CBIZ (CBZ)

CBIZ (NYSE:CBZ) is a $732M provider of business services and solutions such as consulting, litigation support, employee benefits, networking, and more. Shares trade 16.8X Earnings, 0.93X Sales and 13.95X FCF and after 6% revenue and 13% EPS growth in 2016 expecting 5.4% revenue growth and 8.7% EPS growth next year.

CBZ has more than 90,000 clients with 90% retention rate and 80% recurring revenues. Financial Services account for 63% of revenues and Employee Services at 33%. CBZ has been posting accelerating organic growth each year since 2009 and margins also trending higher. On the chart shares broke out above $11.50 and made a strong push into year-end, waiting for a healthy pullback.

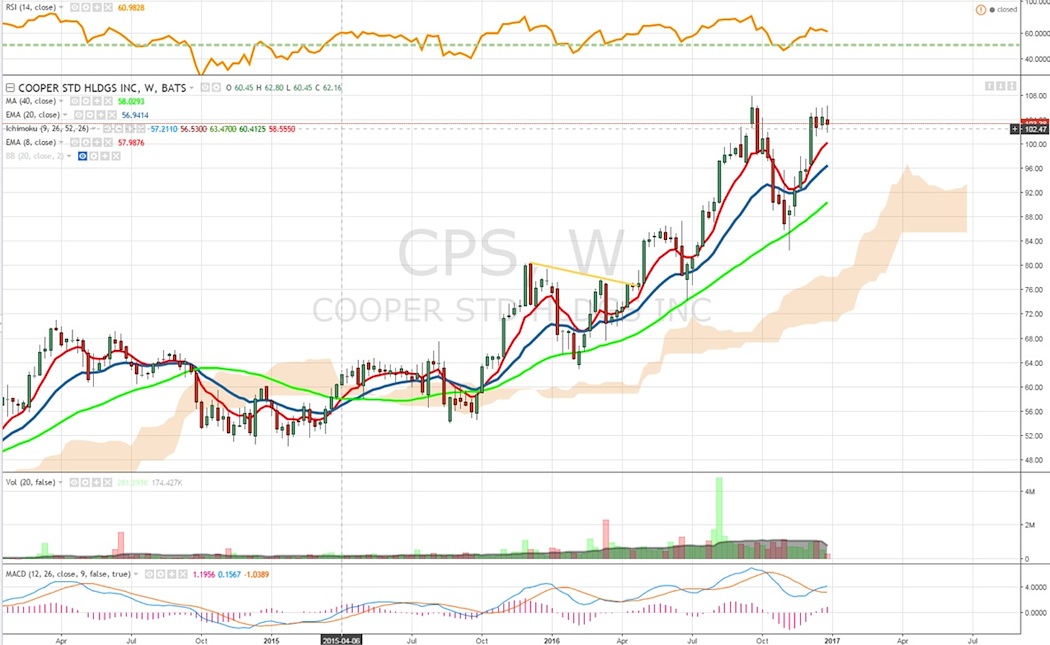

Cooper Standard (CPS)

Cooper Standard (NYSE:CPS) is a $1.82B maker of automotive products trading 9.5X Earnings, 2.58X Book and 9.6X FCF. Revenue growth has been consistent but a lower growth name expecting 3-3.5% annual growth through 2018 while EPS growth of 42% in 2016 and 5.5% expected for next year. CPS is increasing its content per vehicle and new business wins and is a global leader in sealing systems, fuel & brake delivery, and fluid transfer systems. CPS still has very low penetration in large markets that amount to $31B+. On the chart, shares are in a strong trend higher, a name I discovered for clients in April near $75/share, and continues to have strong momentum.

CSG Systems (CSGS)

CSG Systems (NASDAQ:CSGS) is a $1.56B provider of business support solutions such as billing and customer care with shares trading 17.7X Earnings, 2X Sales and 23.2X FCF and a 1.53% dividend yield. CSGS revenues have been fairly flat since 2011 while EPS has seen steady growth, while EBITDA margins showed strong gains in 2015. Its customers are mostly concentrated in the Cable and Telecom markets. It sees growth opportunities in International markets and its Ascendon next generation platform has a 6% CAGR outlook. It continues to have a long runway of migrating Comcast customers to its platform, and a similar consolidation scenario is possible from the Charter/Time-Warner deal. On the chart shares recently hit new highs clearing a lower high channel, a strong performer the last few years.

Houlihan Lokey (HLI)

Houlihan Lokey (NYSE:HLI) is a $2.05B investment banking company providing M&A, financing, restructuring and other services. Shares trade 16.85X Earnings, 2.7X Sales and 38.6X FCF with a 2.19% dividend yield. HLI is set to see 17.5% revenue growth this year and 18.7% EPS growth. HLI is a leader across all its three segments, the #1 US M&A Advisor, Restructuring Advisor and M&A Fairness Opinion Advisor, impressive as it competes with giant banks across all these markets, and seemingly is a nice looking M&A target. On the chart shares recently hit new highs before consolidating with the Financials, momentum into next year.

Hillenbrand (HI)

Hillenbrand (NYSE:HI) is a $2.43B Industrial trading 17X Earnings, 1.58X Sales and 46.7X FCF with a 2.14% dividend yield. HI operates in two segments, the Batesville division is a leader in death care services, while Process Equipment Group (PEG) a leading provider of compounding and extrusion equipment, flow control, and material handling equipment. HI has a 5 year revenue CARG of 11.7% and 64% of business in the Americas. The company is looking to grow via its PEG division both on revenue growth and margin expansion, and Plastics is a 61% end-market for that group. On the chart, shares broke out past highs late in 2016 and have momentum into next year.

continue reading on the next page…