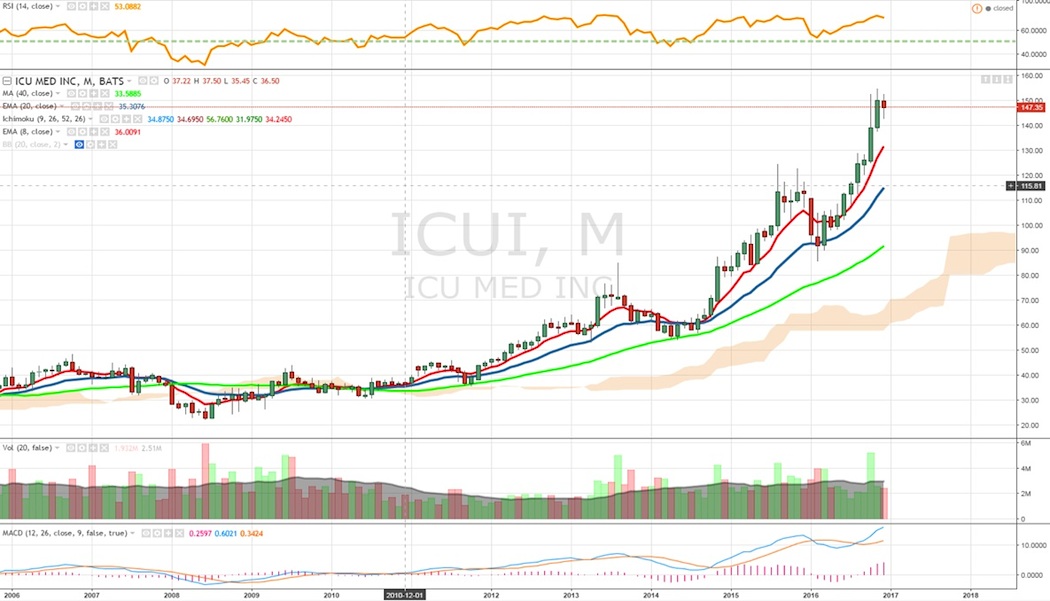

ICU Medical (ICUI)

ICU Medical (NASDAQ:ICUI) is a $2.38B maker of medical devices for infusion therapy, oncology and critical care. Shares trade 29.5X Earnings, 6.35X Sales and 3.68X Book.

ICUI grew revenues 10.7% in 2016 for the second straight year and EPS up 22%, though 2017 looking to see a slowdown with 6% revenue and 3% EPS growth. Infusion therapy is 72% of sales with its industry-leading needle-free IV connector technology and IV sets. The adoption of this technology is increasing opportunity to grow in International markets, while ICUI also has a large amount of recurring revenues. The company could be a candidate for a special dividend as well with $25/share in cash. ICUI announced a $1B deal in October for Hospira’s Infusion Systems.

J&J Snack Foods (JJSF)

J&J Snack Foods (NASDAQ:JJSF) is a $2.49B maker of nutritional snack foods trading 29.75X Earnings, 2.5X Sales and 3.9X Book with a 1.26% yield, and shares higher 16% in 2016 impressive as it trended higher despite weakness in the consumer staples group in Q4. JJSF is an impressive FCF name and a ROIC above 12%. Shares broke out in December and enter 2017 at record highs.

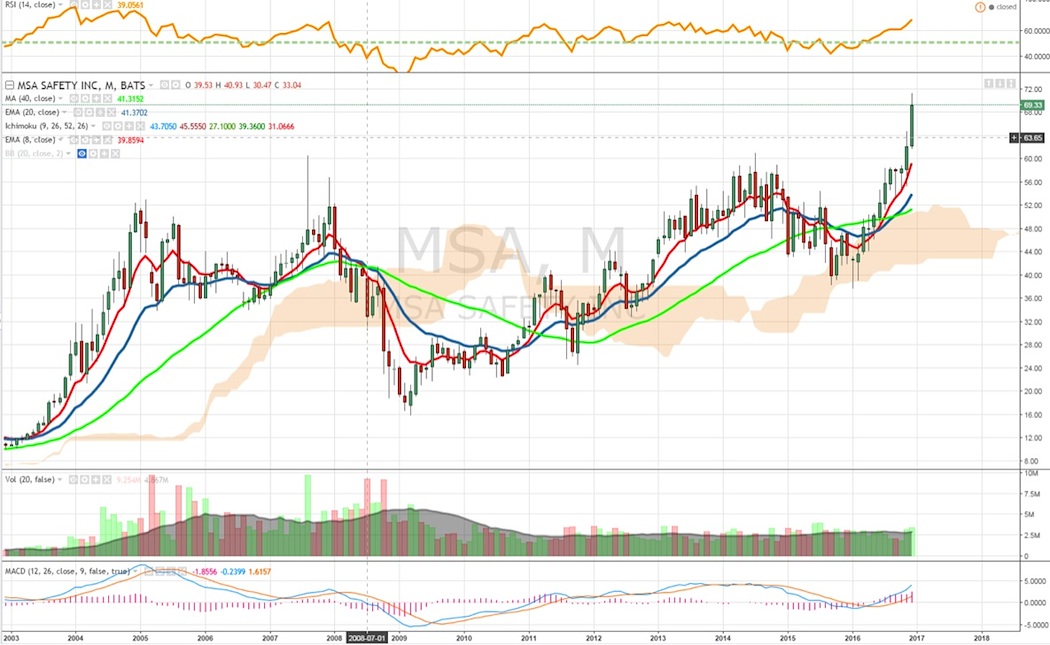

MSA Safety (MSA)

MSA Safety (NYSE:MSA) is a $2.76B maker of safety products trading 22X Earnings, 2.37X Sales and yielding a 1.9% dividend. MSA’s core products have a 5 year CAGR of 8% organic growth. MSA is seeing strength in the global fire services markets, breathing apparatus and fixed gas and flame detection two strong growth markets. On the chart MSA shares have seen a strong push higher in 2016 making new highs.

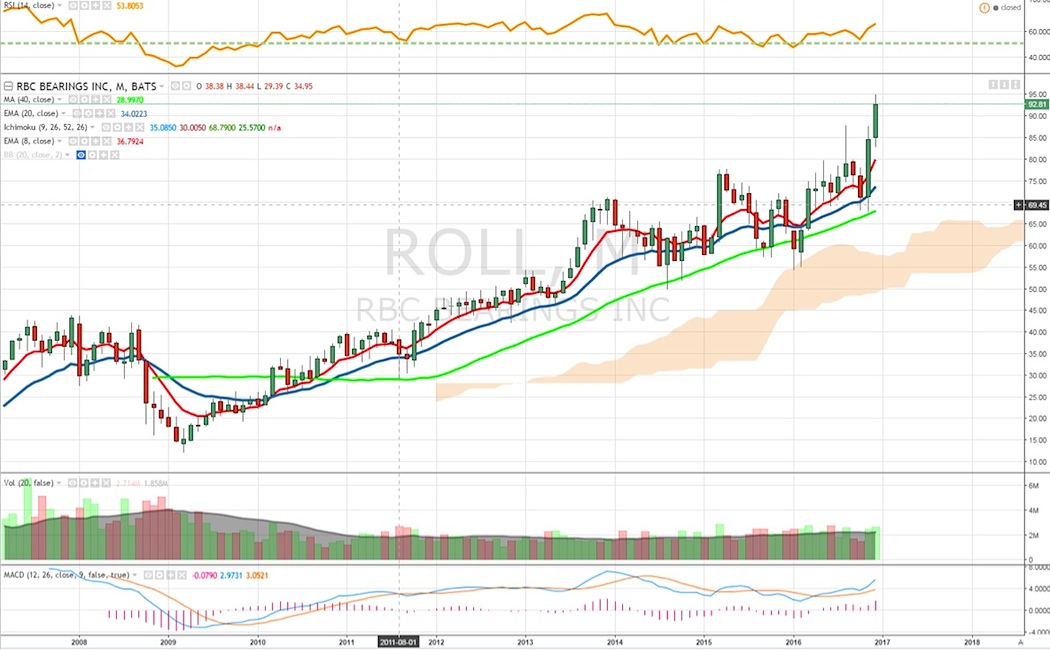

RBC Bearings (ROLL)

RBC Bearings (NASDAQ:ROLL) is a $2.2B maker of precision bearings trading 24.85X Earnings, 3.58X Sales, and 3.27X Book. ROLL grew revenues 34% in 2016 and EPS 14.6%, expecting just 4.8%/2.9% respectively in 2017. ROLL has strong FCF, a ROIC at 10.7%, and better EBITDA margins than peers. Industrial markets account for 44% of revenues and Aerospace/Defense at 56%. On the chart, shares broke out in November and saw strong continuation to new highs in December.

Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.