There are a lot of ways to mess up a good trade. We add useless complexity to our plans. And market volatility can lead to a stronger presence of emotions and arrogance.

Interesting, but unimportant market statistics can also take hold of our thinking in the near term. The best way to fight these issues is to raise self awareness. Tune into your trading, technique, discipline, and plans. Better yourself.

We’ll examine this and more in this week’s “Top Trading Links”.

MARKET INSIGHTS

Various sentiment readings are getting quite negative and suggest some fear. @RyanDetrick investigates.

Hilary Clinton is taking a lot of the blame for the damage in biotech stocks. Actually, the group is seeing a major break down. That all could be related of course.. post via @AndrewThrasher

First Trust Amex Biotechnology Index Fund (FBT)

@MktOutperform shared a fund flow stat that damns the bulls…

Short Vol ETF assets hitting all-time highs. New traders not accepting that the V environment is over. $XIV

— Charlie Bilello, CMT (@MktOutperform) Sep. 22 at 10:54 AM

10 signs the market is not that into you @SJosephBurns

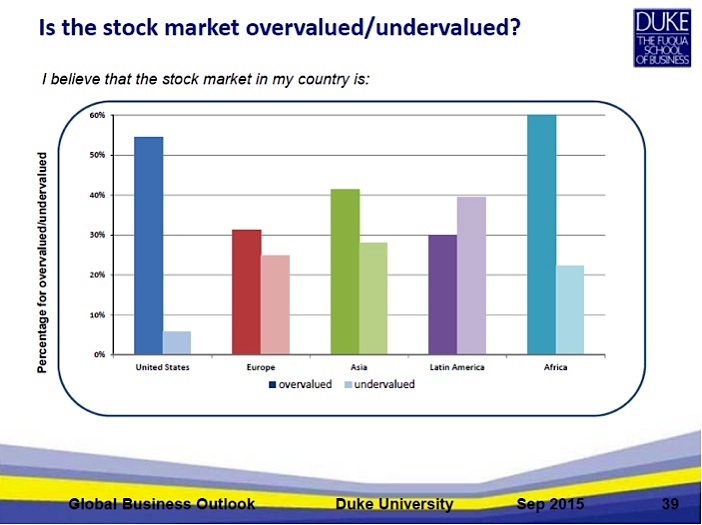

According to the latest CFO Global Business Outlook, most CFOs think the stock market is overvalued. @alphaarchitect shares some very noteworthy data.

@fabiancapital discusses bond ETF TIP and why it’s telling us inflation expectations are cratering.

Down August and September tends to lead to strong Q4s via @AlmanacTrader. Note, the S&P 500 closed August at 1972.

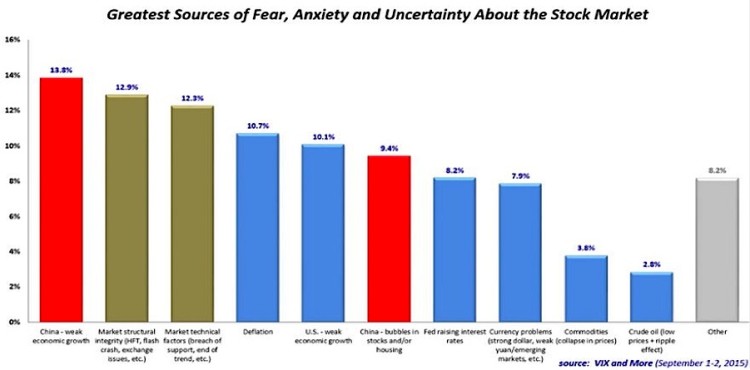

At the start of the month @VIXandMore ran a poll on the greatest fears readers had.

Why won’t Fed rate hikes be aggressive any time soon? We can’t afford higher rates via @hedgopia

continue reading on next page…