Before we get into our expectations for the year ahead, lets raise a glass to cheer 2019 because unless things go really well in 2020, there may be a bit of a hangover coming.

2020 is priced aggressively

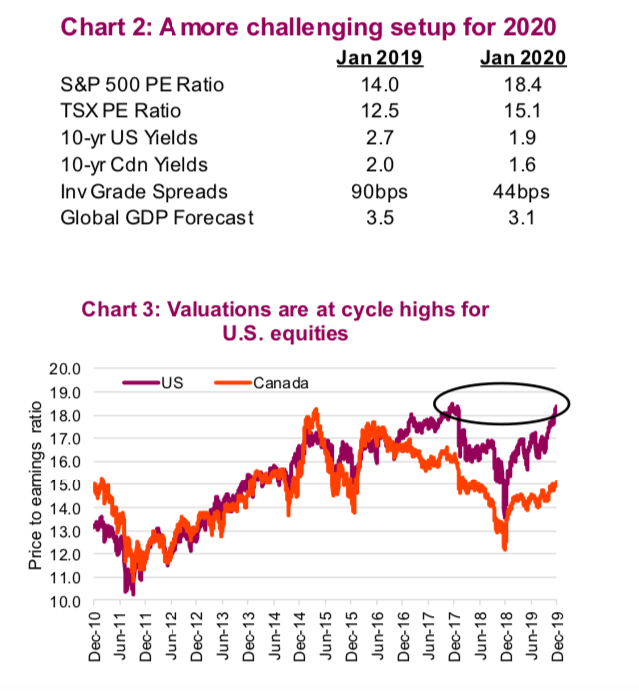

As we start 2020, markets are at all-time highs with elevated valuations, central banks are already highly accommodative, trade tensions have faded, and credit spreads are the tightest we have seen this cycle.

This is a much more challenging starting point; while perhaps not priced to perfection, certainly the market is priced aggressively. Just compare the markets today with those of a year ago.

Stock Market Valuations

Today the S&P 500 is trading at 18.4x earnings, which happens to be the peak valuation of this cycle to date, tying the level right before the first correction of 2018 (chart 3 above). This is also around the peak experienced in 2014, before another subsequent correction. There is some good news though: while the market advance of 2019 was largely driven by valuation multiple expansion as earnings growth was very muted, 2020 does look better from an earnings growth perspective. Earnings in 2019 appear to have grown by about 3-5% depending on how Q4 comes in.

That is pretty low compared with recent years, but also worth noting the market maintained record earnings – an impressive feat. Some good news for the coming year, earnings growth appears set to accelerate, more so in the second half. Current consensus forecasts are for about 15% earnings growth in 2020, and earnings growth often drives market performance.

Few would disagree the U.S. market is expensive. We believe at these valuations and with the index near record highs, there is an elevated risk of a correction. Investors typically get emotional when markets are down, but they should be feeling concerned when markets are developing a slight froth. However, valuations outside the U.S. market are more reasonable.

The TSX (Chart 3) is not as cheap as it was at the start of 2019, yet remains a little below the average valuation during this bull cycle. International markets, including developed Europe and Asia, are more reasonably valued as well, compared to their own histories and the U.S. market. This was a key input into our move earlier this year to pivot our recommended overweight U.S. equities into more international equity exposure.

Spreads & bond yields

Bond yields are materially lower today than a year ago, economic growth is more muted yet credit spreads are at cycle lows. Lower bond yields are in part due to central bank easing and continued soft global economic data. In fact at the beginning of 2019, the global economy was forecast to expand by 3.5% for the year. As we enter 2020, the forecast for the coming year is down to 3.1%.

The pivot of the Fed and many other central banks in 2019 was a big deal and helped inflate asset prices, including real estate and equity prices. Now firmly in easing mode, that is probably largely priced in. So what could lift markets from here? Better economic data would be nice, but not too much because if the economy does improve, the market will begin to price in a Fed that may start raising rates again.

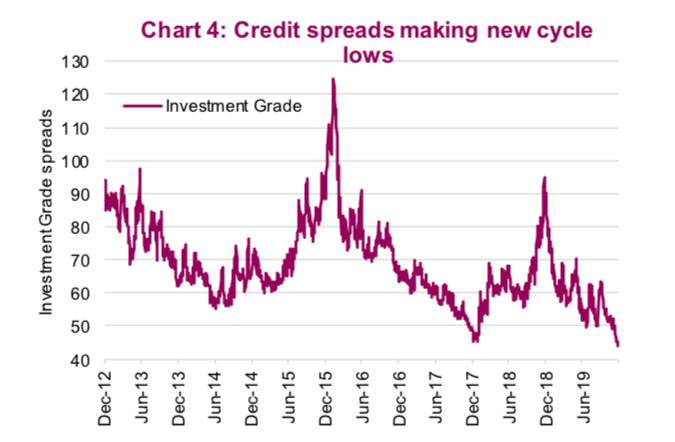

Credit spreads, wow! Investment grade spreads over Treasuries have fallen down to less than 50 basis points. That means after a decade of corporations expanding their debt levels, with the investment grade universe is now comprised of almost half BBB (the lowest rating for investment grade debt), the market is rewarding investors for taking on this risk by less than half a percent a year. Talk about picking up nickels ahead of a potential steamroller.

For comparisons sake, back in 2011 only 27% of investment grade corporate bonds were rated BBB and the investment grade universe was yielding about 1% above Treasuries. The leveraged loan market is also exhibiting signs of froth. Nearly 80% of leveraged loans are covenant lite, versus only 30% during the financial crisis. If (or when) the economic data softens more, these risks will likely be punished by rising credit spreads or default rates.

Most times it’s rather difficult to piece together all of the moving pieces to come to a definitive statement in these types of outlook pieces. We’ll try to be as definitive as possible when we state that spreads will be wider at some point in 2020 as “credit” is very expensive. Forget about eking out every extra basis point, take a step back to focus on what this part of the portfolio is truly about: defense.

Portfolio Thoughts – 2020 may not be priced to perfection but it’s close and that has us believing 2020 will be a challenging year. A lot has to go right to eke out even average gains from this starting point. This could take the form of improving economic growth, more improvement on the trade front, resumption of earnings growth and/or continued central bank accommodation. If some of these fall short or there is a surprise (and there are always surprises), this market is at risk.

We would not abandon the U.S. equity market, but reducing some exposure or tilting to more defensive value/dividend strategies may prove timely for 2020 given the recent market run and valuation levels. On the credit side, investors are not being rewarded adequately; reducing credit exposure may prove timely.

Politics in 2020

While we have never, and will never, claim to be political experts, 2020 is setting up to be an politically interesting one from the market’s perspective. The cadence of the trade war between the U.S. and China, and to a lesser extent with Canada, Japan and the EU, was a driving force for risk appetite in the markets in 2019. When tensions were escallated or rising, markets suffered. When solutions appeared on the horizon, markets rallied. At the moment, markets appear to be riding a wave of optimism: the phase 1 trade deal between the U.S. and China is a sign of cooling tensions.

Understandably, investors have become a bit wary due to false dawns over the past couple years. Our base-case assumption is that this area of market concern continues to fade in 2020 as both countries appear keen. China’s economic growth has slowed and less trade tensions would help the situation. Meanwhile, for Trump to win re-election in 2020, the administration could really use a ‘win’ on this front, especially given how hard key battleground states have been economically hit by the trade war. Americans tend to vote on party lines but if their wages/income have been impacted, loyalty is at risk.

2019 has taught investors, and us, that trying to predict the next move on trade is really anyone’s guess. While we do not believe trade will carry as big a market impact in 2020, this could flare up again. Plus, the market is very optimistic at the moment which is a bit risky.

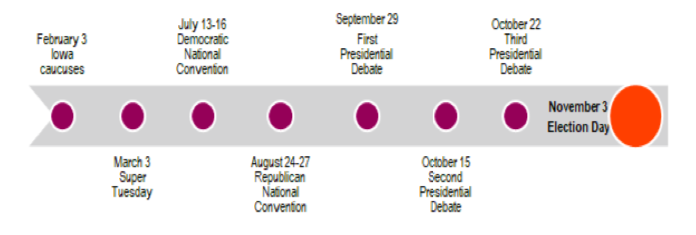

Key dates for the U.S. election

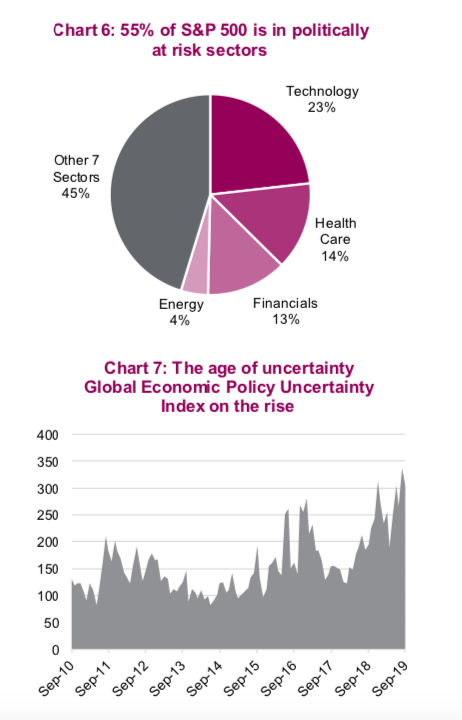

Perhaps the bigger risk in 2020 is the election process itself, namely in terms of the Democratic primary race. The chart to the right outlines all of the key election dates over the course of the coming year. Former VP Joe Biden is probably better understood by the markets, Senators Elizabeth Warren and Bernie Sanders are more wildcards. Both, but more so Warren, have spoken out on the following: the dominance of some technology companies and the desire to break up or reduce ‘monopoly’ situations; the desire to better regulate energy from an environmental perspective; the introduction or re-introduction of additional regulations on financial companies; and revamping America’s approach on health care.

We don’t believe any of these aspirational campaign initiatives would be quick or easy to implement. However, even if they start talking about these kinds of changes, you better believe the market will react and not in a positive way. Technology, energy, financials and health care comprise 55% of the S&P 500 by market capitalization which could see valuation adjustments as the Democratic Party’s nomination process progresses into debates (see chart 6).

One positive is that for any candidate to win, they likely need to move somewhat back to the center. This has been the theme of late, helping health care and other sectors rally. But this is a risk for 2020. Another positive is if there is more talk about increasing U.S. energy regulations, the rather unloved Canadian energy patch may be a beneficiary in the short run.

There are a number of additional political flash points in 2020. Increased violence between the U.S. and Iran is the most pressing at the moment after the death of Qasem Soleimani. Retaliation attacks and how this escalates or de-escalates will matter for markets. In relation to China, there is the unrest in Hong Kong, ongoing human rights issues and the continuing saga with Huawei Technologies. Plus, continued populism globally, Brexit, impeachment and a number of key elections in Europe, 2020 will likely see a market impacted by politics and geopolitical events more than other years, continuing the rise in geopolitical uncertainty (Chart 7).

Portfolio Thoughts – We would not change our outlook as there are too many moving parts. However, as we begin 2020, political tensions within the market are low thanks to the optimism of a Phase 1 trade deal and the fact that nomination rhetoric is not in full swing. If these or others begin to materially weigh on markets, there may be opportunities to deploy capital in the affected areas. Keep some powder dry.

Charts are sourced to Bloomberg or Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.