may have positions in the mentioned companies and underlying securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.